TIDMCLIG

RNS Number : 3233N

City of London Investment Group PLC

20 January 2023

City of London Investment Group PLC

20 January 2023

CITY OF LONDON INVESTMENT GROUP PLC

("City of London", "the Group" or "the Company")

FUNDS UNDER MANAGEMENT ("FuM") AS AT 31 December 2022,

SIX MONTHS TO 31 DECEMBER 2022 TRADING UPDATE AND DIVIDEND

DECLARATION

City of London (LSE: CLIG), a leading specialist asset

management group offering a range of institutional and retail

products investing primarily in closed-end funds, announces that on

a consolidated basis, as at 31 December 2022, FuM were US$9.2

billion (GBP7.6 billion). This compares with US$9.2 billion (GBP7.6

billion) at the Group's year end on 30 June 2022. A breakdown by

strategy follows:

FuM ($ million) Strategy Index

Dec-22 Jun-22 % Net %

(estimate) increase/ Flows increase/

(decrease) (decrease)

EM 3,570 3,703 (4%) (65) MSCI EM Net TR (3.0%)

KIM 3,369 3,433 (2%) (103) Not applicable

INTL 1,894 1,812 5% 13 MSCI ACWI ex US 3.0%

ACWI/Barclays Global

OV 240 193 25% 48 Agg (0.1%)

Other* 77 83 (7%) -

9,150 9,224 (107)

----------- ------- ------

* includes Frontier, REIT and seed investments

Funds under Management figures are rounded

IM Performance

Solid relative performance across CLIG's investment strategies

resulted from good NAV performance at the underlying closed-end

funds.

Over the period, there were inflows of circa US$295 million,

outpaced by outflows resulting in net outflows of circa US$107

million across the Group's strategies, led by EM redemptions and

required minimum distributions for Karpus Investment Management

("KIM") strategies at year end.

Business development will focus on EM, International, and

Opportunistic Value strategies, and KIM balanced mandates, where

additional capacity is now available for prospects.

Operations

The Group's income currently accrues at a weighted average rate

of approximately 73 basis points of FuM, net of third party

commissions. "Fixed" costs are c. GBP1.9 million per month, and

accordingly the current run-rate for operating profit before

profit-share is approximately GBP2.7 million per month based upon

current FuM and a US$/GBP exchange rate of US$1.2083 to GBP1 as at

31 December 2022.

The Group estimates the unaudited profit before amortisation and

taxation for the six months ended 31 December 2022 to be

approximately GBP11.9 million (six months ended 31 December 2021:

GBP15.5 million).

Inclusive of our regulatory and statutory capital requirements,

cash and cash equivalents stood at GBP19.1 million at the end of

the calendar year (GBP22.7 million as at 30 June 2022), in addition

to the seed investments of GBP7.6 million. Our cash reserves will

allow us to continue managing the business conservatively through

volatile markets while following our dividend policy for our

shareholders.

The Company is currently in a close period which will end with

the publication of results for the six months ended 31 December

2022 on 22 February 2023.

Dividend

The Board declares an interim dividend of 11p per share, which

will be paid on 31 March 2023 to shareholders registered at the

close of business on 3 March 2023 (2021: 11 pence).

Shareholders may choose to reinvest their dividends using the

company's Dividend Reinvestment Plan, to do this please visit

www.signalshares.com or if you hold your shares through a broker

please contact them. The deadline to lodge your election is 10

March 2023.

The Board confirms the final dividend timetable for the year to

30 June 2023:

-- ex-dividend date: 2 March 2023

-- dividend record date: 3 March 2023

-- DRIP election date/ deadline 10 March 2023

for currency election:

-- announcement of USD dividend 17 March 2023

conversion rate:

-- dividend payment date: 31 March 2023

City of London Investment Group is a UK registered company,

listed on the London Stock Exchange and declares its dividends in

GBP. Shareholders based in the US can elect to receive dividends in

USD, should they wish to do so. The currency conversion rate from

GBP to USD will be fixed two weeks before the dividend payment

date. The currency election form can be found on our website at

https://clig.com/wp-content/uploads/2022/08/Currency-Election-Form-2022.pdf

Alternatively, overseas shareholders may be able to use the

International Payment Service (IPS) and receive dividend payments

direct to their bank account in local currency. Further information

regarding the IPS including terms and conditions, costs and forms

for signing up are available from Link Group at

https://ww2.linkgroup.eu/ips .

Dividend cover template

Please see dividend cover template attached here.

http://www.rns-pdf.londonstockexchange.com/rns/3233N_1-2023-1-19.pdf

The dividend cover template shows the quarterly estimated cost

of dividend against actual post-tax profits for last year, the

current six months and the assumed post-tax profit for the

remainder of the current year and the next financial year based

upon specified assumptions.

For further information, please visit http://www.clig.com/ or

contact:

Tom Griffith, CEO

City of London Investment Group PLC

Tel: 001-610-380-0435

Martin Green

Zeus Capital Limited

Financial Adviser & Broker

Tel: +44 (0)20 3829 5000

This release includes forward-looking statements, which may

differ from actual results. Any forward-looking statements are

based on certain factors and assumptions, which may prove

incorrect, and are subject to risks, uncertainties and assumptions

relating to future events, the Group's operations, results of

operations, growth strategy and liquidity.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCGPUPGGUPWGMB

(END) Dow Jones Newswires

January 20, 2023 02:00 ET (07:00 GMT)

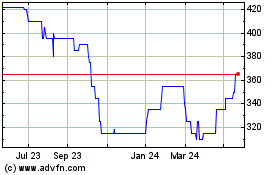

City of London Investment (AQSE:CLIG.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

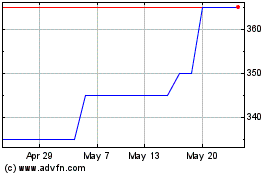

City of London Investment (AQSE:CLIG.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025