TIDMDUKE

RNS Number : 2030U

Duke Royalty Limited

22 November 2023

22 November 2023

Duke Royalty Limited

("Duke Royalty", "Duke" or the "Company")

Interim Results for the six months ended 30 September 2023

Duke Royalty Limited (AIM: DUKE), a provider of alternative

capital solutions to a diversified range of profitable and

long-established businesses in Europe and abroad, is pleased to

announce its interim results for the six-months ended 30 September

2023 ("Interim 2024").

Financial Highlights

-- Total cash revenue up 35% from the prior period to GBP14.1

million (Interim 2023: GBP10.4 million)

-- Recurring cash revenue* totalled GBP12.2 million, up 17% from

Interim 2023 (GBP10.4 million)

-- Free cash flow** up 23% to GBP7.9 million (Interim 2023: GBP6.5 million)

-- Adjusted earnings up 23% to 1.95 pence per share (Interim 2023: 1.58 pence per share)

-- Cash dividends of 1.40 pence per share paid to shareholders

(Interim 2023: 1.40 pence per share)

Operational Highlights

-- Deployed over GBP18 million of capital into new and existing Royalty Partners

-- One new royalty partner added to the portfolio, taking total to 15

-- One investment buyback with Instor delivering a triple digit IRR

-- Over GBP40 million of available liquidity for future deployments

* Recurring cash revenue excludes buyback premiums, cash gains

from the sale of equity investments and one-off fee income

** Free cashflow is defined as operating cashflow, plus cash

gains from the sale of equity investments, less investment costs

less interest payable of Duke's debt facility

Nigel Birrell, Chairman of Duke Royalty, said:

"During the interim period Duke was able to post its twelfth

consecutive quarter of increasing recurring cash revenue which was

a fantastic achievement for the Company. In line with this strong

financial performance, the Company also maintained its quarterly

dividend of 0.70p per share. Investors can be reassured that the

dividend payout remains well covered by operating cashflow with the

attractive yield representing a pillar of Duke's ongoing business

model and its overall financial discipline.

"Looking forward, I am pleased to say that Duke remains

well-positioned for growth. We believe that we have an attractive

offering through our private credit and private equity hybrid

product, as well as a philosophy that resonates with SME business

owners due to our ability to offer a long-term, partnership-based

solution which keeps owners in control of their company."

This announcement contains inside information.

For further information, please contact www.dukeroyalty.com, or

contact:

Neil Johnson / Charles

Cannon Brookes / Hugo

Duke Royalty Limited Evans +44 (0) 1481 231 816

Cavendish Securities

plc (Nominated Adviser Stephen Keys / Callum

and Joint Broker) Davidson / Michael Johnson +44 (0) 207 397 8900

Canaccord Genuity

(Joint Broker) Adam James / Harry Rees +44 (0) 207 523 8000

SEC Newgate Elisabeth Cowell / Alice +44 (0) 20 3757 6880

(Financial Communications) Cho / Matthew Elliott dukeroyalty@secnewgate.co.uk

About Duke Royalty

Duke Royalty Limited provides alternative capital solutions to a

diversified range of profitable and long-established businesses in

Europe and abroad. Duke Royalty's experienced team provide

financing solutions to private companies that are in need of

capital but whose owners wish to maintain equity control of their

business. Duke Royalty's royalty investments are intended to

provide robust, stable, long-term returns to its shareholders. Duke

Royalty is listed on the AIM market under the ticker DUKE and is

headquartered in Guernsey.

Chairman's Report

Dear Shareholder,

I am pleased to report that Duke Royalty's results for Interim

2024 have once again highlighted the robust nature of the Company's

business model in the face of significant ongoing global economic

and political challenges. In particular, I am delighted to say that

Duke was able to post its twelfth consecutive quarter of increasing

recurring cash revenue during the Interim period.

Duke's simple investment philosophy of providing long dated,

senior secured debt capital into long established, profitable SME

owner-operated businesses has largely protected the Company from

the high levels of volatility that have been witnessed in the

public equity markets during the period. The predictable nature of

Duke's monthly cashflows alongside its own tight internal cost

controls has allowed Duke to report a strong financial performance

for Interim 2024. In line with this strong financial performance,

the Company also maintained its quarterly dividend of 0.7p per

share. Investors can be reassured that the dividend payout remains

well covered by operating cashflow with the attractive yield

representing a pillar of Duke's ongoing business model and its

overall financial discipline.

This strong set of results has been achieved despite the

challenging business environment we are operating in. In the last

two years, the UK experienced a record-breaking 14 consecutive

interest rate increases, a trend that has largely been mirrored in

both the EU and North America. Central banks have taken a pause

from additional near-term interest hikes with inflation rates now

trending back towards their longer-term norms. However, we believe

the current elevated level of interest rates are set to remain for

some time and we are not expecting to see any cuts until well into

the Company's FY25 period. For Duke, the higher cost of borrowing

has had a few core effects.

First, it has increased Duke's own debt servicing costs which

have put a squeeze on free cashflow margins and second, it has

resulted in a general reduction in consumer discretionary spend.

Furthermore, there is no question that businesses have become

increasingly burdened by wage inflation and a period of stubbornly

high power costs. This backdrop has had an inevitable effect on

both revenue and profit expectations for some of Duke's partners

but, as long term, supportive investors, our investment team is

working diligently to ensure they are given whatever help is

required.

However, overall I am pleased to be able to report that the Duke

portfolio remains well insulated and in a healthy position,

protected by its increasing level of diversification. A positive

effect that has resulted from the elevated level of interest rates

has been the material increase in the cost of all other competing

forms of debt. As I have mentioned before, Duke's permanent equity

capital base and its long-term lending approach throughout economic

cycles have enabled it to refrain from significantly increasing the

cost of its offering in the short-term. The deliberate decision to

not significantly raise the initial cost allows Duke to evaluate

more opportunities through the lens of that company's ability to

weather continued economic headwinds.

Unsurprisingly, Duke was cautious on making new deployments in

Interim 2024 given the high level of uncertainty in the markets as

well as a general declining trend in valuations that we are seeing

across the board. The Company did welcome Glasshouse Products LLC

as a new partner by entering into an US$11.5 million financing

agreement. Founded in 2002 in Texas, Glasshouse is a

long-established provider of custom glass solutions including the

design, fabrication, sale and installation of glass architectural

products and I hope that Glasshouse will become a long-standing

core holding in the Duke portfolio as it executes its buy and build

strategy. During the period, Duke also announced the successful

exit of its investment in Instor Solutions, Inc., a

California-based product reseller and service provider for work

related to the build-out and migration of data centres. The exit

represented the sixth and most profitable exit for Duke to date,

delivering a triple digit IRR.

Outlook

Duke remains well-positioned for growth, having created a large

and diversified portfolio of royalty investments alongside an

exciting pipeline of new deal opportunities. The Company's

liquidity position remains robust and the current macroeconomic

climate means that demand for Duke's low amortising, patient

capital remains strong. Our approach to monitoring our existing

investments is collaborative and thorough. We evaluate monthly

management accounts and look for signs of stress and aim to be

proactive in working with a partner to address any issues. Having

good visibility into our portfolio allows us to be cautiously

optimistic for the rest of the year.

Looking more broadly, we constantly review the trends in the

financing industry and we are pleased to report that Duke's core

product is unique in the market due to its long duration and low

amortisation qualities. The Private Credit market is a large and

growing segment of the financing sector, and part of its growth has

been from Private Equity players expanding into credit. What used

to be the domain of the high street banks is increasingly

supplemented by alternative financing providers, of which Duke is

one. Our growing pipeline underpins our belief that we have a

philosophy that resonates with SME business owners due to our

ability to offer a long-term, partnership-based solution which

keeps owners in control of their company.

Our product is essentially a hybrid between Private Credit and

Private Equity, and as the Private Credit explosion has become

mainstream in SME lending, we aim to ensure our 'best of both

worlds' approach is articulated to business owners in a way they

can compare. Therefore, we have embarked on a review of how best to

show business owners the advantages of Duke when they are looking

for capital. This review is ongoing and we will share the exciting

changes with our shareholders in the period to come when they have

been finalised. Our product remains the same to new business

owners, but how we will engage with them will open up more

opportunities for Duke and the goal is to broaden our appeal. We

believe we are at the forefront of a large opportunity as Private

Credit solutions become more accepted in SME lending.

As always, I am appreciative of the ongoing support of our

shareholders and, on the back of a period of continued resilience

and growth, I look forward to reporting on the Group's ongoing

progress and development in future periods.

Nigel Birrell

Chairman

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

Note Period Year to Period

to to

30-Sep-23 31-Mar-23 30-Sep-22

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Cash flows from operating

activities

Receipts from royalty investments 6 13,720 21,364 10,234

Receipts of interest from

loan investments 7 259 339 173

Other operating income 45 176 30

Operating expenses paid (2,383) (3,306) (1,061)

Payments for royalty participation

fees 9 (68) (112) (57)

Tax paid (498) (1,346) (813)

------------- ----------- -------------

Net cash inflow from operating

activities 11,075 17,115 8,506

Cash flows from investing

activities

Royalty investments advanced 6 (17,102) (23,809) (6,550)

Royalty investments received 6 7,041 - -

Loan investments advanced 7 - (2,500) (700)

Loan investments received 7 - 2,000 -

Equity investments advanced 8 (926) (500) -

Equity dividends received 8 48 3 -

Receipt of deferred consideration 10 750 - -

Investment costs paid (358) (357) (173)

Net cash outflow from investing

activities (10,547) (25,163) (7,423)

Cash flows from financing

activities

Proceeds from share issue 14 - 20,000 20,000

Share issue costs 14 - (1,115) (1,115)

Dividends paid 17 (5,709) (10,979) (5,282)

Proceeds from loans 12 5,000 71,250 5,050

Loans repaid 12 - (61,450) (18,500)

Interest paid 12 (2,819) (3,976) (1,872)

Other finance costs paid - (2,426) (30)

Net cash (outflow) / inflow

financing activities (3,528) 11,304 (1,749)

Net change in cash and cash

equivalents (3,000) 3,256 (666)

------------- ----------- -------------

Cash and cash equivalents

at beginning of period/year 8,939 5,707 5,707

Effect of foreign exchange

on cash 32 (24) 31

Cash and cash equivalents

at the end of period/year 5,971 8,939 5,072

============= =========== =============

The notes form an integral part of these Condensed Consolidated

Financial Statements.

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Period Year to Period

to to

30-Sep-23 31-Mar-23 30-Sep-22

Note (unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Income

Royalty investment net income 6 13,514 28,266 15,079

Loan investment net income 7 259 339 173

Equity investment net income 8 (3,442) 2,212 485

Other operating income 45 176 30

Total income 10,376 30,993 15,767

Investment costs

Transaction costs (21) (66) (28)

Due diligence costs (309) (620) (455)

Total investment costs (330) (686) (483)

Operating costs

Administration and personnel (2,033) (2,627) (1,811)

Legal and professional (274) (456) (232)

Other operating costs (131) (223) (100)

Expected credit losses 7 - (20) -

Share-based payments 15 (537) (969) (458)

------------- ----------- -------------

Total operating costs (2,975) (4,295) (2,601)

Operating profit 7,071 26,012 12,683

------------- ----------- -------------

Net foreign currency gains 55 66 177

Finance costs 3 (3,326) (5,644) (1,951)

Profit for the period before

tax 3,800 20,434 10,909

------------- ----------- -------------

Taxation expense 4 (408) (842) (614)

Total comprehensive income

for the period 3,392 19,592 10,295

============= =========== =============

Basic earnings per share (pence) 5 0.83 4.92 2.65

============= =========== =============

Diluted earnings per share

(pence) 5 0.83 4.92 2.65

============= =========== =============

All income is attributable to the holders of the Ordinary Shares

of the Company.

The notes form an integral part of these Condensed Consolidated

Financial Statements.

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

30-Sep-23 31-Mar-23 30-Sep-22

Note (unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Non-current assets

Goodwill 13 203 203 203

Royalty finance investments 6 174,149 158,540 149,853

Loan investments 7 4,652 4,652 3,872

Equity investments 8 11,564 13,529 11,305

Deferred tax asset 18 200 200 155

------------- ----------- -------------

190,768 177,124 165,388

Current assets

Royalty finance investments 6 26,521 32,793 22,091

Loan investments 7 - - 1,000

Trade and other receivables 10 1,529 2,290 2,294

Cash and cash equivalents 5,971 8,939 5,072

Current tax asset 463 373 111

------------- ----------- -------------

34,484 44,395 30,568

Total Assets 225,252 221,519 195,956

------------- ----------- -------------

Current liabilities

Royalty debt liabilities 9 167 154 165

Trade and other payables 11 454 433 1,423

Borrowings 12 527 441 337

1,148 1,028 1,925

Non-current liabilities

Royalty debt liabilities 9 988 988 960

Trade and other payables 11 1,286 1,314 1,331

Borrowings 12 59,351 53,930 34,363

61,625 56,232 36,654

Net Assets 162,479 164,259 157,377

============= =========== =============

Equity

Shares issued 14 172,939 172,939 172,939

Share based payment reserve 15 3,984 3,447 2,936

Warrant reserve 15 3,036 3,036 265

Retained losses 16 (17,480) (15,163) (18,763)

Total Equity 162,479 164,259 157,377

============= =========== =============

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share-based

Shares payment Warrant Retained Total

Note issued reserve reserve losses equity

GBP000 GBP000 GBP000 GBP000 GBP000

At 1 April 2022 153,974 2,478 265 (23,776) 132,941

---------- ------------- --------- ---------- ---------

Total comprehensive income for

the period - - - 10,295 10,295

Transactions with owners

Shares issued for cash 14 20,000 - - - 20,000

Share issuance costs 14 (1,115) - - - (1,115)

Shares issued to key advisers

as remuneration 14 80 - - - 80

Share based payments 15 458 - - 458

Dividends 17 - - - (5,282) (5,282)

---------- ------------- --------- ---------- ---------

Total transactions with owners 18,965 458 - (5,282) 14,141

At 30 September 2022 172,939 2,936 265 (18,763) 157,377

---------- ------------- --------- ---------- ---------

Total comprehensive income for

the period - - - 9,297 9,297

Transactions with owners

Share based payments 15 - 511 - - 511

Warrants issued 15 - - 2,771 - 2,771

Dividends 17 - - - (5,697) (5,697)

---------- ------------- --------- ---------- ---------

Total transactions with owners - 511 2,771 (5,697) (2,415)

At 31 March 2023 172,939 3,447 3,036 (15,163) 164,259

---------- ------------- --------- ---------- ---------

Share-based

Shares payment Warrant Retained Total

Note issued reserve reserve losses equity

GBP000 GBP000 GBP000 GBP000 GBP000

At 1 April 2023 172,939 3,447 3,036 (15,163) 164,259

--------- ------------- --------- ---------- ---------

Total comprehensive income for

the period - - - 3,392 3,392

Transactions with owners

Share based payments 15 - 537 - - 537

Dividends 17 - - - (5,709) (5,709)

--------- ------------- --------- ---------- ---------

Total transactions with owners - 537 - (5,709) (5,172)

At 30 September 2023 172,939 3,984 3,036 (17,480) 162,479

========= ============= ========= ========== =========

The notes form an integral part of these Condensed Consolidated

Financial Statements.

1. General Information

Duke Royalty Limited ("Duke Royalty" or the "Company") is a

company limited by shares, incorporated in Guernsey under the

Companies (Guernsey) Law, 2008. Its shares are traded on the AIM

market of the London Stock Exchange.

The "Group" comprised Duke Royalty Limited and its wholly owned

subsidiaries; Duke Royalty UK Limited, Capital Step Holdings

Limited, Capital Step Investments Limited, Capital Step Funding

Limited, Capital Step Funding 2 Limited and Duke Royalty Employee

Benefit Trust. During the period, Capital Step Holdings Limited,

Capital Step Investments Limited, Capital Step Funding Limited,

Capital Step Funding 2 Limited were dissolved via voluntarily

strike offs. Also during the period, the Group incorporated Duke

Royalty US Holdings, Inc., a company registered in Delaware,

USA.

The Group's investing policy is to invest in a diversified

portfolio of royalty finance and related opportunities.

2. Significant accounting policies

2.1 Basis of preparation

The interim Condensed Consolidated Financial Statements of the

Group have been prepared in accordance with UK adopted

international accounting standards, and applicable Guernsey law,

and reflect the following policies, which have been adopted and

applied consistently.

On 31 December 2020, IFRS as adopted by the European Union at

that date was brought into the UK law and became UK-adopted

international accounting standards, with future changes being

subject to endorsement by the UK Endorsement Board. The group

transitioned to UK-adopted international accounting standards in

its consolidated financial statements on 1 April 2021. There was no

impact or changes in accounting from the transition.

The accounting policies adopted in the preparation of the

interim Condensed Consolidated Financial Statements are consistent

with those followed in the preparation of the Consolidated

Financial Statements of the Group for the year ended 31 March

2023.

The Financial Statements have been prepared on a historical cost

basis, except for the following:

-- Royalty investments - measured at fair value through profit or loss

-- Equity investments - measured at fair value through profit or loss

-- Royalty participation liabilities - measured at fair value through profit or loss

The Directors consider that the Group has adequate financial

resources to enable it to continue operations for a period of no

less than 12 months from the date of approval of the financial

statements. Accordingly, the Directors believe that it is

appropriate to continue to adopt the going concern basis in

preparing the financial statements.

2.2 New and amended standards adopted by the Group

There were no new standards adopted by the Group during the

reporting period.

2.3 New standards and interpretations not yet adopted

At the date of authorisation of these interim Condensed

Consolidated Financial Statements, certain standards and

interpretations were in issue but not yet effective and have not

been applied in these interim Condensed Consolidated Financial

Statements. The Directors do not expect that the adoption of these

standards and interpretations will have a material impact on the

interim Condensed Consolidated Financial Statements of the Group in

future periods.

2.4 Going concern

In assessing the going concern basis of accounting the Directors

have had regard to the guidance issued by the Financial Reporting

Council. After making enquiries and bearing in mind the nature of

the Company's business and assets, the Directors consider that the

Company has adequate resources to continue in operational existence

for the foreseeable future.

The cash flow needs of the Group have been assessed taking

account the need for further funding for any of the existing

royalty partners and the ongoing working capital needs of the

business against the current cash and liquidity of the Group.

Furthermore, there is adequate headroom in terms of the uncalled

loan facility in place should it be required.

3. Finance Costs

Period Year to Period

to to

30-Sep-23 31-Mar-23 30-Sep-22

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Interest payable on borrowings 2,905 3,861 1,750

Non-utilisation fees - 194 112

Deferred finance costs released

to P&L 421 1,558 89

Other finance costs - 31 -

3,326 5,644 1,951

============= =========== =============

4. Income tax

The Company has been granted exemption from Guernsey taxation.

The Company's subsidiary in the UK is subject to taxation in

accordance with relevant tax legislation.

Period Year to Period

to to

30-Sep-23 31-Mar-23 30-Sep-22

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Current tax

Income tax expense 408 886 613

Deferred tax

Decrease in deferred tax assets - (44) 1

- (44) 1

Income tax expense 408 842 614

============= =========== =============

Factors affecting income tax expense for the period

Period Year to Period

to to

30-Sep-23 31-Mar-23 30-Sep-22

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Profit on ordinary activities

before tax 3,800 20,434 10,910

Tax using the Groups effective

tax rate of 10.73% (30 September

2022: 5.63%, 31 March 2023:

4.12%) 408 842 614

Income tax expense 408 842 614

============= =========== =============

5. Earnings per share

Period Year to Period

to to

30-Sep-23 31-Mar-23 30-Sep-22

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Total comprehensive income

(GBP000) 3,392 19,592 10,295

Weighted average number of

Ordinary Shares in issue, excluding

treasury shares (000s) 410,484 397,991 388,412

Basic earnings per share (pence) 0.83 4.92 2.65

============= =========== =============

Period Year to Period

to to

30-Sep-23 31-Mar-23 30-Sep-22

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Total comprehensive income

(GBP000) 3,392 19,592 10,295

Diluted weighted average number

of Ordinary Shares in issue,

excluding treasury shares (000s) 410,484 397,991 388,412

Diluted earnings per share

(pence) 0.83 4.92 2.65

============= =========== =============

Basic earnings per share is calculated by dividing total

comprehensive income for the period by the weighted average number

of shares in issue throughout the period, excluding treasury shares

(see Note 14). Diluted earnings per share represents the basic

earnings per share adjusted for the effect of dilutive potential

shares issuable on exercise of share options under the Company's

share-based payment schemes, weighted for the relevant period.

All share options, warrants and Long-Term Incentive Plan awards

in issue are not dilutive at the year-end as the exercise prices

were above the average share price for the period. However, these

could become dilutive in future periods.

Adjusted earnings per share

Adjusted earnings represent the Group's underlying performance

from core activities. Adjusted earnings is the total comprehensive

income adjusted for unrealised and non-core fair value movements,

non-cash items and transaction-related costs, including due

diligence fees, together with the tax effects thereon. Given the

sensitivity of the inputs used to determine the fair value of its

investments, the Group believes that adjusted earnings is a better

reflection of its ongoing financial performance.

Valuation and other non-cash movements such as those outlined

are not considered by management in assessing the level of profit

and cash generation of the Group. Additionally, IFRS 9 requires

transaction-related costs to be expensed immediately whilst the

income benefit is over the life of the asset. As such, an adjusted

earnings measure is used which reflects the underlying contribution

from the Group's core activities during the year.

Period Year to Period

to to

30-Sep-23 31-Mar-23 30-Sep-22

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Total comprehensive income

for the period 3,392 19,592 10,295

Unrealised fair value movements 4,295 (9,111) (5,330)

Expected credit losses - 20 -

Share-based payments 537 969 458

Investment costs 330 686 483

Tax effect of the adjustments

above at Group effective rate (553) 306 247

-------------

Adjusted earnings 8,001 12,462 6,153

============= =========== =============

Period Year to Period

to to

30-Sep-23 31-Mar-23 30-Sep-22

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Adjusted earnings for the year

(GBP000) 8,001 12,462 6,153

Weighted average number of

Ordinary Shares in issue, excluding

treasury shares (000s) 410,484 397,991 388,412

Adjusted earnings per share

(pence) 1.95 3.13 1.58

============= =========== =============

Period Year to Period

to to

30-Sep-23 31-Mar-23 30-Sep-22

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Diluted adjusted earnings for

the year (GBP000) 8,001 12,462 6,153

Diluted weighted average number

of Ordinary Shares in issue,

excluding treasury shares (000s) 410,484 397,991 388,412

Diluted adjusted earnings per

share (pence) 1.95 3.13 1.58

============= =========== =============

6. Royalty investments

Royalty investments are financial assets held at FVTPL that

relate to the provision of royalty capital to a diversified

portfolio of companies.

30-Sep-23 31-Mar-23 30-Sep-22

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Brought forward 191,333 160,479 160,479

Additions 17,102 23,809 6,550

Buybacks (7,041) - -

(Loss) / profit on financial

assets at FVTPL (724) 7,045 4,915

-------------

200,670 191,333 171,944

============= =========== =============

Royalty finance investments are comprised of:

30-Sep-23 31-Mar-23 30-Sep-22

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Non-current 174,149 158,540 149,853

Current 26,521 32,793 22,091

200,670 191,333 171,944

============= =========== =============

Royalty investment net income on the face of the consolidated

statement of comprehensive income comprises:

Period Year to Period

to to

30-Sep-23 31-Mar-23 30-Sep-22

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Royalty interest 12,559 21,364 10,234

Royalty premiums 1,760 - -

(Loss) / gain on royalty assets

at FVTPL (724) 7,045 4,916

Loss on royalty liabilities

at FVTPL (81) (143) (71)

13,514 28,266 15,079

============= =========== =============

All financial assets held at FVTPL are mandatorily measured as

such.

The Group's royalty investment assets comprise royalty financing

agreements with 15 (30 September 2022: 13, 31 March 2023: 15)

investees. Under the terms of these agreements the Group advances

funds in exchange for annualised royalty distributions. The

distributions are adjusted based on the change in the investees'

revenues, subject to a floor and a cap. The financing is secured by

way of fixed and floating charges over certain of the investees'

assets. The investees are provided with buyback options,

exercisable at certain stages of the agreements.

7. Loan investments

Loan investments are financial assets held at amortised cost

which the exception of the GBP2.2 million loan issued at 0%

interest. The impact of discounting is immaterial to the financial

statements. The below table shows both the loans at amortised cost

and fair value.

30-Sep-23 31-Mar-23 30-Sep-22

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Brought forward 4,652 4,172 4,172

Additions - 2,500 700

Buybacks - (2,000) -

Expected credit losses - (20) -

4,652 4,652 4,872

============= =========== =============

The Group's loan investments comprise secured loans advanced to

two entities (30 September 2022: two, 31 March 2023: two) in

connection with the Group's royalty investments.

The loans comprise fixed rate loans of GBP4,652,000 (30

September 2022: GBP4,872,000, 31 March 2023: GBP4,652,000) which

bear interest at rates of between 0% and 15%.

The loans mature as follows:

30-Sep-23 31-Mar-23 30-Sep-22

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

In less than one year - - 1,000

In one to two years - - -

In two to five years 4,652 4,652 3,872

4,652 4,652 4,872

============= =========== =============

Loan investment net income on the face of the consolidated

statement of comprehensive income comprises:

Period Year to Period

to to

30-Sep-23 31-Mar-23 30-Sep-22

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Loan interest 259 339 173

============= =========== =============

ECL Analysis

The measurement of ECLs is primarily based on the product of the

instrument's probability of default ("PD"), loss given default

("LGD"), and exposure at default ("EAD"). The Group analyses a

range of factors to determine the credit risk of each investment.

These include, but are not limited to:

-- liquidity and cash flows of the underlying businesses

-- security strength

-- covenant cover

-- balance sheet strength

If there is a material change in these factors, the weighting of

either the PD, LGD or EAD increases, thereby increasing the ECL

impairment.

The disclosure below presents the gross and net carrying value

of the Group' loan investments by stage:

Gross Net

carrying Allowance Carrying

amount for ECLs amount

As at 30 September 2023 GBP000 GBP000 GBP000

Stage 1 4,692 (40) 4,652

Stage 2 - - -

Stage 3 - - -

4,692 (40) 4,652

=========== =========== ===========

Net

Gross carrying Allowance Carrying

amount for ECLs amount

As at 31 March 2023 GBP000 GBP000 GBP000

Stage 1 4,692 (40) 4,652

Stage 2 - - -

Stage 3 - - -

4,692 (40) 4,652

================ =========== ===========

Net

Gross carrying Allowance Carrying

amount for ECLs amount

As at 30 September 2022 GBP000 GBP000 GBP000

Stage 1 4,892 (20) 4,872

Stage 2 - - -

Stage 3 - - -

4,892 (20) 4,872

================ =========== ===========

Under the ECL model introduced by IFRS 9, impairment provisions

are driven by changes in credit risk of instruments, with a

provision for lifetime expected credit losses recognised where the

risk of default of an instrument has increased significantly since

initial recognition.

The credit risk profile of the investments has not increased

materially and they remain Stage 1 assets. No ECLs have been

charged in the period on these assets as they are not deemed

material.

The following table analyses Group's provision for ECL's by

stage for the period ended 30 September 2023:

Stage Stage Stage Total

1 2 3

GBP000 GBP000 GBP000 GBP000

At 1 April 2022 and 30

September 2022 72 - - 72

Expected credit losses

on loan investments in

period 22 - - 22

Refinanced loans (2) (2)

-------- --------

Carrying value at 31

March 2023 and 30 September

2023 92 - - 92

======== -------- -------- ========

8. Equity investments

Equity investments are financial assets held at FVTPL.

30-Sep-23 31-Mar-23 30-Sep-22

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Brought forward 13,529 10,820 10,820

Additions 1,525 500 -

(Loss) / gain on equity assets

held at FVTPL (3,490) 2,209 485

11,564 13,529 11,305

============= =========== =============

The Group's equity investments comprise unlisted shares in 12 of

its royalty investment companies (30 September 2022: 10, 31 March

2023: 11).

The Group also still holds two (30 September 2022: two, 31 March

2023: two) unlisted investments in mining entities from its

previous investment objectives. The Board does not consider there

to be any future cash flows from the remaining investments and they

are fully written down to nil value.

Equity investment net income on the face of the consolidated

statement of comprehensive income comprises:

Period Year to Period

to to

30-Sep-23 31-Mar-23 30-Sep-22

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

(Loss) / gain on equity investments

at FVTPL (3,490) 2,209 485

Dividend income 48 3 -

(3,442) 2,212 485

============= =========== =============

9. Royalty debt liabilities

Royalty debt liabilities are financial liabilities held at

FVTPL.

30-Sep-23 31-Mar-23 30-Sep-22

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Brought forward 1,142 1,111 1,111

Payments made (68) (112) (57)

Loss on financial assets held

at FVTPL 81 143 71

-------------

1,155 1,142 1,125

============= =========== =============

Royalty debt liabilities are comprised of:

30-Sep-23 31-Mar-23 30-Sep-22

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Current 167 154 165

Non-current 988 988 960

1,155 1,142 1,125

============= =========== =============

10. Trade and other receivables

30-Sep-23 31-Mar-23 30-Sep-22

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Current

Prepayments and accrued income 25 59 8

Other receivables 1,504 2,231 2,286

------------- ----------- -------------

1,529 2,290 2,294

============= =========== =============

The other receivable balance consists of funds due on the sale

of Duke Royalty Switzerland Gmbh, incorporated to hold the

riverboat assets. On 31 March 2021, Duke sold its Swiss subsidiary

to Starling Fleet AG for EUR11,600,000. The deal was structured so

that EUR5,000,000 was payable on or before 30 September 2021 and

EUR4,000,000 was due on or before 30 September 2022. Of the

remaining EUR2,600,000, EUR867,000 was paid in September 2023, with

the remainder due on or before 30 September 2024. The outstanding

balance is accruing interest at 10% er annum.

Using the same methodology as laid out in note 7 for the loan

investments, the deferred consideration has been subject to ECL

impairment. The financial strength of the counterparty has been

reviewed in conjunction with current and future outlook for river

cruising, while also considering the charges that the Group owns

over the riverboats. No impairment was recognised in the period to

30 September 2023.

11. Trade and other payables

30-Sep-23 31-Mar-23 30-Sep-22

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Current

Trade payables 20 6 8

Transaction costs 316 315 279

Accruals and deferred income 118 112 1,136

454 433 1,423

------------- ----------- -------------

Non-current

Transaction costs 1,286 1,314 1,331

1,740 1,747 2,754

------------- ----------- -------------

12. Borrowings

30-Sep-23 31-Mar-23 30-Sep-22

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Secured loan

Current - accrued interest 527 441 337

Non-current 59,351 53,930 34,363

59,878 54,371 34,700

============= =========== =============

In January 2023, the Group entered into a new credit facility

agreement with Fairfax Financial Holdings Limited and certain of

its subsidiaries ("Fairfax") and issued Fairfax 41,615,134

warrants. Refer to Note 15 for details. The facility term is up to

GBP100m to replace Duke's existing GBP55m million term and

revolving facilities. The credit facility has a five-year term,

expiring in January 2028 with a bullet repayment on expiry and no

amortisation payments during the five-year term. Furthermore, the

interest rate is equal to SONIA plus 5.00% per annum.

The Group has adopted Interest Rate Benchmark Reform - IBOR

'phase 2' (Amendments to IFRS 9, IAS 39, IFRS 7, IFRS 4 and 16).

Applying the practical expedient introduced by the amendments, when

the benchmarks affecting the Group's loans are replaced, the

adjustments to the contractual cash flows will be reflected as an

adjustment to the effective interest rate. Therefore, the

replacement of the loans' benchmark interest rate will not result

in an immediate gain or loss recorded in profit or loss, which may

have been required if the practical expedient was not available or

adopted.

At 30 September 202 3, GBP37,000,000 was undrawn on the facility

( 30 September 2022: GBP20,250,000, 31 March 2023: GBP42,000,000

).

Costs and fees of GBP1,439,000 were capitalised against the new

credit facility. At 30 September 2023, GBP1,247,000 of unamortised

fees were outstanding (30 September 2022: GBP387,000, 31 March

2023: GBP1,391,000).

The table below sets out an analysis of net debt and the

movements in net debt for the period ended 30 September 2023, the

prior period and the year ended 31 March 2023.

Interest

Payable Borrowings

GBP000 GBP000

At 1 April 2022 362 47,740

Cash movements

Loan advanced - 5,050

Loan repaid - (18,500)

Interest paid (1,872) -

Other finance costs paid (30) -

Non-cash movements

Deferred finance costs released to P&L - 73

Interest charged 1,862 -

Other finance costs charged 15 -

As at 30 September 2022 337 34,363

========== ============

Cash movements

Loan advanced - 66,200

Loan repaid - (42,950)

Deferred finance costs paid - (2,347)

Interest paid (2,104) -

Non-cash movements

Deferred finance costs released to P&L

- old facility 1,343

Deferred finance costs released to P&L

- new facility - 92

Issue of warrants - (2,771)

Interest charged 2,193 -

Other finance costs charged 15 -

As at 31 March 2023 441 53,930

========= ==========

Interest

Payable Borrowings

GBP000 GBP000

At 1 April 2023 441 53,930

Cash movements

Loan advanced - 5,000

Loan repaid - -

Interest paid (2,819) -

Non-cash movements

Deferred finance costs released to P&L - 421

Interest charged 2,905 -

As at 30 September 2023 527 59,351

========== ============

13. Goodwill

30-Sep-23 31-Mar-23 30-Sep-22

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Goodwill arising on business

combination 203 203 203

============= =========== =============

14. Share capital

External Treasury Total

Shares Shares shares

No. No. No. GBP000

Allotted, called up

and fully paid

At 31 March 2022 348,614 10,190 358,804 153,974

---------- ---------- --------- ---------

Shares issued for cash

during the period 57,143 - 57,143 20,000

Share issuance costs - - - (1,115)

Shares issued to directors

and key advisers as remuneration 205 - 205 80

At 30 September 2022 405,962 10,190 416,152 172,939

---------- ---------- --------- ---------

Shares issued to Employee

Benefit Trust during

the period - 1,382 1,382 -

PSA shares vested during

the year 1,800 (1,800) - -

At 31 March 2023 407,762 9,772 417,534 172,939

---------- ---------- --------- ---------

Shares issued to Employee

Benefit Trust during

the period - 3,955 3,955 -

PSA shares vested during

the year 7,665 (7,665) - -

At 31 September 2023 415,427 6,062 421,489 172,939

========== ========== ========= =========

There is a single class of shares. There are no restrictions on

the distribution of dividends and the repayment of capital with

respect to externally held shares. The shares held by the Duke

Royalty Employee Benefit Trust are treated as treasury shares. The

rights to dividends and voting rights have been waived in respect

of these shares.

15. Equity-settled share-based payments

Warrant reserve

There were no movements in the warrant reserve during the

period:

Warrants

No. (000) GBP000

At 1 April and 30 September 2022 4,375 265

Issued during the period 41,615 2,771

Lapsed during the period (2,000) -

----------- --------

At 31 March 2023 43,990 3,036

----------- --------

Lapsed during the period (2,375) -

----------- --------

At 30 September 2023 41,615 3,036

=========== ========

In January 2023, Duke issued 41,615,134 warrants to Fairfax. The

warrants expire in January 2028 and have an exercise price of 45

pence. As per IFRS 2, the warrants have been valued using the Black

Scholes model. A total expense of GBP2,771,000 has been capitalised

and will be amortised over the life of the warrants. In the period

to 30 September 2023, an expense of GBP277,000 (30 September 2022:

GBPnil, 31 March 2023: GBP92,000) was recognised through finance

costs in relation to the warrants.

At 30 September 2023, 41,615,000 (30 September 2022: 4,375,000,

31 March 2023 43,990,000) warrants were outstanding and exercisable

at a weighted average exercise price of 45 pence (30 September

2022: 46 pence, 31 March 2023: 45 pence). The weighted average

remaining contractual life of the warrants outstanding was 4.26

years (30 September 2022: 0.50 years, 31 March 2023: 4.56

years).

Share-based payment reserve

The following table shows the movements in the share-based

payment reserve during the period:

Share options LTIP Total

GBP000 GBP000 GBP000

At 1 April 2022 136 2,342 2,478

LTIP awards - 458 458

--------------- -------- --------

At 30 September 2022 136 2,800 2,936

LTIP awards - 511 511

--------------- -------- --------

At 31 March 2023 136 3,311 3,447

LTIP awards - 537 537

--------------- -------- --------

At 30 September 2023 136 3,848 3,984

=============== ======== ========

Share option scheme

The Group operates a share option scheme ("the Scheme"). The

Scheme was established to incentivise Directors, staff and key

advisers and consultants to deliver long-term value creation for

shareholders.

Under the Scheme, the Board of the Company will award, at its

sole discretion, options to subscribe for Ordinary Shares of the

Company on terms and at exercise prices and with vesting and

exercise periods to be determined at the time. However, the Board

of the Company has agreed not to grant options such that the total

number of unexercised options represents more than four per cent of

the Company's Ordinary Shares in issue from time to time. Options

vest immediately and lapse five years from the date of grant.

No share options were granted during the period to 30 September

2023.

At 30 September 2023, 200,000 options (30 September 2022:

200,000, 31 March 2023: 200,000) were outstanding and exercisable

at a weighted average exercise price of 50 pence (30 September

2022: 50 pence, 31 March 2023: 50 pence). The weighted average

remaining contractual life of the options outstanding at the period

end was 0.10 year (30 September 2022: 1.00 year, 31 March 2023:

1.50 years).

Long Term Incentive Plan

Under the rules of the Long-Term Incentive Plan ("LTIP") the

Remuneration Committee may grant Performance Share Awards ("PSAs")

which vest after a period of three years and are subject to various

performance conditions. The LTIP awards will be subject to a

performance condition based 50 per cent on total shareholder return

("TSR") and 50 per cent on total cash available for distribution

("TCAD per share"). TSR can be defined as the returns generated by

shareholders based on the combined value of the dividends paid out

by the Company and the share price performance over the period in

question. Upon vesting the awards are issued fully paid.

The fair value of the LTIP awards consists of (a) the fair value

of the TSR portion; and (b) the fair value of the TCAD per share

portion. Since no consideration is paid for the awards, the fair

value of the awards is based on the share price at the date of

grant, as adjusted for the probability of the vesting of the

performance conditions. Since the performance condition in respect

of the TSR portion is a market condition, the probability of

vesting is not revisited following the date of grant. The

probability of vesting of the TCAD per share portion, containing a

non-market condition, is reassessed at each reporting date. The

resulting fair values are recorded on a straight-line basis over

the vesting period of the awards.

3,663,000 performance share awards (PSAs) were granted during

the period to 30 September 2023 (30 September 2022: nil, 31 March

2023: 3,955,000).

At 30 September 2023, 9,726,000 (30 September 2022: 12,298,000,

31 March 2023: 13,727,000) PSAs were outstanding. The weighted

average remaining vesting period of these awards outstanding was

1.49 years (30 September 2022: 1.44 years, 31 March 2023: 1.20

years).

16. Distributable reserves

Under Guernsey law, the Company can pay dividends provided it

satisfies the solvency test prescribed by the Companies (Guernsey)

Law, 2008. The solvency test considers whether the Company is able

to pay its debts when they fall due, and whether the value of the

Company's assets is greater than its liabilities. The Company

satisfied the solvency test in respect of the dividends declared in

the period.

17. Dividends

The following interim dividends have been recorded in the period

to 30 September 2023, 31 March 2023 and 30 September 2022:

Dividend Dividends

per

share payable

Record date Payment date pence/share GBP000

25-Mar-22 12-Apr-22 0.70 2,440

01-Jul-22 12-Jul-22 0.70 2,842

Dividends payable for the period ended 30 September

2022 5,282

=============

Dividend Dividends

per

share payable

Record date Payment date pence/share GBP000

30-Sep-22 12-Oct-22 0.70 2,842

23-Dec-22 12-Jan-23 0.70 2,854

Dividends payable for the period ended 31 March

2023 5,696

=============

31-Mar-23 12-Apr-23 0.70 2,854

23-Jun-23 12-Jul-23 0.70 2,855

Dividends payable for the period ended 30 September

2023 5,709

=============

On 29 September 2023 the Company approved a further quarterly

cash dividend of 0.70 pence per share, totalling GBP2,908,000,

which was paid on 12 October 2023.

18. Deferred tax

Total

GBP000s

1 April 2022 156

Credited / (charged) to profit & loss (1)

---------

At 30 September 2022 155

Credited / (charged) to profit & loss 45

---------

At 31 March 2023 200

Charged to profit & loss -

At 30 September 2023 200

=========

A deferred tax asset has been recognised as it is expected that

future available taxable profits will be available against which

the Group can use against the tax losses.

19. Related parties

Directors' fees

The following fees were payable to the Directors during the

period:

Period Year to Period

to to

30-Sep-23 31-Mar-23 30-Sep-22

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Short term remuneration 831 1,012 734

Share-based payments 256 464 211

1,087 1,476 945

============= =========== =============

Other related party transactions

The following amounts were paid to related parties during the

period in respect of support services fees:

Period Year to Period

to to

30-Sep-23 31-Mar-23 30-Sep-22

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Abingdon Capital Corporation 263 425 205

Arlington Group Asset Management

Limited 50 93 43

313 518 248

============= =========== =============

Support Service Agreements with Abingdon Capital Corporation

("Abingdon"), a company of which Neil Johnson is a director, and

Arlington Group Asset Management Limited ("Arlington"), a company

of which Charles Cannon Brookes is a director, were signed on 16

June 2015. Fees paid to these companies relate to the recharge of

office rental costs. Abingdon fees also includes fees relating to

remuneration of staff residing in North America.

Dividends

The following dividends were paid to related parties:

Period Year to Period

to to

30-Sep-23 31-Mar-23 30-Sep-22

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Directors (1) 196 354 186

Other related parties 50 92 27

246 446 213

============= =========== =============

(1) Includes dividends paid to Abinvest Corporation, a wholly

owned subsidiary of Abingdon Capital Corporation, and to Arlington

Group Asset Management

20. Fair value measurements

Fair value hierarchy

IFRS 13 requires disclosure of fair value measurements by level

of the following fair value hierarchy:

Level 1 : Inputs are quoted prices (unadjusted) in active

markets for identical assets and liabilities that the entity can

readily observe.

Level 2: Inputs are inputs other than quoted prices included

within Level 1 that are observable for the asset, either directly

or indirectly.

Level 3: Inputs that are not based on observable market date

(unobservable inputs).

The Group has classified its financial instruments into the

three levels prescribed as follows:

30-Sep-23 31-Mar-23 30-Sep-22

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Financial assets

Financial assets at FVTPL

- Royalty finance investments 200,670 191,333 171,944

- Equity investments 11,564 13,529 11,305

212,234 204,862 183,249

============= =========== =============

Financial liabilities

Financial liabilities at FVTPL

- Royalty debt liabilities 1,155 1,142 1,125

============= =========== =============

The following table presents the changes in level 3 items for

the periods ended 30 September 2023, 31 March 2023 and 30 September

2022:

Financial Financial

Assets Liabilities Total

GBP000 GBP000 GBP000

At 31 March 2022 171,299 (1,111) 170,188

Additions 6,550 - 6,550

Royalty income received (15,079) - (15,079)

RP liability paid - 57 57

Net change in FV 20,479 (70) 20,409

----------- ------------- ----------

At 30 September 2022 183,249 (1,124) 182,125

Additions 17,759 17,759

Royalty income received (13,187) (13,187)

RP liability paid - 55 55

Net change in FV 17,041 (73) 16,968

----------- ------------- ----------

At 31 March 2023 204,862 (1,142) 203,720

Additions 18,628 - 18,628

Repayments (7,041) - (7,041)

Royalty income received 11,959 - 11,959

RP liability paid - 68 68

Net change in FV (16,174) (81) (16,255)

At 30 September 2023 212,234 (1,155) 211,079

=========== ============= ==========

Valuation techniques used to determine fair values

The fair value of the Group's financial instruments is

determined using discounted cash flow analysis and all the

resulting fair value estimates are included in level 3.

Valuation processes

The main level 3 inputs used by the Group are derived and

evaluated as follows:

Annual adjustment factors for royalty investments and royalty

participation liabilities

These factors are estimated based upon the underlying past and

projected performance of the royalty investee companies together

with general market conditions.

Discount rates for financial assets and liabilities

These are initially estimated based upon the projected internal

rate of return of the royalty investment and subsequently adjusted

to reflect changes in credit risk determined by the Group's

Investment Committee.

Changes in level 3 fair values are analysed at the end of each

reporting period and reasons for the fair value movements are

documented.

Valuation inputs and relationships to fair value

The following summary outlines the quantitative information

about the significant unobservable inputs used in level 3 fair

value measurements:

Royalty investments

The unobservable inputs are the annual adjustment factor and the

discount rate. The range of annual adjustment factors used is -6.0%

to 6.0% and the range of risk-adjusted discount rates is 14.7% to

17.4%.

Equity investments

The unobservable inputs are the EBITDA multiples and

forward-looking EBITDA. The range of EBITDA multiples used is 5.3x

to 10.0x (5.0x to 7.8x).

Royalty participation instruments

The unobservable inputs are the annual adjustment factor and the

discount rate. The range of annual adjustment factors used is -6.0%

to 6.0% and the range of risk-adjusted discount rates is 16.3% to

17.4%.

21. Events after the financial reporting date

Dividends

On 12 October 2023, the Company paid a quarterly dividend of

0.70 pence per share.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR KFLFLXFLFFBE

(END) Dow Jones Newswires

November 22, 2023 02:00 ET (07:00 GMT)

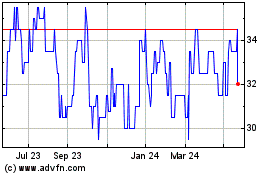

Duke Capital (AQSE:DUKE.GB)

Historical Stock Chart

From Oct 2024 to Nov 2024

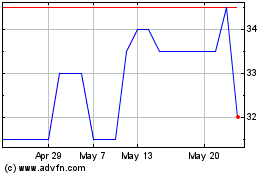

Duke Capital (AQSE:DUKE.GB)

Historical Stock Chart

From Nov 2023 to Nov 2024