TIDMHUM

RNS Number : 9521E

Hummingbird Resources PLC

01 November 2022

Hummingbird Resources plc / Ticker: HUM / Index: AIM / Sector:

Mining

1 November 2022

Hummingbird Resources plc

("Hummingbird" or the "Company")

Update on Dugbe Gold Project

Pasofino Announces Exercise of Right to Consolidate Ownership of

the Dugbe Gold Project

Hummingbird Resources plc (AIM: HUM) is pleased to report that

Pasofino Gold Ltd ("Pasofino") has provided notice to exercise its

right to convert Hummingbird's 51% interest in the Dugbe Gold

Project ("Dugbe") to a 51% interest in Pasofino, such that Pasofino

would become the owner of 100% of Dugbe (prior to giving effect to

the 10% carried interest of the Government of Liberia) and

Hummingbird would own 51% of Pasofino (the "Consolidation").

The Consolidation is subject to all required government, TSX

Venture Exchange and shareholder approvals .

Pasofino will issue to Hummingbird such number of common shares

of Pasofino that results in Hummingbird owning 51% of the

outstanding Common Shares of Pasofino on completion of the

Consolidation. In addition, Hummingbird has an anti-dilution right

that provides that if, as and when any warrants outstanding as at

the date the option satisfaction notice was issued by Pasofino are

exercised, Pasofino shall issue to Hummingbird one Common Share for

each Common Share issued in connection with such exercise.

The announcement by Pasofino can be accessed through the

following link: https://pasofinogold.com/news/default.aspx

Dan Betts , CEO of Hummingbird Resources, commented: "With this

consolidation, Hummingbird moves to owning 51% of Pasofino which

simplifies the ownership structure and ensures that what is one of

the largest gold projects in West Africa has clear visibility of

its own. With 2.8m oz of gold reserves, unrivalled exploration

potential and a recently completed feasibility study, this project

has some of the most attractive economics of any development

project in the region and it is the objective to now maximise value

for all stakeholders."

Krisztian Toth, Chairman of the Board of Pasofino, commented:

"We are excited to consolidate the ownership of the world class

Dugbe Project under Pasofino. By consolidating ownership of the

Dugbe Project, Hummingbird and Pasofino are better placed to

execute on the strategic review process being undertaken to

identify opportunities to generate maximum value for each of our

stakeholders."

ABOUT THE DUGBE GOLD PROJECT

The 2,559 km(2) Dugbe Gold Project is in southern Liberia and

situated within the southwestern corner of the Birimian Supergroup

which is host to most West African gold deposits. To date, two

deposits have been identified on the Project; Dugbe F and Tuzon

discovered by Hummingbird in 2009 and 2011 respectively. The

deposits are located within 4 km of the Dugbe Shear Zone which is

thought to have played a role in large scale gold mineralization in

the area.

A significant amount of exploration in the area was conducted by

Hummingbird up until 2012 including 74,497 m of diamond coring.

Pasofino drilled an additional 14,584 metres at Tuzon and Dugbe

during 2021. Both deposits have Mineral Resource Estimates dated 17

November 2021 with total Measured and Indicated of 3.3 Moz with an

average grade of 1.37 g/t Au, and 0.6 Moz in Inferred. Following

the completion of the Feasibility Study in June 2022 a Mineral

Reserve Estimate was declared, based on the open-pit mining of both

deposits over a 14-year Life of Mine. A technical report for the

Dugbe Gold Project was prepared in accordance with National

Instrument 43-101 and filed on SEDAR at www.sedar.com and on the

Company's website.

Highlights of the Feasibility Study as previously announced

include:

Strong financial metrics :

- Pre-tax NPV5% of USD690M (USD530M post-tax), 26.35% IRR (23.6%

post-tax) at a base gold price of USD1,700/oz.

- Fast capital payback of approximately 3.5 years from start of production:

- Life of mine (LOM) All In Sustaining Cost (AISC) of USD1,005oz and USD29/t cash cost.

- Pre-production capital requirement of USD397M excluding

owners' costs for a 5Mtpa processing plant.

Large Mineral Reserve with potential for expansion:

- 2.27Moz gold produced over a 14-year LOM.

- Average annual production of 200,000oz for the first 5 years.

- 2.76Moz of Mineral Reserves.

- Additional 67koz of Inferred Mineral Resources within the FS

pit and immediate sidewalls which have not been included in the

Mineral Reserves.

Simple project with economies of scale :

- LOM strip ratio of 4.21:1 highlighted by a low 3.56:1 ratio in the first five years.

- Simple (Gravity-CIL) process flow sheet which enhances project economics.

- Low power costs of USD0.175/kWh, with opportunities for

long-term savings with alternative renewable energy sources.

In addition to the existing deposits there are many gold

prospects within the Project including the Bukon Jedeh area and the

DSZ target on the Tuzon-Sackor trend where Pasofino has discovered

a broad zone of surface gold mineralisation in trench and outcrop

along strike from Tuzon. At this and several of the other prospects

no drilling has been carried out to date.

In 2019, Hummingbird signed a 25-year Mineral Development

Agreement ("MDA") with the Government of Liberia providing the

necessary long-term framework and stabilization of taxes and

duties. Under the terms of the MDA, the royalty rate on gold

production is 3%, the income tax rate payable is 25% (with credit

given for historic exploration expenditures), the fuel duty is

reduced by 50%, and the Government of Liberia is granted a free

carried interest of 10% in the Project.

About Pasofino Gold Ltd.

Pasofino Gold Ltd. is a Canadian-based mineral exploration

company listed on the TSX-V (VEIN). Pasofino, through its

wholly-owned subsidiary, owns a 49% economic interest (prior to the

issuance of the Government of Liberia's 10% carried interest) in

the Dugbe Gold Project. Pasofino has exercised its option to

consolidate ownership in the Dugbe Gold Project by requiring

conversion of Hummingbird's 51% ownership of the Project for a 51%

shareholding in Pasofino, such that Pasofino would own 100% of the

Project (prior to the government of Liberia's 10% carried

interest), subject to the receipt of all required government, TSX

Venture Exchange and shareholder approvals.

For further information please visit www.hummingbirdresources.co.uk or contact:

Daniel Betts, Hummingbird Resources Tel: +44 (0) 20

CEO plc 7409 6660

Thomas Hill,

FD

Anthony Köcken,

COO

Edward Montgomery,

CSO & ESG

James Spinney Strand Hanson Limited Tel: +44 (0) 20

Ritchie Balmer Nominated Adviser 7409 3494

---------------------- ----------------------------

James Asensio Canaccord Genuity Tel: +44 (0) 20

Gordon Hamilton Limited 7523 8000

Broker

---------------------- ----------------------------

Bobby Morse Buchanan Tel: +44 (0) 20

George Cleary Financial PR/IR 7466 5000

Email: HUM@buchanan.uk.com

---------------------- ----------------------------

Notes to Editors:

Hummingbird Resources plc (AIM: HUM) is a leading multi-asset,

multi-jurisdiction gold production, development and exploration

Company, member of the World Gold Council and founding member of

Single Mine Origin (www.singlemineorigin.com). The Company

currently has two core gold projects, the operational Yanfolila

Gold Mine in Mali, and the Kouroussa Gold Mine in Guinea, which

will more than double current gold production when production,

scheduled for first gold pour end of Q2 2023. Further, the Company

has a controlling interest in the Dugbe Gold Project in Liberia

that is being developed by Pasofino Gold Limited through an earn-in

agreement. The final feasibility results on Dugbe showcase 2.76Moz

in Reserves and strong economics such as a 3.5-year capex payback

period once in production, 14-year life of mine at a low AISC

profile of US$1,005/oz. Our vision is to continue to grow our asset

base, producing profitable ounces, while central to all we do being

our Environmental, Social & Governance ("ESG") policies and

practices.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFLFVVLSLLIIF

(END) Dow Jones Newswires

November 01, 2022 09:39 ET (13:39 GMT)

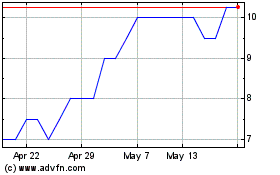

Hummingbird Resources (AQSE:HUM.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Hummingbird Resources (AQSE:HUM.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024