TIDMOMI

RNS Number : 6121R

Orosur Mining Inc

30 October 2023

Orosur Mining Inc.

Results for First Quarter ended August 31, 2023

London, October 30th, 2023 . Orosur Mining Inc. ("Orosur" or

"the Company") (TSX-V: OMI) (AIM: OMI) the minerals developer and

explorer with operations in Colombia, Argentina, Nigeria and Brazil

announces its unaudited results for the quarter ended August 31,

2023. All dollar figures are stated in US$ unless otherwise noted.

The unaudited condensed interim financial statements of the Company

for the quarter ended August 31, 2023 and the related management's

discussion and analysis ("MD&A") have been filed and are

available for review on the SEDAR+ website at www.sedarplus.ca. The

financial statements and the MD&A are also available on the

Company's website at www.orosur.ca .

A link to the PDF version of the financial statements is

available here:

http://www.rns-pdf.londonstockexchange.com/rns/6121R_2-2023-10-27.pdf

A link to the PDF version of the MD&A is available here :

http://www.rns-pdf.londonstockexchange.com/rns/6121R_1-2023-10-27.pdf

HIGHLIGHTS

-- In Colombia, negotiations continued with Monte Aguila on the

shareholders agreement which will govern the new mining company to

be owned 51% by Monte Agulia and 49% by Orosur. These discussions

have continued post the period end. Whilst exploration activities

have been wound back, some mapping and surface sampling has been

carried out; a variety of licence processes, such as the

integration of smaller licences have been advanced; and Monte

Aguila has continued to fund the promotion of relationships with

local community groups to strengthen the social licence to operate

the Project.

-- In Brazil, on July 5, 2023, the Company announced that given

the success of the regional stream sediment program performed

across the Company's Ariquemes district, it had decided to move to

the next phase which has targeted two prospects at Oriente Novo (in

the east of the Company's tenements) and at Paraiso in the west and

to the north of the Bom Futuro tin mine. Sampling was performed

during July and August and assays are expected imminently.

-- In Argentina, on May 4, 2023 the Company announced that

mapping and ground magnetic surveys at El Pantano had identified a

major NW-SE structural corridor over 20km long and 5km wide, with

large areas of silicification, alteration and geochemical anomalism

over extensive areas. Mapping to the north of the main structure

has so far identified over 70 quartz veins over an area in excess

of 20km(2) , with textures indicative of cooler temperatures, fully

consistent with the model of a very large low-sulphidation

epithermal system. Mapping of this vein field continued until the

commencement of the winter recess in early June. Soil sampling

assay results were received and continued to add weight to the

geological model with extended anomalism in gold and key pathfinder

elements. Sampling and ground magnetic surveys recommenced after

the winter recess in September with the plan of completing coverage

of the highest priority parts of the project before the end of the

year.

-- In Uruguay the Company's wholly owned subsidiary, Loryser,

continued to focus its activities on the final stages of the

Creditors Agreement. In line with the Creditors Agreement, Loryser

has sold all of its assets. It has paid for the settlements with

all of its former employees; it has finalised the reclamation and

remediation works on the tailings dam and has successfully

concluded a one-year post-closure control phase. Loryser is well

advanced in distributing the proceeds to Loryser's trade creditors

in accordance with the Creditors' Agreement, via a court approved

paying agent.

-- Post the period end, on October 16,2023, the Company

announced that it had signed a joint venture agreement over four

licences in the Nigerian lithium belt. The Company, via a new 100%

owned UK subsidiary, Lithium West Limited ("Lithium West"), may

earn up to 70% equity in the project in two phases: Phase 1 -

Lithium West can earn 51% equity in the project by spending a total

of US$3m over a maximum of three years. Phase 2 - Lithium West can

earn an additional 19% equity in the project, up to a total of 70%,

by spending an additional US$2m over a maximum of two years. Other

prospective areas are currently being examined and it is possible

that additional licences may be added to the project in the near

term.

Financial and Corporate

-- The unaudited condensed interim consolidated financial

statements have been prepared on a going concern basis under the

historical cost method except for certain financial assets and

liabilities which are accounted for as Assets and Liabilities held

for sale (at the lower of book value or fair value) and Profit and

Loss from discontinued operations. This accounting treatment has

been applied to the activities in Uruguay and Chile.

-- On August 31, 2023, the Company had a cash balance of

$3,186,000 (May 31, 2023: $3,748,000). As at the date of this

announcement the Company had a cash balance of $2,350,000.

Louis Castro, Executive Chairman of Orosur said:

"This has been a very busy progressive first quarter for the

Company, with positive advances across all our portfolio. We are

particularly delighted, post period, to add a high quality Lithium

asset in Nigeria with an in situ team, which will allow us to focus

on both our South American activities and on our new asset. "

Condensed Interim Consolidated Statements of Financial Position

(Expressed in thousands of United States

dollars)

Unaudited

As at As at

August 31, May 31,

2023

$ 2023

$

-------------------------------------------- ------------- ----------

ASSETS

Current assets

Cash 3,186 3,748

Restricted cash 12 12

Accounts receivable and other assets 208 219

Assets held for sale in Uruguay 958 898

-------------------------------------------- ------------- ----------

Total current assets 4,364 4,968

Non-current assets

Property, plant and equipment 137 123

Exploration and evaluation assets 3,787 3,334

-------------------------------------------- ------------- ----------

Total assets 8,288 8,425

-------------------------------------------- ------------- ----------

LIABILITIES AND DEFICIT

Current liabilities

Accounts payable and accrued liabilities 269 336

Liability of Chile discontinued operation 2,248 2,204

Liabilities held for sale in Uruguay 12,719 12,546

-------------------------------------------- ------------- ----------

Total current liabilities 15,236 15,086

-------------------------------------------- ------------- ----------

Deficit

Share capital 69,341 69,341

Share-based payments reserve 10,539 10,539

Currency translation reserve (2,398) (2,725)

Deficit (84,430) (83,816)

-------------------------------------------- ------------- ----------

Total deficit (6,948) (6,661)

-------------------------------------------- ------------- ----------

Total liabilities and deficit 8,288 8,425

-------------------------------------------- ------------- ----------

Condensed Interim Consolidated Statements of Loss and Comprehensive

Loss

(Expressed in thousands of United States

dollars)

(Except common shares and per share

amounts)

Unaudited

Three Months Three Months

Ended Ended

August 31, August 31,

2023 2022

$ $

--------------------------------------------- -------------- ----------------------

Corporate and administrative expenses (398) (407)

Exploration expenses (27) (62)

Other income 6 6

Net finance cost (4) (2)

Gain on fair value of warrants - 76

Foreign exchange (loss) gain net 59 (39)

--------------------------------------------- -------------- ----------------------

Net (loss) for the period for continuing

operations (364) (428)

(Loss) income from discontinued operations (250) 71

--------------------------------------------- -------------- ----------------------

Net (loss) for the period (614) (357)

Item which may be subsequently reclassified

to profit or loss:

Cumulative translation adjustment 327 (505)

--------------------------------------------- -------------- ----------------------

Total comprehensive (loss) for the period (287) (862)

--------------------------------------------- -------------- ----------------------

Basic and diluted net (loss) income

per share for

- continuing operations (0.00) (0.00)

- discontinued operations (0.00) 0.00

Weighted average number of common shares

outstanding 188,560 188,432

--------------------------------------------- -------------- ----------------------

Condensed Interim Consolidated Statements of Cash Flows

(Expressed in thousands of United States

dollars)

Unaudited Three Months Three Months

Ended Ended

August 31, August 31,

2023 2022

$ $

------------------------------------------------ -------------- --------------

Operating activities

Net loss for the period for continued

and discontinued operations (614) (357)

Adjustments for

Depreciation / Write downs 2 -

Gain on fair value of warrants - (76)

Gain on sale of property, plant and equipment - (4)

Foreign exchange and other 109 (266)

Changes in non-cash working capital items:

Accounts receivable and other assets 14 (9)

Inventories - 17

Accounts payable and accrued liabilities 70 (81)

------------------------------------------------ -------------- --------------

Net cash used in operating activities (419) (776)

Investing activities

Decrease in restricted cash - 150

Proceeds received for sale of property,

plant and equipment - 4

Purchase of property, plant and equipment (9) -

Proceeds received from exploration and

option agreement - 37

Exploration and evaluation expenditures (171) (61)

------------------------------------------------ -------------- --------------

Net cash (used in) provided by investing

activities (180) 130

Net change in cash (599) (646)

Net change in cash classified within

assets held for sale 37 59

Cash, beginning of period 3,748 4,221

------------------------------------------------ -------------- --------------

Cash end of period 3,186 3,634

------------------------------------------------ -------------- --------------

Operating activities

- continuing operations (382) (713)

- discontinued operations (37) (63)

Investing activities

- continuing operations (180) 126

- discontinued operations - 4

------------------------------------------------ -------------- --------------

F or further information, visit www.orosur.ca , follow on

twitter @orosurm or please contact:

Orosur Mining Inc

Louis Castro, Chairman,

Brad George, CEO

info@orosur.ca

Tel: +1 (778) 373-0100

SP Angel Corporate Finance LLP - Nomad & Broker

Jeff Keating / Kasia Brzozowska

Tel: +44 (0) 20 3 470 0470

Turner Pope Investments (TPI) Ltd - Joint Broker

Andy Thacker/James Pope

Tel: +44 (0)20 3657 0050

Flagstaff Communications

Tim Thompson

Mark Edwards

Fergus Mellon

orosur@flagstaffcomms.com Tel: +44 (0)207 129 1474

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ('MAR') which has

been incorporated into UK law by the European Union (Withdrawal)

Act 2018. Upon the publication of this announcement via Regulatory

Information Service ('RIS'), this inside information is now

considered to be in the public domain.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this release.

About Orosur Mining Inc.

Orosur Mining Inc. (TSXV: OMI; AIM: OMI) is a minerals explorer

and developer currently operating in Colombia, Argentina, Nigeria

and Brazil,

Forward Looking Statements

All statements, other than statements of historical fact,

contained in this news release constitute "forward looking

statements" within the meaning of applicable securities laws,

including but not limited to the "safe harbour" provisions of the

United States Private Securities Litigation Reform Act of 1995 and

are based on expectations estimates and projections as of the date

of this news release.

Forward-looking statements include, without limitation, the

exploration plans in Colombia, Argentina, Nigeria and Brazil and

the funding in Colombia from Minera Monte Águila of those plans,

Minera Monte Águila's decision to continue with the Exploration and

Option agreement, the ability for Loryser to continue and finalize

with the remediation in Uruguay, the ability to implement the

Creditors' Agreement successfully as well as continuation of the

business of the Company as a going concern and other events or

conditions that may occur in the future. The Company's continuance

as a going concern is dependent upon its ability to obtain adequate

financing and to reach a satisfactory implementation of the

Creditor's Agreement in Uruguay. These material uncertainties may

cast significant doubt upon the Company's ability to realize its

assets and discharge its liabilities in the normal course of

business and accordingly the appropriateness of the use of

accounting principles applicable to a going concern. There can be

no assurance that such statements will prove to be accurate. Actual

results and future events could differ materially from those

anticipated in such forward-looking statements. Such statements are

subject to significant risks and uncertainties including, but not

limited, those as described in Section "Risks Factors" of the

MD&A and the Annual Information Form. The Company disclaims any

intention or obligation to update or revise any forward-looking

statements whether as a result of new information, future events

and such forward-looking statements, except to the extent required

by applicable law.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRFFLFERIELDFIV

(END) Dow Jones Newswires

October 30, 2023 03:00 ET (07:00 GMT)

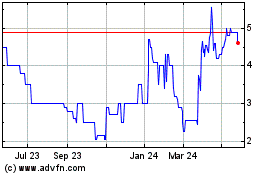

Orosur Mining (AQSE:OMI.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

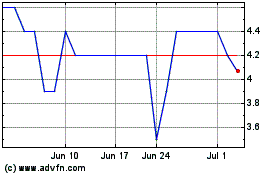

Orosur Mining (AQSE:OMI.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024