TIDMSLP

RNS Number : 2341R

Sylvania Platinum Limited

25 October 2023

25 October 2023

Sylvania Platinum Limited

("Sylvania", the "Company" or the "Group")

First Quarter Report to 30 September 2023

Sylvania (AIM: SLP), the platinum group metals ("PGM") producer

and developer with assets in South Africa, announces its results

for the three months ended 30 September 2023 (the "Quarter").

Unless otherwise stated, the consolidated financial information

contained in this report is presented in United States Dollars

("USD" or "$").

Highlights

-- Sylvania Dump Operations ("SDO") produced 20,173 4E (25,533 6E) PGM ounces in Q1 (Q4 FY2023: 19,072 4E (24,383

6E) PGM ounces), in line with guidance for the Quarter;

-- No Lost-Time Injuries ("LTIs") were recorded during the Quarter;

-- SDO recorded $19.7 million net revenue for the Quarter (Q4 FY2023: $24.4 million);

-- Group EBITDA of $2.8 million (Q4 FY2023: $7.8 million);

-- Lannex MF2 flotation circuit commissioned with optimisation well advanced;

-- Improved recoveries are expected at the completion and commissioning of the Lannex fine grinding circuit; and

-- The Thaba Joint Venture ("Thaba JV") project execution is progressing as planned and ordering of long-lead time

items and first construction packages are in progress.

Outlook

-- Commissioning of the Lannex fine grinding circuit expected by the end of Q2 FY2024;

-- Continuous operational performance improvements relating to the optimisation of feed sources, throughput,

recoveries, and cost saving initiatives implemented;

-- An updated Mineral Resource Estimate ("MRE") statement for both Volspruit North and South orebodies is currently

under review;

-- Preliminary Economic Assessment ("PEA") for the entire Volspruit project, along with the results from the

metallurgical test-work are expected during H2 FY2024; and

-- The Group maintains strong cash reserves, which increased 2% in the Quarter to allow funding of expansion and

joint venture ("JV") initiatives, process optimisation capital, upgrading of the Group's exploration and

evaluation assets with the potential to return value to shareholders.

Commenting on the results, Sylvania's CEO, Jaco Prinsloo,

said:

"I am happy with the good start to the new financial year where

the SDO achieved 20,173 4E PGM ounces for the Quarter. This

performance was achieved on the back of a solid production effort

from all operations, with all plants exceeding production

throughput targets, as well as the contribution of the new Lannex

flotation MF2 circuit that also added to our performance.

"The 15% lower PGM basket price recorded during the Quarter

impacted both the 4E revenue as well as the sales adjustment for

the Quarter. Consequently, revenues and profits were lower than in

Q4 FY2023, nonetheless, the Company maintained a strong cash

position.

"On the cost front, SDO cash costs decreased 3% in both rand and

dollar terms, benefiting from the higher ounces produced compared

with Q4 FY2023. Operations continue to navigate higher global cost

inflation impacts and thus operating cost focus remains a top

priority for management.

"The Thaba JV announced during the Quarter represents a key

milestone in Sylvania's growth strategy and is a significant step

forward for Sylvania Metals in expanding our operations and

leveraging the Group's expertise in the recovery of chrome and PGM

concentrates. The orders of long-lead time items and first

construction packages are in progress with civil construction works

expected to commence in Q2 FY2024. Additionally, an updated MRE

statement for both Volspruit North and South orebodies is currently

under review. The PEA for the Volspruit project, along with the

results from the metallurgical test-work are expected during H2

FY2024. The optimisation of value from the exploration assets

remains a key component of Sylvania Platinum's growth strategy and

will aid in supporting the Company's future value proposition for

all stakeholders."

Operational and Financial Summary

Production Unit Q4 FY2023 Q1 FY2024 % Change

---- ------- --------------

Plant Feed T 702,236 666,824 -5%

---------- ---------- -----------

Feed Head Grade g/t 1.81 1.93 7%

---------- ---------- -----------

PGM Plant Feed Tons T 359,658 358,602 0%

---------- ---------- -----------

PGM Plant Feed Grade g/t 2.89 2.94 2%

---------- ---------- -----------

PGM Plant Recovery(1) % 57.01% 56.71% -1%

---------- ---------- -----------

Total 4E PGMs Oz 19,072 20,173 6%

---------- ---------- -----------

Total 6E PGMs Oz 24,383 25,533 5%

---------------------------------------------------------------------- ---------- ---------- -----------

Unaudited USD ZAR

------------ ------------------------------------- ------ ---------------------------------

Unit Q4 FY2023 Q1 FY2024 % Change Unit Q4 FY2023 Q1 FY2024 % Change

------------ -------------- ---------- --------- ------ ---------- ---------- ---------

Financials(3)

Average 4E Gross

Basket Price(2) $/oz 1,581 1,344 -15% R/oz 29,524 25,069 -15%

------------ -------------- ---------- --------- ------ ---------- ---------- ---------

Revenue (4E) $'000 21,826 19,631 -10% R'000 407,707 366,112 -10%

------------ -------------- ---------- --------- ------ ---------- ---------- ---------

Revenue

(by-products

including base

metals) $'000 3,454 3,303 -4% R'000 64,526 61,607 -5%

------------ -------------- ---------- --------- ------ ---------- ---------- ---------

Sales

adjustments $'000 (859) (3,201) 273% R'000 (16,056) (59,700) 272%

------------ -------------- ---------- --------- ------ ---------- ---------- ---------

Net revenue $'000 24,421 19,733 -19% R'000 456,177 368,019 -19%

------------ -------------- ---------- --------- ------ ---------- ---------- ---------

Direct Operating

costs $'000 12,577 12,886 2% R'000 234,945 240,323 2%

------------ -------------- ---------- --------- ------ ---------- ---------- ---------

Indirect

Operating

costs $'000 2,939 3,226 10% R'000 54,899 60,159 10%

------------ -------------- ---------- --------- ------ ---------- ---------- ---------

General and

Administrative

costs $'000 701 699 0% R'000 13,095 13,036 0%

------------ -------------- ---------- --------- ------ ---------- ---------- ---------

Group EBITDA $'000 7,806 2,818 -64% R'000 145,816 52,556 -64%

------------ -------------- ---------- --------- ------ ---------- ---------- ---------

Net Interest $'000 1,784 1,642 -8% R'000 33,325 30,623 -8%

------------ -------------- ---------- --------- ------ ---------- ---------- ---------

Net Profit(4) $'000 3,136 1,802 -43% R'000 58,580 33,607 -43%

------------ -------------- ---------- --------- ------ ---------- ---------- ---------

Capital

Expenditure $'000 6,185 3,218 -48% R'000 115,537 60,013 -48%

------------ -------------- ---------- --------- ------ ---------- ---------- ---------

Cash Balance(5) $'000 124,983 126,865 2% R'000 2,360,929 2,402,823 2%

------------ -------------- ---------- --------- ------ ---------- ---------- ---------

Ave R/$ rate R/$ 18.68 18.65 0%

------------ -------------- ---------- --------- ------ ---------- ---------- ---------

Spot R/$ rate R/$ 18.89 18.94 0%

------------ -------------- ---------- --------- ------ ---------- ---------- ---------

Unit Cost/Efficiencies(4)

SDO Cash Cost

per

4E PGM oz(4) $/oz 660 639 -3% R/oz 12,319 11,913 -3%

------------ -------------- ---------- --------- ------ ---------- ---------- ---------

SDO Cash Cost

per

6E PGM oz(4) $/oz 516 505 -2% R/oz 9,636 9,412 -2%

------------ -------------- ---------- --------- ------ ---------- ---------- ---------

Group Cash Cost

Per 4E PGM

oz(4) $/oz 824 782 -5% R/oz 15,392 14,584 -5%

------------ -------------- ---------- --------- ------ ---------- ---------- ---------

Group Cash Cost

Per 6E PGM

oz(4) $/oz 645 618 -4% R/oz 12,049 11,526 -4%

------------ -------------- ---------- --------- ------ ---------- ---------- ---------

All-in

Sustaining

Cost (4E) $/oz 881 830 -6% R/oz 16,446 15,476 -6%

------------ -------------- ---------- --------- ------ ---------- ---------- ---------

All-in Cost (4E) $/oz 1,159 959 -17% R/oz 21,642 17,894 -17%

------------ -------------- ---------- --------- ------ ---------- ---------- ---------

The Sylvania cash generating subsidiaries are incorporated in

South Africa with the functional currency of these operations being

ZAR. Revenues from the sale of PGMs are recorded in USD and then

converted into ZAR. The Group's reporting currency is USD as the

parent company is incorporated in Bermuda. Corporate and general

and administration costs are incurred in USD, GBP and ZAR.

(1) PGM plant recovery is calculated on the production ounces

that include the work-in-progress ounces when applicable.

(2) The gross basket price in the table is the September 2023

gross 4E basket used for revenue recognition of ounces delivered in

Q1 FY2024, before penalties/smelting costs and applying the

contractual payability.

(3) Revenue (6E) for Q1 FY2024, before adjustments is $22.7

million (6E pill split is Pt 53%, Pd 17%, Rh 9%, Au 0%, Ru 16%, Ir

5%). Revenue excludes profit/loss on foreign exchange.

(4) The cash costs include operating costs and exclude indirect

cost for example royalty tax and EDEP payments.

(5) Q1 FY2024 cash balance includes restricted cash held as

guarantees of $0.8 million.

A. OPERATIONAL OVERVIEW

Safety, health and environment

The safety, health and environmental ("SHE") performance for

this period has again been impressive, driven by the concerted

focus on compliance . The Group is proud to report that there were

no significant SHE related incidents reported during this time.

The Company continues to target Zero Harm to employees and every

injury that is recorded is fully investigated and corrective

measures are implemented to prevent any future reoccurrences.

Sylvania continuously strives to maintain high safety standards and

a safe working environment at all operating sites, with each plant

continuing to operate in accordance with legislated safety and

occupational regulations pertaining to the industry through the

collaborative efforts of management and employees . The 'Make It

Personal' campaign is still in full swing and will be supported by

the launch of the 'Silly Season' campaign in November 2023.

Historically, a high number of accidents at mines are reported

during the last quarter of the calendar year. This period is often

challenging from a health and safety perspective and is commonly

known as 'Silly Season/ Critical Season'. Sylvania, therefore, is

initiating a safety campaign with the objective to proactively

prevent incidents from happening, focusing on current issues and

challenges with the potential to cause injuries and fatalities

.

Meanwhile, the 'Make It Personal' campaign is designed to

improve and maintain personal safety on site. The Company believes

that by making safety a personal matter that everyone is

responsible for, it will become second nature for all. This will

assist to ensure all workers make it home safely, every day, in

line with Sylvania's goal of achieving Zero Harm.

The current lost-time injury frequency rate ("LTIFR") for the

financial year is 0.00 which is a marked improvement from last

quarter when two LTIs were reported.

Operational performance

The SDO delivered 20,173 4E PGM ounces for the Quarter, which

was a 6% improvement on Q4 FY2023. The increased PGM ounces

included approximately 995 4E PGM ounces released from stock and

was supported by the consistency of the PGM feed tons and a 2%

improvement in PGM feed grade, while PGM recoveries declined

marginally during the period. The slightly lower PGM recovery was

primarily due to Mooinooi and Lesedi experiencing lower recovery

efficiencies associated with current feed sources.

The Lannex MF2 flotation circuit has been commissioned with

optimisation well advanced. The completion of the fine grinding

circuit is expected towards the end of Q2 FY2024. Recovery

improvements have been noted with further improvements expected at

the completion and commissioning of the fine grinding circuit.

SDO operating cash costs per 4E PGM ounce decreased 3% in rand

and dollar terms to ZAR11,913/ounce and $639/ounce respectively (Q4

FY2023: ZAR12,319/ounce and $660/ounce). The average ZAR:USD

exchange rate remained largely unchanged during the Quarter.

The Group incurred capital expenditure of ZAR60.0 million ($3.2

million), in line with planned capital project schedules.

Operational opportunities

The Lannex flotation MF2 circuit has been successfully

commissioned. With the construction, completion and commissioning

of the fine grinding circuit scheduled for Q2 FY2024, a further

increase in recoveries is expected.

PGM concentrate quality remains a focus area with the potential

to improve smelter payability, as both concentrate grade and metal

recoveries contribute positively towards the revenue stream of the

Group. A filtration plant is also being evaluated to facilitate the

conversion to dry filtered concentrate instead of the current

slurry tankers, which would assist in reducing concentrate

transport costs and remediate handling challenges at off-take

smelters.

The effect of load curtailment of power at Lesedi decreased

significantly from the 221 hours downtime recorded in Q4 FY2023 to

81 hours in Q1 FY2024, no other operations were impacted. In line

with the power mitigation strategy, the Lesedi back-up generator

installation is progressing and scheduled for commissioning during

the latter part of Q2 FY2024.

The Company's Pelletiser project, developed with a 'binding

technology' player, continues to make progress. Following the

completion of the pilot-scale work, discussions are still ongoing

with potential industry partners to assess the commercial viability

of the technology.

B. FINANCIAL OVERVIEW

Financial performance

Revenue (4E) for the Quarter decreased by 10% to $19.6 million

(Q4 FY2023: $21.8 million) impacted by the 15% decrease in the

basket price recorded in September 2023 and applied to calculate

revenue for ounces produced and delivered in the Quarter. These

deliveries are invoiced in the following quarter and revenue will

be adjusted in the month of invoice. The higher ounces produced in

the quarter contributed $1.2 million to the gross revenue. The

average 4E gross basket price for the Quarter was $1,344/ounce

against $1,581/ounce in Q4 FY2023, impacted mainly by the drop in

rhodium and palladium prices in Q1 FY2024.

Net revenue for the Quarter, which includes base metals and

by-products and the quarter-on-quarter sales adjustment, was $19.7

million (Q4 FY2023: $24.4 million). Net revenue also includes

attributable revenue received for ounces produced from material

processed from a third-party on a trial basis.

Group cash costs per 4E PGM ounce decreased by 5% in rand terms

from ZAR15,392/ounce to ZAR14,584/ounce and saw a 5% decrease in

dollar terms from $824/ounce in the previous quarter to $782/ounce

as a result of the 5% increase in ounce production

quarter-on-quarter.

General and administrative costs were unchanged at $0.70 million

quarter-on-quarter. These costs are incurred in USD, GBP and ZAR

and were minimally impacted by the exchange rate as the USD/ZAR

exchange quarter-on-quarter remained aligned.

Group EBITDA for the Quarter was $2.8 million (Q4 FY2023: $7.8

million) and net profit was $1.8 million (Q4 FY2023: $3.1 million),

the decrease was primarily a result of the lower basket price and

increase in total operating costs.

The Group cash balance increased 2% from $125.0 million

(including restricted cash held as guarantees of $0.8 million) to

$126.9 million during the Quarter. Cash generated from operations

before working capital movements was $3.1 million with net changes

in working capital amounting to $0.7 million, which is mainly due

to the change in trade debtors and trade creditors. The 15%

decrease in basket price off-set marginally by a 6% increase in

production, resulted in the decrease in the trade debtors balance

quarter-on-quarter. Trade debtors arise from the concentrate

delivered in the Quarter but only paid for in the following quarter

as per the concentrate off-take agreements.

Provisional payments for both mineral royalty tax and income tax

are made in December 2023 in line with the South African tax

authority timelines, at an anticipated rate of 6% - 7% for mineral

royalty tax on applicable ounces, and 27% on taxable income in

South Africa. A final cash dividend for FY2023 of 5 pence per

Ordinary Share was declared and is payable on 1 December 2023 to

all shareholders on the register at the close of business on 27

October 2023. The Group spent $3.2 million on capital projects for

the quarter mainly at Lannex for the Lansky Screens $0.6 million

(ZAR10.8 million) ; MF2 project $0.4 million (ZAR6.8 million) and

elevated penstock and drains $0.2 million (ZAR3.4 million) and at

Mooinooi for the recommissioning of the tailings storage facility

$0.2 million (ZAR3.4 million) .

C. MINERAL ASSET DEVELOPMENT AND JOINT VENTURES

The Group holds approved mining rights for three PGM-base metal

projects on the Northern Limb of the Bushveld Igneous Complex in

South Africa. Optimisation of the assets has been on-going since

2021 in order to ascertain how best to develop these projects. An

Exploration Results and Resource Statement was completed during

FY2023, and further work continues based on recommendations made in

this report.

Volspruit Project

Work has continued on both the Volspruit North and South

orebodies with large diameter boreholes being drilled on the North

in order to better understand metal recoveries as well as provide

the required detail for plant and infrastructure design to be

completed during the Preliminary Feasibility Study ("PFS"). This

phase of work will commence upon the completion of a positive PEA,

which is expected in the second half of FY2024. Results from the

metallurgical test-work are expected in the same period.

Updated draft MRE statements for both the North and South ore

bodies have been received and are currently under review. These

updated draft statements include estimates for rhodium and

ruthenium which historically have not been assayed for. Samples

collected from the large diameter drilling campaign were assayed

for 6E PGMs and the results statistically analysed against the

historic assay database. Strong relationships exist between the

presence of platinum, palladium, gold, rhodium and ruthenium, which

allows for the latter two PGM values to be predicted from the

historical 3E PGM results. It is anticipated that these statements

will be published within the next quarter once the internal review

process has been completed.

Steady progress is being made in the permitting process

necessary for the existing mining right. Local Economic Development

projects are gaining traction with discussions kicking off with the

relevant local municipalities. The Water Use License application

for mining and on-site processing operations and the updated

Environmental Impact Assessment submissions are expected to be made

in the first quarter of FY2025, which although later than

anticipated, does allow for a more comprehensive public engagement

process to be completed.

Far Northern Limb Projects

Relogging of the historical core continues across the Aurora

project area with more than 75% of the work being completed. Once

the final data has been compiled and assessed a targeted drilling

programme will be designed and implemented. This is likely to occur

during the fourth quarter of FY2024 to support an updated MRE and

PEA to be commissioned for Aurora.

As reported in the Statement of Exploration Results, Mineral

Resources, and Scoping Study released in FY2023, some significant

results were returned from the Hacra North underground target . A

review of the work undertaken to date has been finalised and

results from the study will be released in the second quarter of

FY2024.

D. THABA JV

On 9 August 2023, the Company announced that its wholly owned

South African subsidiary, Sylvania Metals (Pty) Ltd "Sylvania

Metals"), entered into an unincorporated JV Agreement with Limberg

Mining Company (Pty) Ltd ("LMC"), a subsidiary of ChromTech Mining

Company (Pty) Ltd ("ChromTech"), the Thaba JV.

The Thaba JV represents a major step in delivery of Sylvania's

growth strategy and is a significant step forward for Sylvania

Metals in expanding its operations and leveraging its expertise in

the recovery of chrome and PGM concentrates, adding attributable

annual production of approximately 6,500 4E PGM ounces and

introducing 200,000 tons of chromite concentrate to Sylvania

Metals' existing annual production profile. The project execution

phase will be 18-24 months with first production expected in H2

FY2025.

The first contractor is already on site for demolition of

redundant works and to make space at the plant's front-end for new

crushing infrastructure and for the optimisation of conveyor

transfers and stockpile capacity. Procurement of long-lead items

and the first construction packages are currently in progress. The

Thaba JV's civil works are on schedule to commence during Q2

FY2024.

E. CORPORATE ACTIVITIES

Notification of Transaction by PDMR

The Company announced on 12 September 2023 that Adrian Reynolds,

Non-Executive Director, purchased 20,000 ordinary shares of $0.01

each in the Company ("Ordinary Shares") at 80.40 pence per Ordinary

Share on 11 September 2023.

Following this transaction, his shareholding in the Company

totals 40,000 Ordinary Shares, representing 0.01% of the total

number of Ordinary Shares with voting rights.

CONTACT DETAILS

For further information, please

contact:

Jaco Prinsloo CEO

Lewanne Carminati CFO +27 11 673 1171

Nominated Adviser and Broker

Liberum Capital Limited +44 (0) 20 3100 2000

Richard Crawley / Scott Mathieson

/ Kane Collings

Communications

BlytheRay +44 (0) 20 7138 3205

Tim Blythe / Megan Ray sylvania@BlytheRay.com

CORPORATE INFORMATION

Registered and postal address: Sylvania Platinum Limited

Clarendon House

2 Church Street

Hamilton HM 11

Bermuda

SA Operations postal address: PO Box 976

Florida Hills, 1716

South Africa

Sylvania Website : www.sylvaniaplatinum.com

About Sylvania Platinum Limited

Sylvania Platinum is a lower-cost producer of platinum group

metals (PGM) (platinum, palladium and rhodium) with operations

located in South Africa. The Sylvania Dump Operations (SDO)

comprises six chrome beneficiation and PGM processing plants

focusing on the retreatment of PGM-rich chrome tailings materials

from mines in the Bushveld Igneous Complex. The SDO is the largest

PGM producer from chrome tailings re-treatment in the industry.

Additionally, the Thaba JV comprises chrome beneficiation and PGM

processing plants, treating a combination of ROM and historical

chrome tailings from the JV partner, adding a full margin chromite

concentrate revenue stream. The Group also holds mining rights for

PGM projects in the Northern Limb of the Bushveld Complex.

For more information visit https://www.sylvaniaplatinum.com/

ANNEXURE

GLOSSARY OF TERMS FY2024

The following definitions apply throughout the period:

3E ounces include the precious metal elements platinum, palladium

3E PGMs and gold

4E ounces include the precious metal elements platinum, palladium,

4E PGMs rhodium and gold

--------------------------------------------------------------------

6E ounces include the 4E elements plus additional Iridium

6E PGMs and Ruthenium

--------------------------------------------------------------------

AGM Annual General Meeting

--------------------------------------------------------------------

AIM Alternative Investment Market of the London Stock Exchange

--------------------------------------------------------------------

All-in sustaining cost plus non-sustaining and expansion

All-in costs capital expenditure

--------------------------------------------------------------------

All-in sustaining Production costs plus all costs relating to sustaining current

cost production and sustaining capital expenditure

--------------------------------------------------------------------

CLOs Community Liaison Officers

--------------------------------------------------------------------

Fresh chrome tails from current operating host mines processing

Current arisings operations

--------------------------------------------------------------------

DMRE Department of Mineral Resources and Energy

--------------------------------------------------------------------

EBITDA Earnings before interest, tax, depreciation and amortisation

--------------------------------------------------------------------

EA Environmental Authorisation

--------------------------------------------------------------------

EAP Employee Assistance Program

--------------------------------------------------------------------

EEFs Employment Engagement Forums

--------------------------------------------------------------------

EDEP Employee Dividend Entitlement Programme

--------------------------------------------------------------------

ESG Environment, social and governance

--------------------------------------------------------------------

EIA Environmental Impact Assessment

--------------------------------------------------------------------

EIR Effective interest rate

--------------------------------------------------------------------

EMPR Environmental Management Programme Report

--------------------------------------------------------------------

ESG Environment, Social and Governance

--------------------------------------------------------------------

GBP Pounds Sterling

--------------------------------------------------------------------

GHG Greenhouse gases

--------------------------------------------------------------------

GISTM Global Industry Standard on Tailings Management

--------------------------------------------------------------------

GRI Global Reporting Initiative

--------------------------------------------------------------------

JORC Joint Ore Reserves Committee

--------------------------------------------------------------------

IASB International Accounting Standards Board

--------------------------------------------------------------------

ICE Internal combustion engine

--------------------------------------------------------------------

IFRIC International Financial Reporting Interpretation Committee

--------------------------------------------------------------------

IFRS International Financial Reporting Standards

--------------------------------------------------------------------

Phoenix Platinum Mining Proprietary Limited, renamed Sylvania

Lesedi Lesedi

--------------------------------------------------------------------

LSE London Stock Exchange

--------------------------------------------------------------------

LTI Lost-time injury

--------------------------------------------------------------------

LTIFR Lost-time injury frequency rate

--------------------------------------------------------------------

MF2 Milling and flotation technology

--------------------------------------------------------------------

MPRDA Mineral and Petroleum Resources Development Act

--------------------------------------------------------------------

MRA Mining Right Application

--------------------------------------------------------------------

MRE Mineral Resource Estimate

--------------------------------------------------------------------

Mt Million Tons

--------------------------------------------------------------------

NWA National Water Act 36 of 1998

--------------------------------------------------------------------

Platinum group metals comprising mainly platinum, palladium,

PGM rhodium and gold

--------------------------------------------------------------------

PAR Pan African Resources Plc

--------------------------------------------------------------------

PDMR Person displaying management responsibility

--------------------------------------------------------------------

PEA Preliminary Economic Assessment

--------------------------------------------------------------------

PFS Preliminary Feasibility Study

--------------------------------------------------------------------

Pipeline ounces 6E ounces delivered but not invoiced

--------------------------------------------------------------------

Revenue recognised for ounces delivered, but not yet invoiced

Pipeline revenue based on contractual timelines

--------------------------------------------------------------------

Pipeline sales Adjustments to pipeline revenues based on the basket price

adjustment for the period between delivery and invoicing

--------------------------------------------------------------------

Project Echo Secondary PGM Milling and Flotation (MF2) program announced

in FY2017 to design and install additional new fine grinding

mills and flotation circuits at Millsell, Doornbosch, Tweefontein,

Mooinooi and Lesedi

--------------------------------------------------------------------

Revenue (by products) Revenue earned on Ruthenium, Iridium, Nickel and Copper

--------------------------------------------------------------------

ROM Run of mine

--------------------------------------------------------------------

SDO Sylvania dump operations

--------------------------------------------------------------------

SHE Safety, health and environmental

--------------------------------------------------------------------

SLP Social and Labour Plan

--------------------------------------------------------------------

Sylvania Sylvania Platinum Limited, a company incorporated in Bermuda

--------------------------------------------------------------------

Sylvania Metals Sylvania Metals (Pty) Limited

--------------------------------------------------------------------

tCO2e Tons of carbon dioxide equivalent

--------------------------------------------------------------------

Thaba JV Thaba Joint Venture

--------------------------------------------------------------------

TRIFR Total recordable injury frequency rate

--------------------------------------------------------------------

TSF Tailings storage facility

--------------------------------------------------------------------

UNSDGs United Nations Sustainability Development Goals

--------------------------------------------------------------------

USD United States Dollar

--------------------------------------------------------------------

WULA Water Use Licence Application

--------------------------------------------------------------------

UK United Kingdom of Great Britain and Northern Ireland

--------------------------------------------------------------------

ZAR South African Rand

--------------------------------------------------------------------

Zero Harm The South African mining industry is committed to the shared

aspiration of achieving the goal of Zero Harm, which aims

to ensure that mineworkers return home from work healthy

and unharmed every day

--------------------------------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRFPPGUCUUPWUAA

(END) Dow Jones Newswires

October 25, 2023 02:00 ET (06:00 GMT)

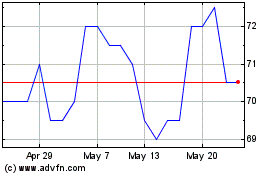

Sylvania Platinum (AQSE:SLP.GB)

Historical Stock Chart

From Feb 2025 to Mar 2025

Sylvania Platinum (AQSE:SLP.GB)

Historical Stock Chart

From Mar 2024 to Mar 2025