TIDMTPT

RNS Number : 2987M

Topps Tiles PLC

11 January 2023

11 January 2023

Topps Tiles Plc

Q1 Trading Update

Topps Tiles Plc ("Topps Group", or the "Group"), the UK's

leading tile specialist, announces a trading update for the 13-week

period ended 31 December 2022.

Group

The Group has developed and diversified in recent years and now

operates across three business areas: our omni-channel Topps Tiles

brand is the clear market leader in the UK and offers specialist

product expertise and world-class customer service to trade and

homeowner customers; our Online Pure Play offer consists of Pro

Tiler Tools and Tile Warehouse; and our Parkside brand works

directly with architects, designers and contractors in the

commercial market.

Group sales in the 13 weeks to 31 December 2022 were 10.2%

higher year on year(1) , with approximately half of this growth due

to the comparative period in 2021 being prior to the acquisition of

Pro Tiler Tools.

Omnichannel - Topps Tiles

Topps Tiles continues to perform well and has delivered a strong

first quarter. Like-for-like sales(2) were 5.1% higher than last

year, with total sales growth in Topps Tiles approximately 2

percentage points below this due to a lower average number of

stores trading this year(3) . The timing of Christmas and New Year

benefitted first quarter sales by about half a percentage point.

Overall, the business delivered another strong period of trading in

the weeks leading into Christmas, and sales to trade customers

continued to be an area of particular strength.

Online Pure Play - Pro Tiler Tools and Tile Warehouse

Pro Tiler Tools, acquired in March 2022(4) , has continued to

grow at an exceptional rate, with sales in the most recent quarter

up significantly year on year. The introduction of new,

trade-focused brands, further investment in stock and a continued

focus on outstanding customer service have contributed to this

performance, and we are currently working through options to

deliver additional value to the Group through the Pro Tiler team.

Tile Warehouse, launched in May 2022, is now largely through the

initial start-up phase and we are now focusing on driving more

traffic to the website and higher levels of conversion.

Commercial - Parkside

Parkside's financial performance improved at pace in FY22 and,

following a strong second half, the business was trading at

breakeven by the final quarter. Parkside is targeted to deliver a

modest profit this year.

Summary

Overall, the financial year has started well. Following strong

market share growth in FY22, our focus remains on our goal of '1 in

5 by 2025'(5) , which we now expect to deliver ahead of

schedule.

As previously disclosed in the 2022 full year results, we expect

Group profitability in the current financial year to be more second

half weighted than is usually the case. The drivers of this are a

significant year on year increase in our gas expense which will be

weighted towards the autumn and winter period, the timing of

various accruals, the impact of the newer businesses and some

easing in supply chain costs as the year progresses.

The business remains strongly cash generative, with the balance

sheet, cash flows and profitability remaining in line with our

expectations.

Rob Parker, CEO, said: "We are pleased with what has been a

strong first quarter of the new financial year, with strong

like-for-like sales growth in Topps Tiles of 5.1%, excellent

performance from our recent acquisition, Pro Tiler Tools, and

overall Group sales up 10.2% compared with the same period last

year.

"We remain mindful of the macroeconomic headwinds which may

impact UK consumers and businesses in the forthcoming year, but the

Group's strong balance sheet, world class customer service,

specialist expertise and ambitious growth strategy gives us

confidence that we will continue to deliver value over the medium

term."

(1) Group revenue growth is stated before accounting adjustments

including revenue recognition and customer returns provisions.

Includes sales from Pro Tiler Tools and Tile Warehouse in FY23

compared to GBPnil sales recognised in in the Group's consolidated

accounts for Q1 FY22 in the pre-acquisition / pre-launch

period.

(2) Topps Tiles like-for-like sales is defined as online sales

and sales from Topps Tiles stores that have been trading for more

than 52 weeks.

(3) The lower number of stores this year is as a result of the

store closure programme, which has now been completed.

(4) 60% of the share capital of Pro Tiler Limited was acquired

in March 2022, with options in place to acquire the remaining 40%

in March 2024.

(5) Refers to Topps' goal of accounting for GBP1 in every GBP5

spent on tiles and associated products in the UK by 2025, thereby

increasing its market share to 20% from approximately 17% in 2019.

In the 52 weeks ended 1 October 2022 the Group's market share

increased to 19.0% (2021: 17.6%).

For further information please contact:

Topps Tiles Plc

Rob Parker, CEO

Stephen Hopson, CFO 0116 282 8000

Citigate Dewe Rogerson

Kevin Smith

Ellen Wilton 020 7638 9571

Notes to editors

Topps Tiles Plc is the UK's largest specialist supplier of tiles

and associated products, targeting the UK domestic refurbishment

and commercial markets and serving homeowners, trade customers,

architects, designers and contractors from 304 nationwide Topps

Tiles stores, four commercial showrooms and six websites:

www.toppstiles.co.uk , www.parkside.co.uk , www.protilertools.co.uk

, www.northantstools.co.uk , www.premiumtiletrim.co.uk and

www.tilewarehouse.co.uk .

Since opening its first store in 1963, Topps has maintained a

simple operating philosophy -- inspiring customers with unrivalled

product choice and providing exceptional levels of customer

service. For further information on the Group, please visit

http://www.toppstilesplc.com/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTGPUBAGUPWGQU

(END) Dow Jones Newswires

January 11, 2023 02:00 ET (07:00 GMT)

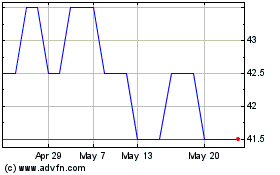

Topps Tiles (AQSE:TPT.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Topps Tiles (AQSE:TPT.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024