Asia Stocks Falter as Political Concerns Build

04 November 2016 - 2:30PM

Dow Jones News

Asian shares were broadly lower Friday, with Japan shrugging off

better-than-expected economic data as concerns around the narrowing

race for the White House curbed investor appetite.

The Nikkei Stock Average was off 1.4% as traders digested recent

yen strength after the market reopened following a public holiday

Thursday. The yen is up almost 2% against the dollar so far this

month. Australia's S&P/ASX 200 was down 0.7%, on track for a

fourth week of losses. Korea's Kospi was 0.1% lower, while Hong

Kong's Hang Seng Index rose 0.3%.

Early Friday, the Nikkei Japan services purchasing managers

index rose to 50.5 in October from 48.2 in September. A reading

above 50 indicates expansion, while a reading below 50 indicates

contraction.

Nevertheless, local traders were more concerned with the U.S.

presidential election next week. Electronics and auto stocks, which

are particularly sensitive to economic cycles, led the declines.

Sony was down 3.6%, while Honda Motor traded 3.9% lower. Democrat

Hillary Clinton, who is seen by investors as more market friendly,

has seen her lead over Republican Donald Trump erode in recent

polls.

"Major fundamental data are taking a back seat ahead of this

U.S. presidential election," said Alex Wijaya, a senior sales

trader at CMC Markets. The Japan data, like several releases this

week, "had a minimal impact," Mr. Wijaya said.

Elsewhere, a ruling by the U.K. High Court on Thursday that

British Prime Minister Theresa May can't trigger Article 50 to

start the process of leaving the European Union without approval

from Parliament saw the pound surge 1.2% against the greenback.

The fresh doubts around the path for a British exit from the EU

added to investor uncertainty, though.

"We're seeing a big pickup in short interest because of the

uncertainty, and we're seeing a lot of hedging activity," said

Chris Weston, chief market strategist at IG Markets.

Gold stocks were the refuge of choice during a volatile week as

investors sought safety. Among Australian gold miners, Newcrest

Mining was up 11.8% week-to-date, Evolution Mining rose 12.4%, and

Resolute Mining gained 5.1%. Spot gold was recently up 0.1% at

$1303.08 a troy ounce.

Among individual shares, Japanese air bag maker Takata was

suspended following a Nikkei report that it is preparing for a

possible bankruptcy protection filing in the U.S. amid the mounting

costs related to defective air bags.

The market will be watching for nonfarm payrolls data out of the

U.S. later Friday for clues to when the Federal Reserve might raise

interest rates. According to CME Group's FedWatch tool, the

probability of an increase next month is steady at 71.5%.

Kosaku Narioka and Alexis Flynn contributed to this article.

Write to Ese Erheriene at ese.erheriene@wsj.com

(END) Dow Jones Newswires

November 03, 2016 23:15 ET (03:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

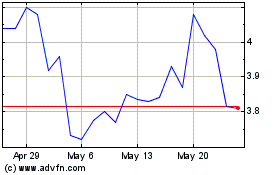

Evolution Mining (ASX:EVN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Evolution Mining (ASX:EVN)

Historical Stock Chart

From Dec 2023 to Dec 2024