UPDATE: Australia ACCC Chairman Steps Aside From AXA APH/NAB Merger Case

18 August 2010 - 4:22PM

Dow Jones News

The chairman of Australia's competition regulator Graeme Samuel

on Wednesday stood aside from deliberations on National Australia

Bank Ltd.'s (NABZY) bid for AXA SA's (AXAHY) Asia Pacific unit to

avoid a perception of conflict of interest over his family's

investment in the troubled Direct Factory Outlet shopping center

chain that owes money to the bank.

Investors and analysts, however, said Samuel's exit from the

Australian Competition & Consumer Commission's review of NAB's

long-running bid for AXA Asia Pacific Holdings Ltd. (AXA.AU) is

unlikely to have much impact on whether the regulator lets the deal

go ahead.

"It isn't a one-man band. They've got processes and a team of

people who know what the issues are and will see that they're

addressed. So I can't see this making a material difference," said

Peter Vann, head of research at Constellation Capital

Management.

Representatives of the owners of the DFO shopping empire, which

owes A$450 million to a lending syndicate including NAB, were

locked in crisis talks with the banks on Wednesday to try and head

off receivership after the banks issued notices warning they might

call in the company's loans, said people familiar with the

situation.

The ACCC said NAB and AXA Asia Pacific have been consulted and

expressed no concern at Samuel's involvement in the review of the

takeover.

"However, the commission accepted Mr. Samuel's position that he

would cease to be involved in any further Commission deliberations

on the NAB/AXA merger proposal," the regulator said in a

statement.

"Mr. Samuel advised that he considered this course of action

necessary to remove any perception of a conflict of interest

arising from current issues concerning his family's investment in

the DFO shopping center chain."

The ACCC surprised the market in April when it rejected NAB's

plan to buy AXA Asia Pacific, arguing the biggest deal in

Australia's financial services history would crimp competition in

the market for supply of retail investment platforms, internet

portals that link retail investors with the wide range of

investment products that fund management companies provide.

However the regulator on Aug. 9 reopened its investigation into

the bid after NAB made an undertaking to on-sell the target's

retail investment platform North to wealth manager IOOF Holdings

Ltd. (IFL.AU) and is scheduled to make decision on Sept. 9.

Samuel's family is a major investor via a blind trust in

Austexx, which is the holding company for various entities

operating under the DFO brand including South Wharf Retail and

South Wharf Tower that run the heavily indebted South Wharf project

at Melbourne's Docklands.

Korda-Mentha could be appointed as receiver to the two South

Wharf companies later this week if an agreement isn't reached with

the syndicate that also includes St. George Bank Ltd.,

Suncorp-Metway Ltd. (SUN.AU) and Bank of Scotland International,

with each of the banks owed about 25% of the total borrowing, three

of the people familiar with the situation said.

The banks lost confidence in the business after a dispute

between the Austexx equity partners over whether to borrow more

money to complete work on the South Wharf DFO site, one of the

people said.

One of the partners--a trustee managing Samuel's blind

trust--had opposed further borrowing after Samuel discovered that

successful sites to which he thought his investment had been

confined were used as collateral for debt-funded expansion into

other areas, the person said.

If the two South Wharf companies collapse, that could have a

snowball effect on other DFO sites as the South Wharf project has

been used as collateral for other sites, the person said.

A spokeswoman for the ACCC said Samuel would not be making any

comment on his investment in DFO.

Spokespeople for St George Bank, Suncorp-Metway, NAB and BOS

International declined to comment on the progress of the talks.

Under NAB's takeover proposal, 55% owner AXA SA would retain the

Asian assets of AXA APH, while minority shareholders would be given

the choice between A$6.43, or 0.1745 NAB share and A$1.59 for each

of their shares in the target.

A lower cash and share offer by AMP Ltd. (AMP.AU) of 0.6896 of

its own shares and A$1.92 for each AXA APH share was rejected by

the target's independent directors in favor of the NAB bid in

December.

-By Rebecca Thurlow, Dow Jones Newswires; 61-2-8272-4679;

rebecca.thurlow@dowjones.com

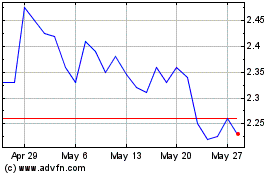

Insignia Financial (ASX:IFL)

Historical Stock Chart

From Feb 2025 to Mar 2025

Insignia Financial (ASX:IFL)

Historical Stock Chart

From Mar 2024 to Mar 2025