James Hardie Fiscal Year Net Loss US$347.0 Million; Operating Profit Beats Guidance

19 May 2011 - 9:32AM

Dow Jones News

Building materials manufacturer James Hardie Industries SE

(JHX.AU) Thursday reported a net loss of US$347.0 million for the

year ended March 31, a more than fourfold deepening of a loss of

US$84.9 million in fiscal 2010, as a result of a non-cash tax

liability.

Excluding extraordinary items, net operating profit fell 12% on

year to US$116.7 million, a little higher than company guidance of

a range of US$105 million to US$115 million and also above

analysts' consensus forecast of US$108 million.

Extraordinary items included a non-cash charge of US$345.2

million for a tax liability following unit RCI Pty. Ltd.'s loss on

appeal in the Australian Federal Court against a Tax Office

assessment relating to fiscal 1999. A tax adjustment of US$32.6

million was also made as a result of an internal organization.

Total revenue for 2010-11 rose 4.5% on year to US$1.17 billion

from US1.12 billion. The company won't pay a final dividend.

Chief Executive Louis Gries said operating conditions in the

U.S. residential housing market remain challenging and the company

is yet to see any substantive evidence that a sustainable recovery

has started.

"Additionally, raw material and input costs, particularly pulp,

remain high and freight costs are rising," he said in a

statement.

With the exception of New Zealand, though, the Asia Pacific

businesses have enjoyed relatively robust operating environments

and performed strongly, with the Australian operations growing

market share and increasing sales of Scyon lightweight cement

composites, he said.

-by Ray Brindal, Dow Jones Newswires; 612 62080902;

ray.brindal@dowjones.com

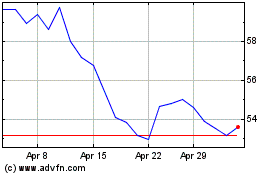

James Hardie Industries (ASX:JHX)

Historical Stock Chart

From Nov 2024 to Dec 2024

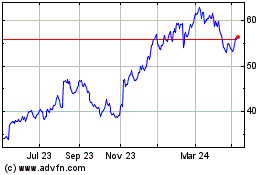

James Hardie Industries (ASX:JHX)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about James Hardie Industries plc (Australian Stock Exchange): 0 recent articles

More James Hardie Industries News Articles