James Hardie no longer employs Jack

Truong

Raises Fiscal Year 2022 Adjusted Net Income

Guidance Range to US$605 Million and US$625 Million from US$580

Million and US$600 Million

James Hardie Industries plc (ASX: JHX; NYSE: JHX), the

world’s #1 producer and marketer of high-performance fiber cement

and fiber gypsum building solutions, today announced the

appointment of Harold Wiens as Interim Chief Executive Officer.

In calendar 2017 the James Hardie Board of Directors, along with

senior management, identified the need for a strategic

transformation to ensure the future growth and profitability of the

company. Based on the need identified, the Board CEO succession

plan moved to finding a new CEO to lead this strategic

transformation.

On 1 February 2019, the Board appointed Jack Truong as CEO of

James Hardie Industries, and as discussed in our May 2021 investor

day, the global leadership team has successfully driven the

transformation into “A New James Hardie” over the past three

years.

Chairman Mike Hammes commented, “The transformation that has

occurred over the past three years is truly remarkable. The company

now has a clear, correct and very well-defined strategy, that is

aligned with what the Board and management identified as necessary

in 2017. This strategy is now deeply embedded throughout the

organization, from the line employee at our plants all the way to

the executive leadership team.”

While Mr. Truong has helped in this transformation, employees

raised concerns about his work-related interactions. The Board

undertook extensive due diligence which included retaining outside

counsel and a third-party consultant and provided opportunities and

support for sincere change in Mr. Truong’s behavior. Based on

additional employee complaints the Board undertook further due

diligence including additional due diligence from the third-party

consultant. The Board ultimately concluded, based on independent

third-party consultant surveys and analysis, direct input from

various executives, and additional information that Mr. Truong’s

conduct, while not discriminatory, extensively and materially

breached the James Hardie Code of Conduct, and at a Board meeting

held today resolved to terminate Mr. Truong’s employment, effective

immediately. The Board took this action to uphold the Company’s

core values, including Operating with Respect, and to maintain

continuity of the management team that has been instrumental in our

transformation. Per the terms of Mr. Truong’s contract, his on-foot

incentives, including unvested LTI, will lapse. He will receive

only statutory entitlements.

Mr. Wiens joined the Board of James Hardie Industries as an

independent non-executive director in May 2020 following a

distinguished career with 3M Company where he led several of its

largest business segments based in the United States, Asia and

Europe. He brings extensive senior executive experience to the

role, operating in international environments.

Commenting on his appointment as Interim CEO, Mr. Wiens stated,

“It is a pleasure to join such a deep and talented leadership team,

which I have worked with and admired for their professionalism,

strategic thinking and strong execution since I became a Board

member. More importantly, I am coming into the role with a

well-established strategy in place and embedded throughout the

organization. I believe this strategy, along with a world class

leadership team and our 5,000 committed and hard-working employees,

will drive us to meet our mission of being a high-performance

global company that delivers organic growth above market with

strong returns.”

Mr. Hammes added, “Harold is well placed to step into the role,

and lead James Hardie as the Board conducts a global search for a

permanent CEO. He is an individual of outstanding integrity who

demonstrates great passion for our Company, and importantly its

people and our core values, including Operating with Respect.

Harold has been a wise and insightful Board colleague reflecting

his time as a senior international executive, that was evident as

we have worked to refine and oversee the implementation of our

strategy. We are fortunate that he is able to take on these

responsibilities.”

In addition to Mr. Wiens’ appointment, Michael Hammes has been

appointed to the role of Executive Chairman while the CEO

succession is undertaken. In this role, Mr. Hammes will provide

additional leadership and oversight for the executive team and

support the Interim CEO.

Details of Mr. Wiens’ and Mr. Hammes’ remuneration packages are

set out in the attachment.

Mr. Wiens announced the following changes in responsibility for

James Hardie executives:

Sean Gadd has been promoted to North America President,

effective immediately. In this role Sean is responsible for running

the Company’s North America activities. Mr. Wiens stated, “Sean has

been the key leader within our North America business driving our

transformation over these past three years. His involvement in

developing our strategy and his proven track record of execution

make him the right leader to drive our North American business

forward.” Speaking on his appointment, Mr. Gadd stated “I am

excited to take on this expanded responsibility, we have the right

strategy in place, strong customer relationships and a great team,

I believe our North America business is well positioned for

continued growth.”

A search for a new CEO will commence immediately.

Outlook and Earnings

Guidance

Based on the continued, strong execution of the global strategy

across all three regions and the expectation for continued

residential and market growth in the USA, the Company is raising

its guidance for fiscal year 2022, ending 31 March 2022. Management

now expects fiscal year 2022 Adjusted Net Income to be between

US$605 million and US$625 million, compared to the prior range of

US$580 million and US$600 million. The comparable prior year

Adjusted Net Income for fiscal year 2021 was US$458.0 million.

James Hardie’s guidance is based on current estimates and

assumptions and is subject to several known and unknown

uncertainties and risks, including those related to the COVID-19

pandemic. James Hardie continues to assess the impacts and the

uncertainties of the COVID-19 pandemic on the geographic locations

in which it operates, and the continuing impact of the pandemic on

the Company’s business and future financial performance remains

uncertain.

Management Briefing for Analysts,

Investors and Media

James Hardie will conduct a teleconference and audio webcast for

analysts, investors, and media on Friday 7 January 2022, 9:00am

Sydney, Australia time (Thursday 6 January 2022, 5:00pm New York

City, USA time). Analysts, investors, and media can access the

management briefing via the following:

- All participants wishing to join the teleconference will need

to pre-register by navigating to:

https://s1.c-conf.com/diamondpass/10018782-3jam56.html

Once registered, you will receive a calendar invite with dial-in

numbers and a unique PIN which will be required to join the

call.

- Webcast Replay: Will be available two hours after the Live

Webcast concludes at https://ir.jameshardie.com.au

Forward-Looking

Statements

This Media Release contains forward-looking statements and

information that are necessarily subject to risks, uncertainties

and assumptions. Many factors could cause the actual results,

performance or achievements of James Hardie to be materially

different from those expressed or implied in this release,

including, among others, the risks and uncertainties set forth in

Section 3 “Risk Factors” in James Hardie’s Annual Report on Form

20-F for the year ended 31 March 2021; changes in general economic,

political, governmental and business conditions globally and in the

countries in which James Hardie does business; changes in interest

rates; changes in inflation rates; changes in exchange rates; the

level of construction generally; changes in cement demand and

prices; changes in raw material and energy prices; changes in

business strategy and various other factors. Should one or more of

these risks or uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those described herein. James Hardie assumes no obligation to

update or correct the information contained in this Media Release

except as required by law.

This media release has been authorized by the James Hardie Board

of Directors.

James Hardie Industries plc is a limited liability company

incorporated in Ireland with its registered office at Europa House,

2nd Floor, Harcourt Centre, Harcourt Street, Dublin 2, D02 WR20,

Ireland

Harold Wiens Biography

Mr Wiens had a distinguished career across 38 years at 3M

Company leading several of its most significant business units,

including the largest in the Industrial Business and Transportation

Business from 1998 until his retirement from 3M in 2006. During

this time, Mr Wiens restructured the business, leading a global

implementation of Six Sigma that drove significant international

growth. Other roles included heading Sumitomo 3M, the largest

subsidiary of 3M, headquartered in Tokyo, Japan. He was appointed

as an independent non-executive director of James Hardie in May

2020.

Roles & Responsibilities of Board Members

Harold Wiens, Interim Chief Executive

Officer

Key Roles &

Responsibilities

In the role of Interim CEO, Mr. Wiens is

responsible for the global business activities of the company,

focusing on rolling out the successive stages of our strategic

plan. In this capacity he will operate in the same manner as a

permanent CEO who was also on the Board, which has been the normal

structure for James Hardie Industries. The Interim CEO reports to

the Executive Chairman (acting on behalf of the Board) and to the

Board directly.

Changes in Remuneration

Mr. Wiens will receive a temporary

exertion fee of US$130,000 per month for the period he is in the

interim CEO role. The exertion fee will be in addition to his

regular board fees as a director. Reasonable expenses associated

with relocation and other costs incurred during this period because

of undertaking this role will also be compensated. In determining

appropriate remuneration, the Board, through the Nominating and

Governance Committee, received data and advice from the Board’s

independent remuneration adviser.

Mike Hammes, Executive Chairman

Key Roles &

Responsibilities

In addition to his responsibilities as

Chairman, Mr. Hammes will provide additional ‘hands-on’ assistance

to the Mr. Wiens, Interim CEO and the broader executive leadership

team. Consistent with executive chairman roles that co-exist with

CEOs, Mr. Hammes’ primary support to Mr. Wiens will be in the

engagement and relationship management with external

stakeholders.

Changes in Remuneration

Mr. Hammes will receive a temporary

exertion fee of US$40,000 per month for the period he is in the

Executive Chairman role. The exertion fee will be in addition to

his regular board fees as a director. Reasonable expenses

associated with relocation and other costs incurred during this

period because of undertaking this role will also be compensated.

In determining appropriate remuneration, the Board, through the

Nominating and Governance Committee, received data and advice from

the Board’s independent remuneration adviser.

Anne Lloyd, Lead Independent

Director

Key Roles &

Responsibilities

With Mr. Wiens and Mr. Hammes both taking

on Executive non-independent responsibilities, Ms. Lloyd has been

appointed as the Lead Independent Director. In this role, Ms. Lloyd

has the responsibility of ensuring proper governance of the Board

and that the Board remains independent and objective in its

stewardship of the company.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220106005925/en/

Media/Press Enquiries: Brett Clegg Managing Director,

Citadel Magnus Telephone: +61 487 436 985 Email:

bclegg@citadelmagnus.com

Investor/Analyst Enquiries: James Brennan-Chong Director

of Investor Relations and Market Intelligence Telephone: +61

2 9638 9205 Email: media@jameshardie.com.au

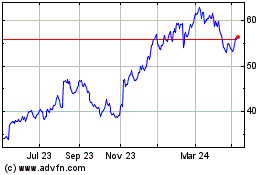

James Hardie Industries (ASX:JHX)

Historical Stock Chart

From Nov 2024 to Dec 2024

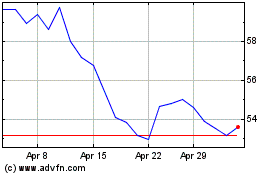

James Hardie Industries (ASX:JHX)

Historical Stock Chart

From Dec 2023 to Dec 2024