Joint Venture Plans to Revive Rare-Earths Processing in U.S.

20 May 2019 - 7:10PM

Dow Jones News

By Rhiannon Hoyle

SYDNEY--An American chemicals company and an Australian miner

want to build the first rare-earths separation plant in the U.S. in

years, seeking to shore up supplies of important commodities caught

up in the U.S.-China trade conflict.

The proposal by Blue Line Corp. and Lynas Corp. illustrates how

companies are growing increasingly worried by the trade rhetoric

out of Washington and Beijing, while looking for opportunities to

profit from tit-for-tat tariffs if they aren't short-lived. The

companies aim to build the plant in Hondo, Texas, near where Blue

Line is based.

Production of rare earths is dominated by China, but some of the

world's biggest consumers are U.S. manufacturers of advanced

technology such as electric vehicles, wind turbines and military

equipment. That explains why the U.S. has been reluctant to impose

tariffs on Chinese rare-earths shipments, despite the escalating

trade rift.

China, however, has put the rare-earths trade squarely in its

sights. The U.S. ships ore from its only active mine, in Mountain

Pass, Calif., to China for processing. Starting June 1, those

shipments will be saddled with a 25% tariff. That is up from 10%,

making the operation less profitable than before.

Blue Line and Lynas signaled that the lack of supply options

outside China played a key role in their decision to work together

over the coming year on plans for the new plant. The joint venture

would "help to ensure that U.S. companies have continued access to

rare earth products by providing a U.S.-based source," management

said in a joint statement.

The Trump administration worries a lack of domestic rare-earth

supplies undermines a competitive modern economy and strong

military. Last year, the U.S. Geological Survey designated 35

minerals as critical to the economy and national defense. The U.S.

is nearly reliant on imports for more than half of them.

Rare earths are among the most extreme examples of such critical

minerals, with China accounting for more than 90% of the world

supply over the past decade, according to U.S. government

figures.

China's control of the global rare-earths market has long been a

concern of manufacturers, particularly after Chinese export quotas

led to a price surge that in 2011 made some of the elements more

valuable than gold.

Lynas has grown from a small Australian miner to become the

largest producer of rare earths outside China in a decade. The

company digs up ore in Australia's arid western region and ships it

to Malaysia for processing. That unique supply chain recently led

Australian conglomerate Wesfarmers Ltd. to make a $1 billion

takeover offer for Lynas, despite uncertainty over the future of

its operating license amid environmental opposition to the

Malaysian plant.

Blue Line and Lynas said their proposed joint venture, which

would be majority owned by the Australian miner, would focus on

separating heavy rare earths such as dysprosium and terbium. That

would make it the only large-scale producer of medium and heavy

rare earths outside China, the companies said.

The plant could later be expanded to separate light rare earths

such as neodymium and praseodymium, they said. Those elements are

the main products of Lynas's Malaysia facility.

There are no separation plants in the U.S. for either heavy or

light rare-earth materials after Molycorp Inc. sought chapter 11

bankruptcy protection in 2015. Blue Line buys separated rare

earths, mainly from Lynas, that it processes further and sells to

customers including automotive and electronics manufacturers.

Jon Blumenthal, Blue Line's chief executive, said the venture's

aim was to provide "a secure source of rare-earth materials to both

U.S. and international markets."

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

May 20, 2019 04:55 ET (08:55 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

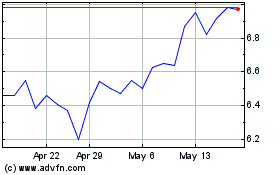

Lynas Rare Earths (ASX:LYC)

Historical Stock Chart

From Jan 2025 to Feb 2025

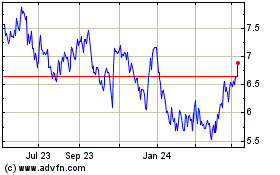

Lynas Rare Earths (ASX:LYC)

Historical Stock Chart

From Feb 2024 to Feb 2025