NAB Fiscal Year Profit Up 7.6%, Raises Dividend -- Update

09 November 2023 - 9:20AM

Dow Jones News

By Alice Uribe

SYDNEY--National Australia Bank said increased lending and

deposits in its business-related divisions helped to drive a 7.6%

increase in its annual profit and an almost 8% improvement in its

dividend.

The bank said net profit for the 12 months through September

rose to 7.41 billion Australian dollars (US$4.74 billion). Analysts

had expected a full-year net profit of A$7.71 billion, according to

FactSet's consensus estimate.

Cash earnings--a profitability measure tracked closely by

analysts--rose by 8.8% to A$7.73 billion.

Still, Chief Executive Ross McEwan said challenges in the

operating environment became more evident as fiscal 2023

progressed, reflecting the impacts of monetary policy tightening

and inflationary pressures on households and the economy.

This had led to its financial results softening in the second

half of the period, compared to the previous six months. "While the

economic transition has further to go, we are well placed to

navigate this environment," McEwan said. "We continue to see

attractive growth options and productivity is helping us manage

inflationary pressures."

NAB's annual operating expenses rose 9.1% to A$9.02 billion,

partly due to higher personnel costs and continued investment in

technology and compliance capabilities, the lender said.

At a divisional level, the Corporate and Institutional banking

unit's annual cash earnings rose by 15% to A$1.87 billion, while

the Business and Private Banking unit's cash earnings rose by 10%

to A$3.32 billion. Still, NAB's Personal Banking unit's cash

earnings fell by 9.1% to A$1.45 billion.

NAB's net interest margin--the difference between the interest

income generated and the amount of interest paid out to

lenders--rose 9 basis points to 1.74%, and on an adjusted basis it

rose 14 basis points.

The lender said this reflected higher earnings on deposits and

capital as a result of the rising interest rate environment,

partially offset by mortgage competition, deposit mix and higher

wholesale funding costs.

NAB, like other lenders, has benefited from the rising interest

rate environment. The Reserve Bank of Australia this week raised

its official cash rate by 25 basis points to 4.35%, marking the

first hike since July, following the news of higher-than-expected

inflation in the third quarter.

But the lender said the benefits of higher rates through FY 2023

had been increasingly offset by competition and inflationary

pressures in the second half of the year. Some analysts believe

that Australian lenders may soon see limited earnings growth, with

the rates tailwind for net interest margin and earnings likely to

slow into FY 2024 and beyond.

NAB said with inflation moderating, the cash rate looked to be

at or near peak levels.

"The extent to which households continue to adjust to cost of

living pressures and higher interest rates and the timeframe over

which inflation softens remain key to the outlook including the

path of monetary policy," NAB said.

For fiscal 2023 the ratio of 90+ days past due and gross

impaired assets to gross loans and acceptances increased by 9 bps

to 0.75%, which NAB said was driven by higher delinquencies across

the home loan and business lending portfolios.

Directors of the company raised the final dividend to A$0.84 per

share, compared with A$0.78 a year ago, while the group's Common

Equity Tier 1 capital ratio was 12.22% at the end of September,

compared with 11.51% the previous year.

Write to Alice Uribe at alice.uribe@wsj.com

(END) Dow Jones Newswires

November 08, 2023 17:05 ET (22:05 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

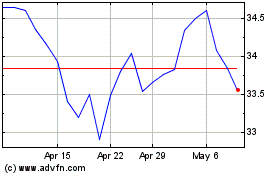

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Dec 2024 to Dec 2024

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Dec 2023 to Dec 2024