- Offer open to existing and new investors

- Opportunity to receive consistent and stable income stream

paid via monthly distributions

- Neuberger Berman to pay all fees and costs for

Offer

Global investment manager Neuberger Berman today announced an

offer of new Units in the NB Global Corporate Income Trust (ASX:

NBI). The offer of new Units will comprise of an Entitlement Offer

and a Shortfall Offer with the maximum potential raise being

approximately $749 million.

The offer period will commence on 29 January 2019. The joint

lead managers of the offer are Bell Potter, E&P, Morgans, NAB,

and Ord Minnett, and the co-manager is Canaccord Genuity

Financial.

“We are delighted to again offer existing unit holders and new

investors the opportunity to gain exposure to the global high yield

corporate bond market,” said Matt Thompson, Head of Intermediary

Distribution for Neuberger Berman.

“Given the current low interest rate environment, we believe the

Trust’s objective to deliver consistent and stable income via

monthly distributions makes it an attractive investment option for

Australian investors seeking a higher yielding and globally

diversified income solution.” added Mr. Thompson.

From its inception to the end of December 2019, NBI has achieved

an annualised total return of 8.43%1 and, for the financial year

ended 30 June 2019, paid an annualised distribution of 6.24%2 (net

of fees and expenses).

For the current financial year to the end of December 2019, NBI

has paid distributions totaling 5.39 cents per Unit, which

represents an annualised distribution of 5.25% (net of fees and

expenses) and is in line with NBI’s Target Distribution3.

Neuberger Berman has committed to paying for all the upfront

fees and costs of the Offer. Australia’s leading specialist

corporate fiduciary, Equity Trustees, is the Responsible Entity and

issuer of the Trust.

The Entitlement Offer for Eligible Unitholders and the Shortfall

Offer for new investors closes at 5:00pm (AEDT) on 21 February

2020.

Details of the Offer:

Trust

NB Global Corporate Income Trust

ASX Code

NBI

Entitlement Offer ratio

3 New Units for every 4 existing Units

Offer Price4

$2.05

Maximum number of New Units that may be

issued under the Entitlement Offer

334,089,462

Maximum gross proceeds from the

Entitlement Offer5

Up to $684,883,397 at the Offer Price

Key Dates:

Offer opens

29 January 2020

Entitlement Offer Closing Date (5.00 pm

AEDT)

21 February 2020

Shortfall Offer Closing Date (5.00 pm

AEDT)

21 February 2020

New Units under Entitlement Offer quoted

on a deferred settlement basis

24 February 2020

Results of the Offer announced

26 February 2020

Entitlement Offer Issue Date

2 March 2020

Normal trading of New Units and Additional

New Units under Entitlement Offer expected to commence on the

ASX

3 March 2020

Shortfall Offer Issue Date

9 March 2020

Normal trading of New Units issued under

Shortfall Offer expected to commence on the ASX

10 March 2020

To participate in the Offer

The Offer is being made under the Trust’s product disclosure

statement that was lodged with ASIC on 21 January 2020 (2020

PDS) and is available on the Trust’s website at

http://www.nb.com/nbi. Investors should review the 2020 PDS for

full details of the terms of the Offer, including, in particular,

the “Overview of the Trust”, “Overview of the Investment Strategy”,

“Risk Factors” and “Fees and Other Costs” sections of the 2020

PDS.

Applications under the Shortfall - General Offer can be made by

completing the application form attached to the 2020 PDS.

Applicants under the Shortfall – Broker Firm Offer should contact

their broker for application details.

About Neuberger Berman

Neuberger Berman, founded in 1939, is a private, independent,

employee-owned investment manager. The firm manages a range of

strategies—including equity, fixed income, quantitative and

multi-asset class, private equity, real estate and hedge funds—on

behalf of institutions, advisors and individual investors globally.

With offices in 23 countries, Neuberger Berman’s diverse team has

2,200 professionals. For six consecutive years, the company has

been named first or second in Pensions & Investments Best

Places to Work in Money Management survey (among those with 1,000

employees or more). The firm was awarded an A+ in every category in

the latest 2019 PRI report for our approach to ESG integration

across asset classes. The firm manages US$356 billion in client

assets as of December 31, 2019. For more information, please visit

our website at www.nb.com.

About Equity Trustees

Equity Trustees Limited (“Equity Trustees”) (ABN 46 004

031 298, AFSL 240975), is the Responsible Entity for the NB Global

Corporate Income Trust (“NBI”). Equity Trustees is a

subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly

listed company on the Australian Securities Exchange (ASX: EQT).

This release has been prepared by Neuberger Berman Australia Ltd

(ABN 90 146 033 801) (“Neuberger Berman”) to provide you

with general information only. In preparing this release, Neuberger

Berman did not take into account the investment objectives,

financial situation or particular needs of any particular person.

It is not intended to take the place of professional advice and you

should not take action on specific issues in reliance on this

release. Neither Neuberger Berman, Equity Trustees nor any of its

related parties, their employees or directors, provide any warranty

of accuracy or reliability in relation to such information or

accepts any liability to any person who relies on it. Past

performance should not be taken as an indicator of future

performance. You should obtain a copy of NBI’s latest Product

Disclosure Statement from its website (www.nb.com/nbi) before

making a decision about whether to invest in NBI. The information

contained in this release is taken from publicly available sources

that is subject to change without notice. EQT and Neuberger Berman

make no representation as to the reliability or accuracy of the

publicly available information.

For more information about NBI, please visit www.nb.com/nbi.

Notes:

- Listing Date: 26 September 2018. Performance has been

annualized. Total Return is calculated based on the

pre-distribution month end NTA and assumes all distributions are

reinvested. Performance is calculated net of management costs,

which includes the Responsible Entity fee, the Management fee, the

Administration fee, along with custodian, audit and legal fees and

other transactional and operational costs. Investors should review

NBI’s product disclosure statement dated 21 January 2020 (“2020

PDS”) for full details of NBI, including, in particular, the “Fees

and Other Costs” section.

- Based on the Initial Public Offer Subscription Price of

$2.00.

- The Target Distribution is only a target and may not be

achieved. Actual distributions will be monitored against the Target

Distribution. The Target Distribution will be formally reviewed at

least annually (as at the end of each financial year) and any

change in Target Distribution will be notified by way of ASX

announcement as required. Investors should review the Risk summary

set out in Section 8 of the 2020 PDS. Section 3.3.1 of the 2020 PDS

sets out the Manager’s views in relation the interest rate

environment and impact on target distributions. The Manager

anticipates the Trust having to revise its Target Distribution for

the financial year beginning 1 July 2020 marginally downwards given

the recent decline in yields across global fixed income markets and

the ongoing turnover of the Trust’s holdings resulting from the

Manager’s active management approach.

- The Offer Price is based on the NTA per Unit as at 17 January

2020, net Distributable Earnings. The Distributable Earnings is the

accrued and forecast cash available for distribution in respect of

the financial year ending 30 June 2019. Investors should refer to

Section 2.5 of the 2020 PDS for NBI’s Distribution Policy. The 2020

PDS is available on NBI’s website at www.nb.com/nbi.

- The Shortfall Offer, which will allow new investors to

participate in the Offer, includes an invitation to apply for up to

31,098,707 New Units over and above the Shortfall from the

Entitlement Offer (representing that number of New Units which can

be issued under the Trust’s available placement capacity under ASX

Listing Rule 7.1 (“Placement Capacity”)). In that event, the number

of New Units issued under the 2020 PDS will be up to approximately

365,188,169 New Units and the maximum gross proceeds from the Offer

will be up to approximately $749 million.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200120005547/en/

Arthur Chan WE Communications WE-AUNeuberger@we-worldwide.com T:

02 9237 2805

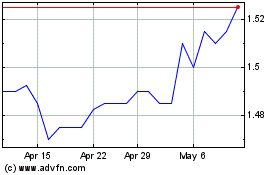

NB Monthly Income (ASX:NBI)

Historical Stock Chart

From Nov 2024 to Dec 2024

NB Monthly Income (ASX:NBI)

Historical Stock Chart

From Dec 2023 to Dec 2024