Splitit Partners with ChargeAfter

09 June 2021 - 2:44AM

Business Wire

Partnership Adds Splitit’s Installments to

ChargeAfter’s Consumer Financing Portfolio

- The partnership will add Splitit to ChargeAfter’s global

point-of-sale financing portfolio for both online and in-store

shopping.

- Shoppers now have a more intuitive and flexible way to use the

hard-earned credit on their existing credit cards to spread

payments over time.

- Splitit helps merchants attract and convert higher-value

customers.

Splitit (ASX:SPT), the company empowering consumers to use their

existing line of credit to pay in installments, announced a

partnership with ChargeAfter, the leading global network of

personalized buy now pay later (BNPL) and point-of-sale financing

for merchants, adding Splitit to complement its existing portfolio

of consumer financing offerings. Splitit will be the first

financing-free installment payment option available on the

platform.

Merchants using ChargeAfter can now offer their shoppers

Splitit, a more intuitive and flexible way to leverage the

hard-earned credit on their existing credit cards to spread

payments out over time. No applications, no fees and no hassle.

Because Splitit rewards customers for their good credit, shoppers

can easily take advantage of installment payments without adding

another line of credit. At the same time, they continue to earn

rewards points, cash-back or other benefits from their credit

cards. The benefit for merchants offering Splitit is attracting and

boosting conversion rates of higher-value customers. Splitit’s

average order value (AOV) is over $1,000 -- four times higher than

most other Buy Now, Pay Later alternatives.

“The partnership with ChargeAfter extends our reach introducing

Splitit to even more merchants and shoppers,” notes Splitit CEO

Brad Paterson. “Not every consumer is looking to open a new line of

credit for the purchase and just want a smarter way to use the

credit they have already earned. We serve this type of shopper by

giving them the flexibility to use their existing credit cards to

spread payments over time without additional fees.”

ChargeAfter is the market-leading BNPL network that connects

retailers and lenders to offer consumers personalized point-of-sale

financing options during shopping and at checkout from multiple

lenders. Merchants on the ChargeAfter platform include leading

iconic U.S .retailers across home appliances, furniture,

mattresses, consumer electronics and automotive, amongst other

verticals.

“ChargeAfter’s mission is to create the next wave of credit by

providing BNPL financing, installments, and other alternative

payment options made for every shopper, no matter their financial

or banking history. Our new partnership with Splitit helps us

further our goal of democratizing credit and providing our global

merchant retailers with the very best point-of-sale consumer

financing options and products available in a single platform,“

said ChargeAfter CEO Meidad Sharon. “Splitit’s easy installment

product is a great addition to the ChargeAfter platform by enabling

consumers to have more choice at checkout by dividing their

purchase into easy, affordable and manageable installments using

their credit card.”

Visit www.splitit.com for more information on how Splitit can

help attract and convert high-value shoppers.

About ChargeAfter

ChargeAfter is the leading multi-lender buy now pay later

financing platform connecting retailers and lenders to offer

shoppers personalized financing options.

With its data-driven decisioning engine and network of global

lenders, ChargeAfter delivers the most relevant financing offers to

consumers from multiple lenders based on credit type – resulting in

credit approvals for up to 85% of customer applications.

ChargeAfter streamlines the distribution of credit into a single

platform that retailers can implement swiftly both online and

in-store. The company’s growing lender network offers seamless

integration to lenders seeking to grow their customer base while

expanding into new retail markets.

ChargeAfter investors include Visa, MUFG, BBVA, Synchrony

Financial, Propel Venture Partners, PICO Venture Partners and Plug

and Play VC.

Headquartered in Sunnyvale, California, ChargeAfter has offices

in Atlanta, Dallas, New York, and Tel Aviv. For more information,

visit https://chargeafter.com.

About Splitit

Splitit empowers consumers to use the hard-earned credit on

their existing credit cards to spread payments over time with no

applications, fees and hassle. Splitit attracts and converts

higher-value customers helping merchants improve conversion rates

and increase average order value by giving customers an easy and

fast way to pay for purchases over time without requiring

additional approvals. Splitit serves many of Internet Retailer’s

top 500 merchants and is accepted by more than 2,000 e-commerce

merchants in over 30 countries and shoppers in over 100 countries.

Headquartered in New York, Splitit has an R&D center in Israel

and offices in London and Australia. The company is listed on the

Australian Securities Exchange (ASX) under ticker code SPT.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210608005960/en/

Splitit Brian Blank brian.blank@splitit.com

ChargeAfter Jeffrey Tower jeffrey.tower@chargeafter.com

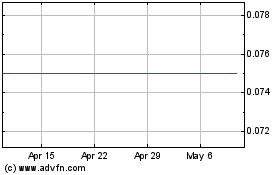

Splitit Payments (ASX:SPT)

Historical Stock Chart

From Jan 2025 to Feb 2025

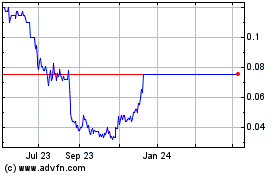

Splitit Payments (ASX:SPT)

Historical Stock Chart

From Feb 2024 to Feb 2025