Homebase to Close 42 Stores, Up to 1,500 Jobs at Risk

14 August 2018 - 10:53PM

Dow Jones News

By Maryam Cockar

Homebase said Tuesday that it will close 42 stores, putting up

to 1,500 jobs at risk, as part of a rescue deal with its

creditors.

The home-improvement retailer said it will seek approval from

its creditors to launch a company voluntary arrangement to shore up

its finances. The company voluntary arrangement, a type of

insolvency that allows a company to close underperforming stores

and renegotiate rents with landlords, will be voted on by creditors

on Aug. 31.

Homebase said its sales performance and profitability declined

significantly under the previous ownership during the last two

years. Hilco bought Homebase for one pound ($1.27) in May from

Australia's Wesfarmers Ltd. (WES.AU) who bought the retailer for

340 million pounds ($433.7 million) in 2016.

The 42 stores are expected to close during late 2018 and early

2019, resulting up to 1,500 jobs cuts. Homebase said it will aim to

redeploy staff where possible.

Write to Maryam Cockar at maryam.cockar@dowjones.com

(END) Dow Jones Newswires

August 14, 2018 08:38 ET (12:38 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

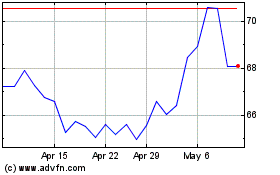

Wesfarmers (ASX:WES)

Historical Stock Chart

From Feb 2025 to Mar 2025

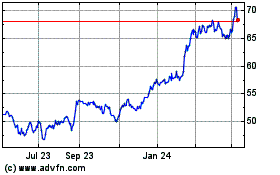

Wesfarmers (ASX:WES)

Historical Stock Chart

From Mar 2024 to Mar 2025

Real-Time news about Wesfarmers Limited (Australian Stock Exchange): 0 recent articles

More Wesfarmer Fpo News Articles