China's Consumer Inflation Picks Up

18 February 2016 - 4:10PM

Dow Jones News

BEIJING—Consumer inflation in China edged up in January, buoyed

by rising food prices ahead of the Lunar New Year holiday, though

economists said the uptick is likely to be short-lived as excess

capacity weighs on the economy.

China's consumer-price index rose 1.8% in January from a year

earlier, the government's statistics bureau reported Thursday. The

rate is higher than December's 1.6% rise and matched the median

forecast by 13 economists in a survey by The Wall Street

Journal.

Despite the rise, price pressure remains weak and deflation is

still a risk for the world's second-largest economy as it struggles

to slough off a housing glut, high debt levels and factories

pumping out too many goods.

"Deflation is the main risk rather than inflation," said ANZ

Research economist Li-Gang Liu. "Domestic demand is quite weak.

They need to deal with overcapacity," he said.

Prices at the factory gate remain deep in deflationary territory

and have been so for nearly four years. The producer-price index

declined 5.3% in January from a year earlier, slightly better than

expected. This compared with a 5.9% year-over-year drop in

December.

The rise in January's consumer inflation came from double-digit

price increases for pork, China's staple meat and a fixture in

dishes served over the Lunar New Year holiday, which ends this

month. Prices for vegetables and fruits rose too due to colder

weather, statistics bureau economist Yu Qiumei said in a

report.

Zhou Jinhong, a 40-something accountant working in Beijing, said

she has seen pork, beef and egg prices increase, prompting her to

consider changing her eating habits and shop more carefully.

"If pork gets too expensive, I'll consider buying less," she

said, emerging from a Beijing Hualian supermarket in the

northwestern part of the capital. "But supermarket sales can

compensate for higher prices in other goods. That can make the

increases less obvious."

Lower prices tend to help an economy if consumers and companies

use the savings to buy and invest elsewhere. A protracted downward

price pressure can cause them to delay spending in the belief that

waiting will result in still lower costs in the near future,

dragging down growth. It can also make debt repayment more

difficult.

Consumer prices in China rose 1.4% in 2015, well below the

government's goal of keeping them under 3%, the smallest increase

since 2009.

China continues to battle deflation at the factory gate as the

price of oil and other commodities weakens further. Chinese steel

prices in the 2015 fourth quarter were 60% to 70% below peak

second-quarter 2008 levels, on average, the Australian government

and Westpac Bank said in a report this month.

Weak consumer inflation gives policy makers more leeway to

loosen monetary and fiscal policy further. Economists said they

expect Beijing to continue to cut interest rates and reduce the

portion of reserves that banks are required to maintain.

"The economy still faces huge downward pressure," said Nomura

Group economist Zhao Yang. "Monetary policy will likely remain

supportive."

Mr. Zhao said he expects the central bank to make four cuts in

required bank reserves and two broad interest-rate cuts in 2016.

ANZ Research's Mr. Liu said the next cut in bank reserves could

come this quarter to be followed by one or more broad interest-rate

cuts later this year.

Low inflation or outright deflation is also weighing on tax

receipts, said rating company Moody's Investors Service in a

report, as fiscal revenue last year grew by 8.4%, its smallest rise

in over two decades.

Liyan Qi and Grace Zhu contributed to this article.

Write to Mark Magnier at mark.magnier@wsj.com

(END) Dow Jones Newswires

February 17, 2016 23:55 ET (04:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

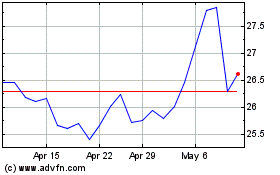

Westpac Banking (ASX:WBC)

Historical Stock Chart

From Oct 2024 to Nov 2024

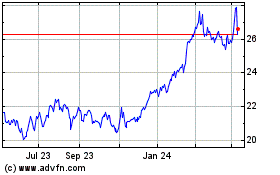

Westpac Banking (ASX:WBC)

Historical Stock Chart

From Nov 2023 to Nov 2024