Australia Stocks Decline, Snapping Three-Day Run Higher

21 October 2016 - 5:40PM

Dow Jones News

By Robb M. Stewart

MELBOURNE--Broad declines by energy shares and sharp falls among

a few stocks weighed on the Australian equities market Friday,

leaving it modestly lower for the week.

Snapping a run higher the past three days, the S&P/ASX 200

finished down 11.8 points, or 0.2%, at 5430.3. That left the index

almost 0.1% lower for the week, after dropping 0.6% last week.

Oil and gas stocks were under pressure as crude-oil prices fell

again in Asian trade after the U.S. dollar strengthened following

comments from Russia's top producer that it could lift output if

demand required.

After hitting a fresh one-year high Wednesday, oil has been

retreating as traders consider the global supply glut. Igor Sechin,

chief executive of Russia's Rosneft Oil Co., said in comments

Thursday that his country has the capacity to raise output by as

much as 200 million metric tons a year, or four million barrels a

day, according to Russian media.

Woodside Petroleum Ltd. fell 0.9% for the day, Oil Search Ltd.

dropped 2.3% and Origin Energy Ltd. was 0.9% lower. Santos,

however, gained 0.5% after releasing third-quarter production and

revenue figures that showed growth compared with last year thanks

to higher liquefied-natural-gas output.

Hospital operator Healthscope Ltd. slumped 19% after it said it

had experienced slower-than-expected revenue growth in the first

quarter of its financial year. Ramsay Heath Care Ltd., another

ASX-listed hospital operator, declined 5.9%.

The Australian shares of casino operator Skycity Entertainment

Group Ltd. were 13% weaker after it cautioned it may face a

financial hit from the fallout over the detention of 18 Crown

Resorts employees in China. The New Zealand company's shares have

fallen 19% on the ASX this week, while Crown's lost 16% despite

recovering 1.6% on Friday.

The major banks were mostly higher, led by a 0.9% gain by

Westpac Banking Corp. and a 0.8% push higher by Australia & New

Zealand Banking Group Ltd. Macquarie said in a research report that

it believed the big banks, other than National Australia Bank Ltd.,

can sustain their dividends even in the current low-growth

environment. NAB's shares dipped slightly.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

October 21, 2016 02:25 ET (06:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

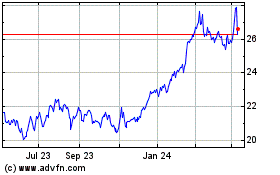

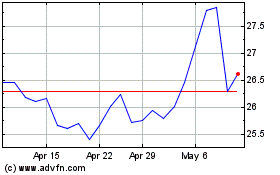

Westpac Banking (ASX:WBC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Westpac Banking (ASX:WBC)

Historical Stock Chart

From Feb 2024 to Feb 2025