UniCredit Seals $4.10 Billion Sale of Asset Manager to Amundi

12 December 2016 - 8:30PM

Dow Jones News

MILAN—UniCredit SpA agreed to sell its asset-management unit

Pioneer Investments to France's Amundi SA for €3.88 billion ($4.10

billion), bolstering its capital buffers as it tries to meet

tougher new banking regulations.

Amundi will pay UniCredit €3.55 billion in cash and a special

dividend of €315 million before the transaction closes.

The sale of Pioneer, which manages assets worth €225.8 billion,

is part of a broader plan that UniCredit is set to announce on

Tuesday to strengthen its finances.

The bank is under increased scrutiny. The sale of Pioneer and

Unicredit's restructuring plan coincide with political turmoil in

Italy after the resignation of Prime Minister Matteo Renzi last

week following a 'no vote' in a referendum on constitutional reform

he had backed. Premier-designate Paolo Gentiloni is trying this

week to form a new government.

Italian lenders in general have been battered by investor

anxiety about the robustness of the country's banking system, which

is struggling with bad loans and low profitability.

The sale of Pioneer is the latest in a number of disposals

UniCredit has made. It sold a 30% stake in FinecoBank SpA and a 10%

stake in Bank Pekao SA since the end of the second quarter. This

helped raise its common equity tier 1 ratio with fully applied

Basel 3 rules—a commonly used measure of a bank's financial

health—to 10.82%, from 10.33% at the end of the second quarter.

UniCredit said it expects to book a consolidated net capital

gain next year of €2.2 billion from the sale of Pioneer—the

transaction is expected to close early in 2017—which would improve

the bank's fully loaded common equity tier 1 ratio by 0.78

percentage point.

UniCredit and Amundi have agreed to form a 10-year partnership

to distribute their asset-management products in Italy, Germany and

Austria.

For Amundi, the Pioneer deal turns it into the world's eighth

largest asset manager, according to main shareholder Credit

Agricole SA of France, handling €1.28 trillion in assets.

-- Inti Landauro in Paris contributed to this article.

Write to Eric Sylvers at eric.sylvers@wsj.com

(END) Dow Jones Newswires

December 12, 2016 04:15 ET (09:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

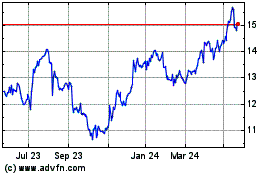

Finecobank (BIT:FBK)

Historical Stock Chart

From Nov 2024 to Dec 2024

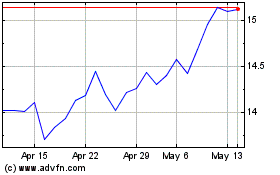

Finecobank (BIT:FBK)

Historical Stock Chart

From Dec 2023 to Dec 2024