Banca Ifis: net profit for the quarter comes to 20,1 million Euro

with two-figure growth seen in revenues from core business

Banca Ifis: net profit for the quarter

comes to 20,1 million Euro with two-figure growth seen in revenues

from core business

The first quarter of 2021 saw an all-time high

recorded for cash collections on Npl portfolios acquired, which

came to 81 million Euro (+24%) coupled with excellent performance

in revenues from commercial and corporate banking (+21%) on the

same period of last year. Faced with an improving macroeconomic

context, positive signs are recorded by customers: more than a

third have chosen to resume payments of the instalments that had

benefited from moratoriums, early. Concrete commercial

contributions from the digitisation of business. Capital ratios

have improved further; liquidity position and quality of assets are

amongst the best in class.

-

Equity position strengthened with CET1 at 11,77%, (+0,48%

on 31 December 2020)

-

Net banking income totalled 137,7 million Euro, up 30% from

the first quarter of 2020

-

Cost of credit1 of 16

million Euro, including 8 million Euro in additional provisions

made on performing exposures under the scope of the additional

prudence applied in respect of the Covid-19 scenario

-

Solid liquidity position: approximately 1,2 billion Euro at

31.03.2021 in reserves and free assets that can be financed by the

ECB (LCR above 1.400%)

-

Retail funding stable at 4,5 billion Euro

-

Dividend of 0,47 Euro per share scheduled for payment on 26

May

First quarter 2021

resultsReclassified data1 - 1 January 2021/31 March

2021

- Net banking income up

to 137,7 million Euro (+30% on 31.03.2020), benefiting

from the macroeconomic recovery and progressive normalisation of

the Npl business.

- Operating costs at

91,3 million Euro (+24,2% on 31.03.2020) due to higher variable

costs linked to the legal business of the Npl Segment, the entrance

of Farbanca into the scope and new ICT projects.

- Net profit of 20,1

million Euro, up 10 million Euro on the first quarter of last year

(excluding the extraordinary capital gain of 24,2 million Euro from

this and the related tax effect due to the sale of the Milan

property in Corso Venezia).

Capital requirements with the consolidation

within La Scogliera

- CET1 up

to 11,77% (11,29% at 31 December 2020) with respect to an

SREP requirement of 8,12%; TCR: 15,47% (14,85% at 31 December 2020)

with respect to an SREP requirement of 12,5%. These results are

calculated without including the profits generated by the Banking

Group during the first three months of 2021.

Capital requirements without the consolidation

within La Scogliera2

-

CET1: 15,97% (15,47% at 31 December 2020); TCR:

20,51% (19,87% at 31 December 2020). These results are calculated

net of the profits generated by the Banking Group during the first

three months of 2021.

Mestre (Venice), 13 May 2021 – The Board of

Directors of Banca Ifis, chaired by the Deputy Chairman, Ernesto

Fürstenberg Fassio, today approved the results for the first three

months of 2021.

“Banca Ifis is a unique, highly resilient

organisation that can well oversee specific businesses that call

for a distinctive skill set”, Frederik Geertman, the

Group’s CEO starts out.

“The results of the first quarter, which closes

with net period profit of 20,1 million Euro consequently confirm

the validity of a model based on quality and specialisation that

today boasts good industrial performance. The commercial

business has shown very dynamic performance and greater

disbursements, particularly in loans backed by

Mediocredito Centrale, reporting revenues of 65 million Euro, up

21% on the first quarter of 2020. We are speeding up the

digitisation of processes with a view to increasing efficiency,

speed and an omni-channel approach, already obtaining

concrete commercial contributions. In the first quarter of 2021,

one fifth of our new customers were acquired digitally. The aim is

to incorporate technology into our processes and offer customers a

“business-measure” experience. The new platforms will allow for not

only the marketing of the Bank's products but also, indeed above

all, the more automated management of back-office in order to focus

people and skills on the activities with high added value”

Mr Geertman continues.

“The performance of the Npl business,

with revenues of 58,3 million Euro, +35% on the first quarter of

2020, benefits from a normalisation of the court's work

and a better management of the voluntary recovery plans, with an

increase in “balances paid off” on the most uncertain realignment

plans, on the basis of the analysis of each individual position. In

the Npl business, the strategy aims to optimise servicing in terms

of costs and recovery time: in these first three months of the

year, we have achieved an all-time high in cash collection on

portfolios acquired, which comes to 81 million Euro, up 24% on Q1

2020.

The cost of credit was 16 million Euro and

includes 8 million Euro in additional provisions made on performing

exposures under the scope of the additional prudence applied in

respect of the Covid-19 scenario. We have devoted particularly

close attention to monitoring loans in moratorium with a segment

analysis and for the main positions. The initial feedback is

positive: to date, one third of our customers have chosen to resume

making payments of their instalments that had benefited from

moratorium early, thanks to the progressive improvement of the

macroeconomic context. The CET1 has reached

11,77%, calculated excluding the quarter profit. The

allocation of capital will be according to the profitability of the

individual business units and projects, in any case maintaining a

diversification between the commercial business and the NPLs, which

has confirmed its value even amidst the Covid-19 crisis”,

Mr Geertman concludes.

HighlightsRECLASSIFIED DATA 13

The Banca Ifis Group's consolidated income

statement for the first three months of 2021 reported a profit

attributable to the Parent Company of 20,1 million Euro.

Highlights from the Banca Ifis Group’s income

statements for the first three months of 2021 are set out

below.

Net banking

income1

Net banking income totalled 137,7 million Euro,

up 30% from 106 million Euro at 31 March 2020. This increase of

31,8 million Euro is mainly linked to the following two

factors:

- effect of the better general

economic context on the Npl Segment, in particular

court activities and, consequently, lawsuits to collect debt that

resulted in growth of net banking income of around 15,0 million

Euro;

- contribution of the

Commercial & Corporate Banking Segment, with

growth of approximately 11,2 million Euro, mainly due to the

Corporate Banking & Lending Business Area following:

- the contribution for 4,8 million

Euro of Farbanca S.p.A. (a company that was not yet part of the

Banca Ifis Group in Q1 2020);

- the net profit of assets measured

at fair value for 2,0 million Euro, up 4,0 million Euro on the loss

recorded during the first three months of 2020, due to the unique

macroeconomic context and the instability of the main listed

indices used in the valuation models;

- the positive contribution of the

Governance & Services and Non Core Segment, up

approximately 5,6 million Euro, due to the greater contribution

made both by the PPA for approximately 2,8 million Euro, for

certain early repayments made at the start of 2021 and other

positive components of net banking income connected with

investments in financial assets.

Net impairment

losses1

At 31 March 2021, net credit risk losses came to

16,1 million Euro, as compared with the 18,5 million Euro booked at

31 March 2020 (-13,0%). In particular, during the first quarter of

2021, the Factoring Area records net write-backs

for 4,3 million Euro due to the reduction in non-performing

exposures, in particular in segments considered as more at risk in

connection with the economic effects of the pandemic and a review

of the credit risk measurement models. This positive contribution

is juxtaposed against the Leasing Area, whose net

value adjustments on receivables come to 3,7 million Euro (4,3

million Euro at 31 March 2020) and the Corporate Banking

& Lending Area, with net adjustments 6,3 million Euro,

up 4,2 million Euro on the same period of last year, due to

additional provisions made for reasons of prudence in connection

with the Covid-19 scenario. Finally, the Governance &

Services and Non-Core Segment contributes with net

adjustments for 10,4 million Euro, up on the 7,5 million Euro at 31

March 2020, mainly due to the write-down of a significant position

in the run-off portfolio.

Operating costs

Operating costs totalled 91,3

million Euro, showing an increase of 24,2% on 31 March 2020. The

trend is linked to the increase in payroll costs, mainly due to the

entrance of Farbanca into the scope, to higher legal costs and

costs for the collection of NPLs, new ICT projects, greater

investments made in marketing and advertising, in addition to net

period provisions made for risks and charges and to the Single

Resolution Fund (SRF).

Below are details of the item’s main

components.

- Personnel

expenses rose by 5,5% to 33,8 million Euro (32,0 million Euro for

the period ended 31 March 2020). The slight increase in this item

as compared with Q1 2020, is mainly due to the entrance of Farbanca

S.p.A. into the Banca Ifis Group, for approximately 0,8 million

Euro and greater variable provisions made for around 1,0 million

Euro. The number of Group employees at 31 March 2021 was 1.765 as

compared with 1.750 resources at 31 March 2020.

- Other

administrative expenses at 31 March 2021 come to 52,5 million Euro

and increase by 29,5% on 31 March 2020, mainly due to the higher

legal costs and costs for collecting on NPLs (+5,5 million Euro as

compared with the first quarter of 2020, which had been impacted by

the court closures), entrance of Farbanca into the consolidation

scope (+1,2 million Euro), higher costs linked to ICT projects

(+2,2 million Euro as compared with the first quarter of 2020),

professional services (+0,6 million Euro on 31 March 2020) and

investments in marketing and advertising (+0,7 million Euro on the

same period of 2020).

- Net allocations

to provisions for risks and charges amounted to 7,4 million Euro,

an increase on the 4,9 million Euro at 31 March 2020. Net period

provisions refer 4,0 million Euro to the Single Resolution Fund

(SRF). Provisions are also made for 2,5 million Euro for

commitments to disburse funds and guarantees.

- Other net

operating income of 6,8 million Euro is down by 14,8% on the same

period of last year, which had been positively impacted by

indemnities against guarantees received on the sales of Npl

portfolios.

Net profit attributable to the Parent

Company

At 31 March 2021, net profit pertaining to the

Parent Company came to 20,1 million Euro, up 10 million Euro on the

to the same period of 2020 (excluding the extraordinary capital

gain of 24,2 million Euro from this and the related tax effect due

to the sale of the Milan property in Corso Venezia).

Focus on individual

Segments

Below are the main dynamics recorded in the

individual Segments that go towards forming the economic-equity

results at 31 March 2021.

Net profit from the Commercial &

Corporate Banking Segment rose by 40,5% on 31 March the

previous year and came to 15,3 million Euro. This

change is due to the growth of net banking income for 11,2 million

Euro, and by greater credit risk losses for 5,3 million Euro as

compared with the first quarter of last year. Operating costs rose

by a total of 8,8 million Euro on the figure recorded for Q1

2020.

- The contribution

made by the Factoring Area towards net banking

income booked by the Commercial & Corporate Banking Segment

came to 34,0 million Euro in the period, down 6,5% on the same

period of last year. This result was due to the lower contribution

both of net interest income (down by 1,2 million Euro, -5,3%) and

net commission income (down by 1,3 million Euro, -9,0%). During the

period, the net banking income is less by 2,4 million Euro on the

same quarter of 2020.

- Net banking

income from the Leasing Area amounted to 13,6

million Euro, +15% on 31 March 2020. The higher margin is due for

1,9 million Euro to lesser interest expense. This positive effect

on the interest margin is partially offset by the reduction in the

commission margin for 0,2 million Euro.

- Net

banking income of the Corporate Banking & Lending

Area came to 17,3 million Euro, up 11,7 million Euro on 31

March 2020. In detail, the increase is the result of the sum of 6,7

million Euro in interest margin, one million Euro in commission and

4 million Euro in other items making up net banking income.

Period profit of the Npl

Segment1 is approximately 11,5

million Euro, up 69,5% on the same period of 2020 thanks

to the recovery of all business activities.

The net banking income of the Segment1 amounted

to 58,3 million Euro (+34,8%) as compared with 43,2 million Euro at

31 March 2020. The increase is due to both the increase in the

amount of loans at amortised cost that generated interest income

for 36,2 million Euro (up 4,9% at 31 March 2021), and the

improvement of cash flow forecasts as a result of collections made

in respect of projections, with an effect of 27,5 million Euro on

the interest margin in Q1 2021 (+82,5%).

Collections made in the Npl Segment in Q1 2021

came to 80,9 million Euro, +24% on the 65,2 million Euro booked for

Q 2020 and include the instalments collected on realignment plans,

garnishment orders and transactions performed.

Operating costs go from 33,5 million Euro in the

first quarter of 2020 to 41,5 million Euro for 31 March 2021, an

increase of 23,9% mainly due to the variable costs connected with

debt collection.

At 31 March 2021, the Governance &

Services and Non Core Segment recorded a loss of 6,0

million Euro as compared with the profit of 8,8 million Euro of 31

March 2020, which benefited notably from the capital gain, net of

the related costs of sale, of 24,2 million Euro of the sale of the

property in Corso Venezia, Milan.

The Segment’s net banking income comes to 14,5

million Euro, up 5,6 million Euro on the same period of last year

and with an increase seen both in the Non Core Area for 4,7 million

Euro and in the Governance & Services Area for 0,9 million

Euro.

Operating costs come to 12,9 million Euro, up

0,9 million Euro on 31 March 2020. The increase is almost

exclusively the result of the higher cost for the contribution to

the Single Resolution Fund (SRF): approximately 1,0 million Euro

more than the allocation made during the same period of last

year.

The breakdown of the main statement of financial

position items of the Banca Ifis Group at 31 March 2021 is shown

below.

Receivables due from customers measured

at amortised cost

Total receivables due from customers measured at

amortised cost amounted to 9.032,1 million Euro, down 1,1% on 31

December 2020 (9.135,4 million Euro). The item includes debt

securities for 1,4 billion Euro (1,3 billion Euro at 31 December

2020). The Commercial & Corporate Banking

Segment is down on the same period of last year (-2,7%).

This reduction is concentrated above all on the Factoring Area

(-8,8%) and was only partially offset by the growth of the

Corporate Banking & Lending Area (+5,0%, equal to growth of

approximately 92 million Euro); leasing is also slightly down,

-0,6%. Receivables of the Npl Segment are down

0,5%, whilst an increase is recorded of 63,5 million Euro in

exposures of the Governance & Services and Non-Core

Segment, mainly due to the purchase of debt

securities.

Total net non-performing exposures, which are

significantly affected by the receivables of the Npl

Segment, amounted to 1.598,0 million Euro at 31 March

2021, compared to 1.591,9 million Euro at 31 December 2020

(+0,4%).

Net of the Npl Segment portfolio, non-performing

loans come to 222,1 million Euro, up on the 210,8 million Euro

recorded at 31 December 2020.

Funding

During the first three months of 2021, the Group

continued its strategy of differentiating between distribution

channels, in order to ensure a better balance with respect to

retail funding. The Group has surplus liquidity in respect of its

needs (approximately 1,2 billion Euro at 31 March 2021 in reserves

and free assets that can be financed in the ECB), thereby enabling

it to easily respect the LCR and NSFR limits (with indexes more

than of 1.400% and 100% respectively).

At 31 March 2021, total funding came to 9.735,3

million Euro, -1,7% on the end of FY 2020; the funding structure

was as follows:

- 56,8% customers;

- 10,9% debt securities;

- 9,2% ABSs;

- 20,5% TLTROs;

- 2,7%

other.

Payables due to customers at 31 March 2021

totalled 5.526,3 million Euro: +1% on 31 December 2020, recording

substantial stability of retail funding (mainly Rendimax and

Contomax), which comes to 4.489,2 million Euro at end March 2021

(+0,7%).

Payables due to banks amounted to 2.251,1

million Euro, down 4,9% compared to 31 December 2020.

Securities issued at 31 March 2021 came to

1.957,9 million Euro, down on the 2.069,1 million Euro at end 2020.

During the first quarter of 2021, upon reaching the due date, the

debenture loan that had, at the time, been issued by the

incorporated Interbanca, and which at 31 December 2020 had a

residual balance of 62,7 million Euro, was repaid in full.

Equity and ratios

At 31 March 2021, the Group’s consolidated

equity was up 1,4%, coming in at 1.571,7 million Euro as compared

with the 1.550,0 million Euro at end 2020, mainly due to the period

result pertaining to the Parent Company for 20,1 million Euro and

the net positive change of 0,9 million Euro in the valuation

reserve on securities in the first quarter of 2021.

With prudential consolidation within La

Scogliera, capital ratios at 31 March 2021 amounted to a

CET1 ratio of 11,77%4 (compared with 11,29% at 31 December 2020), a

TIER1 ratio of 12,38%4 (11,86% at 31 December 2020) and a Total

Capital ratio of 15,47%4 (compared with 14,85% at 31 December

2020).

At 31 March 2021 the ratios for the

Banca Ifis Group only, without considering the effects of

consolidation within the parent company, La Scogliera, amounted to

a CET1 ratio of 15,97%44 (compared with 15,47% at 31 December

2020), a TIER1 ratio of 15,99%54 (15,49% at 31 December 2020) and a

Total Capital ratio of 20,51%4 (compared with 19,87% at 31 December

2020).

In addition, please note that the Bank of Italy

has asked the Banca Ifis Group to satisfy the following

consolidated capital requirements in 2021, in continuity with 2020,

including a 2,5% capital conservation buffer:

- Common Equity Tier 1 (CET1) capital

ratio of 8,12%, with a required minimum of 5,62%;

- Tier 1 Capital Ratio of 10,0%, with

a required minimum of 7,5%;

- Total Capital

Ratio of 12,5%, with a required minimum of 10,0%.

At 31 March 2021, the Banca Ifis Group easily

met the above prudential requirements.

Significant events occurred in the

period

The Banca Ifis Group transparently and promptly

discloses information to the market, constantly publishing

information on significant events through press releases. Please

visit the "Investor Relations" and "Media" sections of the

institutional website www.bancaifis.it to view all press

releases.

Corporate reorganisation of the Group’s business

in the Npl SegmentOn 1 January 2021, the Npl Segment underwent a

corporate reorganisation with the creation of a vertical chain

aiming to guarantee the separation and independence of loan

acquisitions and collections. The Group’s business in the

Non-Performing Loans has therefore been reorganised into three

separate companies: Ifis Npl Investing, Ifis Npl Servicing and Ifis

Real Estate. The first acquires the portfolios, the second deals

with management and collection and Ifis Real Estate deals with the

real estate business, servicing the other two companies.

Resignation of Director Divo GronchiOn 14

January 2021, the Independent Director Divo Gronchi tendered his

resignation, with immediate effect, from the position of Director

and, consequently, member of the Company’s Appointments Committee

and Supervisory Body. Having acknowledged the resignation tendered

by Mr Gronchi, the Board of Directors resolved to replenish the

Appointments Committee members, choosing Monica Billio as new

member. The Board has also resolved to replenish the members of the

Bank’s Supervisory Body, appointing Beatrice Colleoni as new

member.

Agreement for the cessation of contracts with

Luciano ColombiniOn 11 February 2021, Chief Executive Officer

Luciano Colombini tendered his resignation, as already announced in

December 2020, from the role of Chief Executive Officer and the

position of director on the board of Banca Ifis, to embark on new

professional challenges. Mr Colombini ceased office upon conclusion

of the Shareholders' Meeting held on 22 April 2021.

On 11 February 2021, the Bank’s Board of

Directors therefore approved, with the opinion in favour given by

the Remuneration Committee and the Board of Auditors, an agreement

for the cessation of contracts with Luciano Colombini. This

agreement, which is in line with the Bank's approved Remuneration

Policy, establishes that Mr Colombini will be paid his remuneration

for the office of Chief Executive Officer until the date on which

he effectively leaves office, as well as the deferred components of

the bonus already accrued and recognised for FY 2019, which will be

paid in accordance with the terms and conditions of the

Remuneration Policy. In addition, at the date on which he leaves

office, Mr Colombini will receive severance indemnity equal to the

fixed and variable remuneration envisaged for the residual term of

the three-year mandate originally conferred upon him (12 months of

recurring remuneration), to be paid in accordance with the terms

and conditions of the Remuneration Policy (and, therefore, 50% in

financial instruments, with a deferral period, of a portion of 40%

of the indemnity, of 3 years, without prejudice, in any case, to

the application of the malus and clawback clauses). No

non-competition obligations are envisaged.

Banca Ifis has developed the first

securitisation in Italy of NPLs backed by assignment orders On 22

March 2021, Banca Ifis declared that for the purpose of a loan,

through the subsidiary Ifis Npl Investing, it had implemented the

very first securitisation in Italy of a non-performing portfolio

mainly comprising unsecured loans backed by assignment orders. The

transaction is an innovative solution for this type of

non-performing exposure, where the debt collection procedure

through compulsory enforcement (attachment of one fifth of the

salary) and is at an advanced stage. The transaction aimed to

collect funding for Ifis Npl Investing of up to 350 million Euro in

liquidity on the institutional market, without deconsolidating the

underlying credits. The loan portfolios concerned by the

transaction (a portfolio of secured loans and an unsecured

portfolio backed by assignment orders) owned by the subsidiary Ifis

Npl Investing, was transferred to a newly-established SPV called

IFIS NPL 2021-1 SPV S.r.l., which issued senior, mezzanine and

junior notes.

Significant subsequent

events

The Shareholders' Meeting has approved the 2020

financial statements. Geertman C.E.O.The Shareholders' Meeting of

Banca Ifis, which met on 22 April 2021 chaired by Sebastien Egon

Fürstenberg, approved the 2020 annual financial statements and the

distribution of a unitary gross dividend of 0,47 Euro per share,

deducted from own funds at 31 December 2020. The amount will be

payable starting 26 May 2021 with record date on 25 May 2021 and

ex-dividend date (no. 23) of 24 May 2021. The Shareholders' Meeting

confirmed Frederik Geertman as CEO, previously coopted as director

on 11 February 2021, and approved the proposal made by the majority

shareholder La Scogliera S.p.A. to appoint Monica Regazzi as new

independent director, to replace the resigning director Luciano

Colombini. The Board of Directors, which met at the end of the

Shareholders' Meeting, therefore appointed Frederik Geertman as

Chief Executive Officer of Banca Ifis, granting him the relevant

powers.

Verified the independence requirements of the

director Monica RegazziOn 13 May 2021, during the meeting the Board

verified the independence requirements, according to the criteria

set out in Legislative Decree no. 58/1998 and in the Corporate

Governance Code, of the director Monica Regazzi.

Declaration of the Corporate Accounting

Reporting Officer

Pursuant to article 154 bis, paragraph 2 of the

Consolidated Law on Finance, the Corporate Accounting Reporting

Officer, Mariacristina Taormina, declares that the financial

information contained in this press release corresponds to the

related books and accounting records.

|

Rosalba BenedettoDirector of Communications,

Marketing and External RelationsBanca Ifis S.p.A.Eleonora

VallinHead of the Press OfficeBanca Ifis S.p.A.M. +39 342

8554140Andrea NalonPress OfficeBanca Ifis S.p.A.M.

+39 335 8225211 |

Martino Da RioHead of IR and Corporate

DevelopmentBanca Ifis S.p.A.M. +39 02 24129953Cristina

Fossati, Luisella MurtasPress OfficeImage Building+ 39 02

89011300 |

Reclassified Financial Statements

Net credit risk losses of the Npl Segment were

reclassified to interest receivable and similar income to present

more fairly this particular business, for which net impairment

losses represent an integral part of the return on the

investment.

Reclassified Consolidated Statement of Financial

Position

|

ASSETS(in thousands of Euro) |

AMOUNTS AT |

CHANGE |

|

31.03.2021 |

31.12.2020 |

ABSOLUTE |

% |

|

Cash and cash equivalents |

88 |

82 |

6 |

7,3% |

|

Financial assets held for trading through profit or loss |

6.053 |

20.870 |

(14.817) |

(71,0)% |

|

Financial assets mandatorily measured at fair value through profit

or loss |

142.699 |

136.978 |

5.721 |

4,2% |

|

Financial assets measured at fair value through other comprehensive

income |

759.471 |

774.555 |

(15.084) |

(1,9)% |

|

Receivables due from banks measured at amortised cost |

1.080.307 |

1.083.281 |

(2.974) |

(0,3)% |

|

Receivables due from customers measured at amortised cost |

9.032.139 |

9.135.402 |

(103.263) |

(1,1)% |

|

Property, plant and equipment |

116.564 |

115.149 |

1.415 |

1,2% |

|

Intangible assets |

61.043 |

60.970 |

73 |

0,1% |

|

of which goodwill |

38.787 |

38.798 |

(11) |

(0,0)% |

|

Tax assets: |

374.264 |

381.431 |

(7.167) |

(1,9)% |

|

a) current |

65.742 |

74.255 |

(8.513) |

(11,5)% |

|

b) deferred |

308.522 |

307.176 |

1.346 |

0,4% |

|

Other assets |

268.582 |

317.478 |

(48.896) |

(15,4)% |

|

Total assets |

11.841.210 |

12.026.196 |

(184.986) |

(1,5)% |

|

LIABILITIES AND EQUITY(in thousands of

Euro) |

AMOUNTS AT |

CHANGE |

|

31.03.2021 |

31.12.2020 |

ABSOLUTE |

% |

|

Payables due to banks measured at amortised cost |

2.251.098 |

2.367.082 |

(115.984) |

(4,9)% |

|

Payables due to customers measured at amortised cost |

5.526.263 |

5.471.874 |

54.389 |

1,0% |

|

Debt securities issued measured at amortised cost |

1.957.906 |

2.069.083 |

(111.177) |

(5,4)% |

|

Financial liabilities held for trading |

8.158 |

18.551 |

(10.393) |

(56,0)% |

|

Tax liabilities: |

52.524 |

48.154 |

4.370 |

9,1% |

|

a) current |

15.619 |

12.018 |

3.601 |

30,0% |

|

b) deferred |

36.905 |

36.136 |

769 |

2,1% |

|

Other liabilities |

406.769 |

438.311 |

(31.542) |

(7,2)% |

|

Post-employment benefits |

8.747 |

9.235 |

(488) |

(5,3)% |

|

Provisions for risks and charges |

58.080 |

53.944 |

4.136 |

7,7% |

|

Valuation reserves |

(19.065) |

(19.337) |

272 |

(1,4)% |

|

Reserves |

1.390.274 |

1.320.871 |

69.403 |

5,3% |

|

Share premiums |

102.555 |

102.491 |

64 |

0,1% |

|

Share capital |

53.811 |

53.811 |

- |

0,0% |

|

Treasury shares (-) |

(2.948) |

(2.948) |

- |

0,0% |

|

Equity attributable to non-controlling interests (+/-) |

26.916 |

26.270 |

646 |

2,5% |

|

Profit (loss) for the period (+/-) |

20.121 |

68.804 |

(48.683) |

(70,8)% |

|

Total liabilities and equity |

11.841.210 |

12.026.196 |

(184.986) |

(1,5)% |

Reclassified Consolidated Income Statement

|

ITEMS(in thousands of Euro) |

PERIOD |

CHANGE |

|

31.03.2021 |

31.03.2020 |

ABSOLUTE |

% |

|

Net interest income |

115.827 |

91.416 |

24.411 |

26,7% |

|

Net commission income |

18.767 |

21.097 |

(2.330) |

(11,0)% |

|

Other components of net banking income |

3.135 |

(6.561) |

9.696 |

(147,8)% |

|

Net banking income |

137.729 |

105.952 |

31.777 |

30,0% |

|

Net credit risk losses/reversals |

(16.102) |

(18.512) |

2.410 |

(13,0)% |

|

Net profit (loss) from financial activities |

121.627 |

87.440 |

34.187 |

39,1% |

|

Administrative expenses: |

(86.234) |

(72.549) |

(13.685) |

18,9% |

|

a) personnel expenses |

(33.779) |

(32.029) |

(1.750) |

5,5% |

|

b) other administrative expenses |

(52.455) |

(40.520) |

(11.935) |

29,5% |

|

Net allocations to provisions for risks and charges |

(7.421) |

(4.889) |

(2.532) |

51,8% |

|

Net impairment losses/reversals on property, plant and equipment

and intangible assets |

(4.413) |

(4.039) |

(374) |

9,3% |

|

Other operating income/expenses |

6.800 |

7.978 |

(1.178) |

(14,8)% |

|

Operating costs |

(91.268) |

(73.499) |

(17.769) |

24,2% |

|

Gains (Losses) on disposal of investments |

- |

24.161 |

(24.161) |

(100,0)% |

|

Pre-tax profit (loss) from continuing

operations |

30.359 |

38.102 |

(7.743) |

(20,3)% |

|

Income taxes for the period relating to continuing operations |

(9.590) |

(11.660) |

2.070 |

(17,8)% |

|

Profit (loss) for the period |

20.769 |

26.442 |

(5.673) |

(21,5)% |

|

Profit (Loss) for the period attributable to non-controlling

interests |

648 |

16 |

632 |

n.s. |

|

Profit (loss) for the period attributable to the Parent

Company |

20.121 |

26.426 |

(6.305) |

(23,9)% |

Own funds and capital adequacy ratios

|

OWN FUNDS AND CAPITAL ADEQUACY RATIOS(in

thousands of Euro) |

AMOUNTS AT |

|

31.03.2021 |

31.12.2020 |

|

Common Equity Tier 1 Capital (CET1) |

1.051.021 |

1.038.715 |

|

Tier 1 Capital (T1) |

1.105.665 |

1.091.858 |

|

Total Own Funds |

1.382.291 |

1.366.421 |

|

Total RWAs |

8.932.891 |

9.203.971 |

|

Common Equity Tier 1 Ratio |

11,77% |

11,29% |

|

Tier 1 Capital Ratio |

12,38% |

11,86% |

|

Ratio – Total Own Funds |

15,47% |

14,85% |

Common Equity Tier 1, Tier 1 Capital, and Total

Own Funds at 31 March 2021 do not include the profits generated by

the Banking Group in the first three months of 2021.

|

OWN FUNDS AND CAPITAL ADEQUACY

RATIOS:BANCA IFIS BANKING GROUP

SCOPE(in thousands of Euro) |

AMOUNTS AT |

|

31.03.2021 |

31.12.2020 |

|

Common Equity Tier 1 Capital (CET1) |

1.425.407 |

1.422.796 |

|

Tier 1 Capital (T1) |

1.427.184 |

1.424.610 |

|

Total Own Funds |

1.829.995 |

1.827.409 |

|

Total RWAs |

8.923.965 |

9.194.733 |

|

Common Equity Tier 1 Ratio |

15,97% |

15,47% |

|

Tier 1 Capital Ratio |

15,99% |

15,49% |

|

Ratio – Total Own Funds |

20,51% |

19,87% |

Common Equity Tier 1, Tier 1 Capital, and Total

Own Funds at 31 March 2021 do not include the profits generated by

the Banking Group in the first three months of 2021.

1 Net credit risk losses of the Npl Segment were

entirely reclassified to Interest receivable and similar income to

present more fairly this particular business, as they represent an

integral part of the overall return on the investment.2

Consolidated own funds, risk-weighted assets and solvency ratios at

31 March 2021 were calculated based on the regulatory principles

set out in Directive 2013/36/EU (CRD IV) and Regulation (EU)

575/2013 (CRR) of 26 June 2013, as updated and amended over time

and transposed, where applicable, in the Bank of Italy's Circulars

no. 285 and no. 286 of 17 December 2013. In particular, the CRR

provides for the prudential consolidation of Banca Ifis in the

holding La Scogliera. For the sake of disclosure, we calculated the

same indicators without including the effects of the consolidation

within La Scogliera. Therefore, the reported total own funds refer

only to the scope of the Banca Ifis Banking Group, as defined in

accordance with Italian Legislative Decree no. 385/93, thus

excluding the effects of the prudential consolidation within the

parent company La Scogliera S.p.A.1 Net credit risk losses of the

Npl Segment were entirely reclassified to Interest receivable and

similar income to present more fairly this particular business, as

they represent an integral part of the overall return on the

investment.3 The term “PPA reversal” refers to the reversal over

time of the difference between the fair value as measured in the

business combination and the carrying amount of the receivables of

the former GE Capital Interbanca Group, acquired on 30 November

2016.4 Common Equity Tier 1, Tier 1 Capital, and Total Own Funds at

31 March 2021 do not include the profits generated by the Banking

Group in the first three months of 2021.

- 20210513_Banca Ifis net profit for the quarter comes to 20,1

million Euro_EN

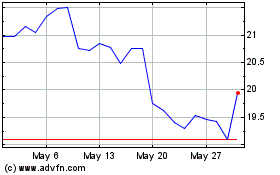

Banca IFIS (BIT:IF)

Historical Stock Chart

From Oct 2024 to Nov 2024

Banca IFIS (BIT:IF)

Historical Stock Chart

From Nov 2023 to Nov 2024