Bitcoin Attempt To Dip Below $96K ‘Led To Nothing’ – Analyst Expects $100K Soon

26 November 2024 - 2:30AM

NEWSBTC

Bitcoin has been on a remarkable upward trajectory, pushing above

the $96,000 mark for several days after consolidating below the

psychological $100,000 level. As the leading cryptocurrency,

Bitcoin has consistently broken all-time highs over the past three

weeks, with yesterday marking a milestone weekly close at

$98,000—the highest in its history. Related Reading: XRP

Analyst Sets $2 Target If It Holds Key Level – Can It Reach

Multi-Year Highs? CryptoQuant analyst Axel Adler shared an

insightful analysis on X, emphasizing that Bitcoin’s recent attempt

to dip below $95,000 met with significant resistance, reinforcing

the strength of current support levels. According to Adler, the

market is now poised for a critical test of the $100,000 mark, a

barrier that could catalyze further bullish momentum or signal a

short-term consolidation phase. With Bitcoin’s bullish trajectory

showing no signs of slowing, traders and investors are closely

watching for a breakout above $100,000. Such a move could ignite

broader market optimism and drive renewed interest in altcoins,

potentially shaping the next phase of the crypto market’s growth.

However, failure to break above this key level might trigger a

healthy correction, setting the stage for a more sustainable rally.

Bitcoin Price Action Remains Strong Bitcoin’s price action has

remained exceptionally bullish despite a recent retrace from

$99,800 to $95,800—a minor dip of less than 4%. Investors widely

see this pullback as a brief consolidation phase before a potential

breakout above the pivotal $100,000 mark. The resilience

demonstrated during this retrace has bolstered confidence among

market participants, with many viewing it as a healthy pause in an

ongoing uptrend. Renowned CryptoQuant analyst Axel Adler weighed in

on the recent market movements via X, sharing a technical analysis

that reinforces Bitcoin’s robust bullish structure. Adler

highlighted that pushing BTC to lower demand levels was

unsuccessful, further solidifying current support zones.

According to his insights, the stage is now set for Bitcoin to

finally test the critical $100,000 area and gauge the market’s

reaction at this psychological threshold. As BTC approaches this

milestone, investor sentiment appears divided. Many traders view

the $100,000 level as an ideal price to begin taking profits,

citing historical patterns of pullbacks after significant

round-number milestones. Related Reading: Avalanche Soars 20%

In 24 Hours – Analyst Reveals Next Price Target However, others

remain optimistic about Bitcoin’s continued strength, forecasting a

potential surge beyond $100,000. Predictions for the rally’s peak

range between $105,000 and $120,000, reflecting a broader belief in

the cryptocurrency’s long-term potential. Whether Bitcoin

consolidates or continues climbing, all eyes remain on its next

moves. Bullish Weekly Close Could Send BTC Higher Bitcoin has

achieved its highest weekly close in history, recording an

impressive $98,000. This milestone is a technical achievement and a

critical psychological boost for market participants. It signals a

strong bullish environment that could soon propel Bitcoin above the

coveted $100,000 mark. The $98,000 level now serves as a robust

support zone, and maintaining this price—or at least staying above

$95,000—in the coming days will be pivotal. A breakout above these

levels could propel Bitcoin towards $100,000 with significant

momentum. Such a move would solidify Bitcoin’s uptrend and attract

further interest from retail and institutional investors. Related

Reading: Massive Ethereum Buying Spree – Taker Buy Volume hits

$1.683B In One Hour However, continued consolidation below $100,000

remains a possibility. Bitcoin may take several weeks of sideways

movement to gather the strength needed for the next leg up. While

potentially frustrating for short-term traders, this consolidation

phase would provide a healthy foundation for sustainable

growth. Featured image from Dall-E, chart from TradingView

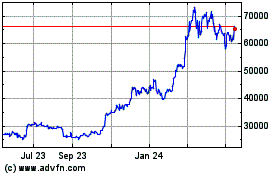

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

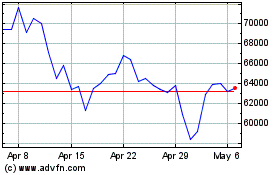

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024