Not Time To Buy Yet? Bitcoin Faces Pressure As Standard Chartered Predicts Further 10% Drop

26 February 2025 - 2:30PM

NEWSBTC

Earlier this morning, Bitcoin (BTC) hit a yearly low of $86,888

amid a broader market downturn. According to data from CoinGlass,

the crypto market sell-off led to over $1.5 billion in liquidations

in the past 24 hours, impacting 394,944 traders. More Downside For

Bitcoin? After trading in the mid-$90,000 range for several weeks,

BTC crashed to $86,888 on the Binance cryptocurrency exchange,

marking its lowest point this year. The premier cryptocurrency is

down 7.6% in the last 24 hours. Related Reading: As Bitcoin Sell

Pressure Fades, Could A Local Bottom Be Forming? Analyst Explains

Similarly, other major cryptocurrencies have suffered sharp

declines. Ethereum (ETH) is down 10.5%, XRP has dropped 14.5%, and

Solana (SOL) has plummeted 18.2% in the past 24 hours. Meanwhile,

the total crypto market cap has shrunk by 9%, tumbling from $3.3

trillion to $3.01 trillion over the same period. Despite the sharp

market pullback, the worst may not be over for BTC just yet.

According to Geoff Kendrick, Global Head of Digital Assets Research

at Standard Chartered, Bitcoin could still see further losses.

Kendrick noted that while BTC has performed “relatively well,” the

flagship cryptocurrency remains caught in a broader market

sell-off, partly driven by Solana-based meme coins. He warned that

another 10% decline may be on the horizon, potentially pushing

Bitcoin’s price down to the low $80,000s. Macroeconomic Uncertainty

Weighs On Crypto Further, Kendrick emphasized that although a

decline in US Treasury yields could eventually benefit BTC, the

large outflows from Bitcoin spot exchange-traded funds (ETFs)

suggest that “it is not time to buy yet.” In addition to the crypto

market downturn, US President Donald Trump reiterated yesterday

that his proposed trade tariffs on Canada and Mexico are set to

take effect on March 4. As a result, the equity market is expected

to open lower today, adding further pressure to risk assets like

cryptocurrencies. The uncertainty in equity markets is expected to

spill over into the digital assets sector, potentially leading to

deeper pullbacks for cryptocurrencies. At the time of writing, the

Crypto Fear and Greed Index has dropped to a five-month low of 25,

signaling “extreme fear” in the market. Bitcoin’s recent price

breakdown aligns with an earlier forecast by seasoned crypto

analyst Ali Martinez, who predicted that if BTC broke below

$93,400, it could experience significant volatility. Related

Reading: Bitcoin Price Forecast Of $150,000 ‘Too Low’ Amid Rising

Adoption, Crypto Trader Says Beyond the recent price action, other

warning signs for BTC indicate that reduced network activity could

signal waning overall interest in the asset class. However, despite

these headwinds, Bitcoin continues to outperform traditional asset

classes like gold and stocks. That said, many industry leaders

remain bullish on Bitcoin, viewing the current macroeconomic

environment as a “generational opportunity” to accumulate BTC. At

press time, BTC trades at $88,150, down 7.6% in the past 24 hours.

Featured image from Unsplash, Chart from TradingView.com

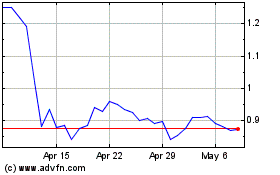

Flow (COIN:FLOWUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Flow (COIN:FLOWUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025