Chainlink (LINK) Could Drop To $8 If It Loses Current Support: On-Chain Data Reveals

29 August 2024 - 9:00PM

NEWSBTC

Chainlink (LINK) has faced significant volatility this week. Its

price dropped over 13% from Monday’s high, bringing LINK to a

critical support level of around $11.20. Traders and investors are

closely monitoring this crucial area. Related Reading: LINK Surges

11% As Key Data Reveals Day Traders Are Locking Gains The

importance of this level is further emphasized by on-chain data

from Santiment, which shows that demand for LINK is cooling off.

This adds to the uncertainty surrounding the asset’s near-term

price action. The next few days will be pivotal as Chainlink hovers

around this crucial support. The outcome here could determine

whether LINK stabilizes and regains its footing or faces further

downside. This level will likely set the stage for LINK’s next

major move, making it a critical point of interest for market

participants. Chainlink Demand Cooling Off? Uncertainty and

fear are currently driving market sentiment for Chainlink (LINK).

Its price is testing a crucial support level amid declining demand.

On-chain data from Santiment highlights a weakening market. A

negative price-daily active address (DAA) divergence confirms the

recent decline in LINK’s demand. This metric compares an asset’s

price movements with the changes in its number of daily active

addresses, providing insight into whether network activity backs

the price action. Currently, LINK’s price DAA divergence

stands at -61.2%. This indicates a significant disconnect between

its price and the number of active users on the network. Such a

substantial negative divergence suggests a weakening market and

hints at the possibility of further price declines. Related

Reading: Ethereum (ETH) Eyes $3,000: Data Suggests Imminent

Breakout The lack of network activity to support the current price

level raises concerns. Traders and investors are worried that LINK

might struggle to maintain its position above the crucial $11.20

support. If demand does not pick up soon, LINK could face

additional downward pressure, possibly leading to a deeper

correction in the coming days. LINK Price Action Shows Indecision

Chainlink is trading at $11.22 after losing its 4-hour 200 moving

average (MA). This critical indicator now acts as low-timeframe

resistance. This development has placed LINK in a precarious

position, with the immediate support level being the $10.91 low

marked on Tuesday. Holding above this level is essential for

maintaining the possibility of a continued uptrend. If LINK

sustains this support, the price could enter a period of sideways

consolidation, setting the stage for a potential push toward local

highs in the coming week. However, LINK may face further downside

pressure if it fails to hold the $10.91 support. Key levels to

monitor include $9.50 and the $8.12 local low. A breakdown below

these levels could signal a deeper correction, potentially leading

to a bearish trend. Related Reading: XRP Remains Strong Despite

Market Pullback: Analyst Forecasts $500 By 2025 On the other hand,

holding above $10.91 could provide the foundation for recovery.

This could allow LINK to re-test higher resistance levels and

possibly continue its uptrend. Traders and investors are closely

watching these price levels to determine LINK’s next move.

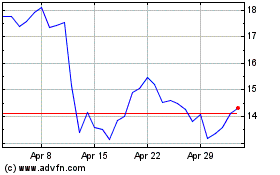

ChainLink Token (COIN:LINKUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

ChainLink Token (COIN:LINKUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024