Why This Signal Means Uniswap’s Bear Run Is Almost Over

27 May 2023 - 5:00AM

NEWSBTC

The price of Uniswap, the largest decentralized exchange by trading

volume, is down roughly 35% from Q1 2023 peaks. Even so, on-chain

data from Etherscan shows that there has been a steady

increase in the number of UNI holders in the past two days. As of

May 13, there were 369,646 UNI holders. Since then, the number has

increased to over 370,100 as of May 26. During this time, UNI

prices have remained stable but relatively high. Based on the

UNIUSDT chart, the prices have found support around $4.9. However,

prices have increased by approximately 10% over the past two weeks,

rising to $5.4. Although the number of UNI holders may not directly

affect the prices, there is a clear correlation between the demand

for UNI and the increase in token prices. Related Reading: Toncoin

(TON) Continues Downward Trend As Bears Maintain Control Several

factors could have provided tailwinds for UNI, the governance token

of Uniswap. Apple Jail Break On May 23, Uniswap’s mobile

wallet was released from what Uniswap Labs, the team

maintaining Uniswap, said was “Apple jail.” With this

jailbreak, users can download the Uniswap Wallet, that’s

non-custodial like MetaMask. Through this wallet, users can

buy and sell various supported cryptocurrencies. This

announcement is bullish because as more users opt for Uniswap

Wallet, the demand for the decentralized exchange could rise,

increasing its dominance and stature. While MetaMask remains

the most dominant Ethereum and Ethereum Virtual Machine (EVM)

wallet enabling the storing and trading of various tokens, even

using processors like PayPal, the popularity of Uniswap could see

Uniswap Wallet gnaw market share. Presently, Uniswap Labs

said their wallet could support the trading of tokens across

Ethereum, Polygon, Optimism, and Arbitrum. Uniswap To Launch On

Base? Earlier on, the Uniswap contributors proposed the

deployment of the DEX v3 on Coinbase’s Base. Among supporters

of this proposal is GFX Labs, one of the largest UNI holders and

supporters of Uniswap’s expansion to other chains. Recently, GFX

Labs voted for the launch of the DEX on BNB Smart Chain (BSC) and

MoonBeam. Even so, before voting starts, the proposal will

undergo a “temperature check-up” to gauge community support. If

there is majority support, it will proceed to the next step.

Uniswap v3 is the latest iteration of the DEX, introducing the

concept of concentrated liquidity for higher capital efficiency and

more return on investment (ROI) for liquidity providers. Base

is a layer-2, open-source, and EVM-compatible platform by Coinbase,

one of the largest cryptocurrency exchanges. Related Reading:

JPMorgan Predicts Bitcoin (BTC) To Revisit $45,000, Here’s Why It

is unclear whether the above-spurred demand for UNI, pushed the

number of holders higher in the last week. However, this

could suggest that the project is generating interest, which may

support future token prices. Feature Image From Canva, Chart From

TradingView

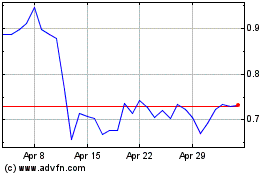

Polygon (COIN:MATICUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Polygon (COIN:MATICUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024