PEPE Struggles Against Strong Resistance, Bearish Pressure Intensify

07 February 2025 - 1:00AM

NEWSBTC

PEPE price is facing renewed bearish pressure as it struggles to

break above the critical $0.00001152 resistance level. The recent

failure to push higher has left the token consolidating, hinting at

a possible downward move if buyers fail to regain control. With

market sentiment tilting in favor of the bears, traders are bracing

for what could be another wave of selling. If bulls cannot generate

enough momentum, PEPE may slip further, testing lower support zones

in the coming sessions. The battle between buyers and sellers at

this level will be crucial in determining the token’s next major

move. PEPE Consolidation Near Resistance: A Breakdown Or Rebound?

Pepe’s price action remains trapped in a consolidation phase just

below a crucial resistance level, indicating market indecision. Its

recent failed breakout attempt highlights the strength of sellers

in this zone, preventing bullish momentum from taking over. As the

price struggles to push higher, the risk of a potential breakdown

increases, especially if bearish pressure intensifies.

Related Reading: PEPE Recovery Hits A Wall: Can Bulls Smash Through

$0.00001313? The price continues to trade below the 4-hour Simple

Moving Average (SMA), reflecting that the meme coin is still under

negative pressure. This price action suggests that the market

sentiment remains tilted toward the downside, as the failure to

break above the SMA highlights a lack of buying strength.

Furthermore, the Relative Strength Index (RSI) is trending below

the 50% threshold, further supporting the bearish outlook. Usually,

the RSI’s position below this key level indicates that the selling

pressure is currently stronger than the buying, with the market

leaning more toward the downside. Further downward movement remains

high until the price can break through the 4-hour SMA and the RSI

sustains a move below the 50% key level. Crucial Support Zones In

Focus As Selling Pressure Rises With selling pressure mounting in

the market, $0.00000766 is the initial support level to watch.

Historically, this level has proven to be a critical price point,

acting as a psychological and technical barrier. If the price can

maintain above this level, it could signal that buyers are still

holding the line, offering a potential for stabilization or even a

rebound. Related Reading: PEPE Marks Bottom After Scary Market

Crash, Enters Wave 3 With Over 500% Promise Should selling pressure

persist, the $0.00000589 mark will be the next key area to watch.

This support level represents a deeper point of defense for PEPE,

and its ability to hold might be crucial for preventing a more

significant downturn. A drop below $0.00000589 would be concerning,

as it can expose the price to a possible extension of the bearish

trend, causing traders to reevaluate their positions. However, if

the price remains above the $0.00000766 level, it may pave the way

for a surge toward the $0.00001152 resistance level as buyers

remain in control. A break above this level points to further

gains, with the price targeting $0.00001313 and moving above the

100-day SMA. Featured image from Adobe Stock, chart from

Tradingview.com

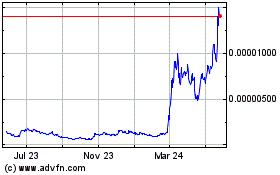

Pepe (COIN:PEPEUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

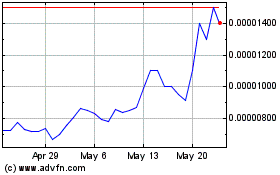

Pepe (COIN:PEPEUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025