Bitcoin Funding Rates Touch Same Level As Early September, More Correction To Come?

27 October 2021 - 6:00AM

NEWSBTC

Data shows Bitcoin funding rates right now are at the same level as

they were in early September. This means the coin may see another

flush out similar to how it happened back then. Bitcoin Funding

Rates Float Around Similar Levels To Early September As per this

week’s on-chain report from Glassnode, the BTC futures perpetual

funding rate of all exchanges is currently at the level similar to

what it was back in early September before the crash. The “funding

rates” is an indicator that shows the premium that traders have to

pay each other while holding on to their positions in the perpetual

swap futures markets. When the metric has negative values, it means

that short traders are paying longs, and that many traders are

bearish on Bitcoin right now. Opposite to that, positive funding

rates imply that the overall market sentiment is leaning towards

bullish and longs are currently paying shorts to keep their

positions. Related Reading | BTC Holders Reduce Spending, Why

Bitcoin Could Get More Rocket Fuel Now, here is a chart that

highlights the trend in the value of the indicator over the last

six months: Looks like the metric is currently showing highly

positive values | Source: Glassnode's The Week On-Chain, Week 43 As

the above graph shows, when Bitcoin made its new all-time high

(ATH) some days ago, the indicator reached positive local highs.

This means traders started opening many leveraged long positions so

that they don’t miss out on the wave of BTC making new ATHs.

Related Reading | On-Chain Data Shows Surge In Stablecoins

Supply Pouring Into Bitcoin However, the price had a correction,

which has often been the case during periods of high leverage, and

a lot of the excess leverage was flushed out. Nonetheless, the

funding rates are still at similarly high levels right now as in

early September. What followed then was the El Salvador crash that

took the rates to negative values. It’s possible another correction

can take place now in order to flush out more of the currently high

leverage in the market. Though it’s not a certainty that it will be

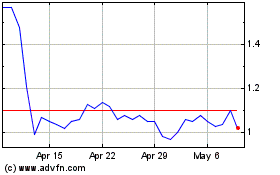

how it plays out. BTC Price At the time of writing, Bitcoin’s price

floats around $62.5k, down 0.4% in the last seven days. Over the

past month, the crypto has gained 44% in value. The below chart

shows the trend in the price of the crypto over the last five days.

BTC's price seems to be recovering somewhat from the dip | Source:

BTCUSD on TradingView Over the last few days, Bitcoin has shown

some effort to bounce back from the correction, but in the last

couple of days, the crypto has only moved rather sideways. If the

futures funding rates are anything to go by, the market may be

heading towards another correction soon that will wipe out the

excess leverage. Featured image from Unsplash.com, charts from

TradingView.com, Glassnode.com

Perpetual (COIN:PERPUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Perpetual (COIN:PERPUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about Perpetual (Cryptocurrency): 0 recent articles

More Perpetual News Articles