Monero And Zcash Take Off With 15% Gains, Here’s What May Have Spurred The Rally

10 March 2022 - 5:00AM

NEWSBTC

Privacy coins, Zcash (ZEC) and Monero (XMR), have been

outperforming larger cryptocurrencies in the last 24 hours. The

sudden surge on the price of these cryptocurrencies seems to be

responding to recent developments around the Russia-Ukraine

conflict, and the signed of an executive order from the U.S. Joe

Biden administration. Related Reading | Monero (XMR) Price

Slides As Canada Includes Crypto In Emergencies Act At the time of

writing, Zcash (ZEC) records a 11.7% profit trading at $142, while

Monero (XMR) records a 15.5% profit trading at $195. These

cryptocurrencies have been following the general sentiment in the

crypto market flipping towards a more positive stands as Bitcoin

breaks above $41,000. Zcash And Monero React To A FED Coin As

mentioned, the U.S. President Joe Biden has signed an executive

order which has surprise for its positive approach to

cryptocurrencies and digital assets. As the war between Russia and

Ukraine ranges on, the International Community has quickly imposed

financial sanctions of Putin, the Russian elite, and its banking

system. As Coin Center’s Executive Director Jerry Brito said,

mainstream media have been pushing a negative narrative around

cryptocurrencies. Classifying them as “dangerous”, and with the

potential to allow Russia to evade sanctions. Fortunately, some

U.S. government officials have also look at the other side of the

coin. The core message in this executive order, as Brito said, is a

serious acknowledgment from the U.S. Federal Government of

cryptocurrencies as legitimate assets. The crypto market seems to

have gotten used to negative or nothing messages from the U.S.,

thus, why this news could have been translated into a relief rally.

Jake Chervinsky, Head of Policy at the Blockchain Association,

commented the following on Biden’s executive order and why it has

been perceived as bullish by market participants: Anyone worried

that President Biden’s executive order would spell doom & gloom

for crypto can fully relax now. The main concern was that the EO

might force rushed rulemaking or impose new & bad restrictions,

but there’s nothing like that here. It’s about as good as we could

ask. In addition to the total surge in cryptocurrencies, privacy

coins like Zcash and Monero seem to have benefited from the shift

in narrative. The executive order also contemplates the creation of

a U.S. Central Bank Digital Currency (CBDC). This assets have been

perceived as the oppositive of Bitcoin, Zcash, and Monero. Rather

than give individuals power over their finances, they seem to

provide governments with absolute control and oversight on the

national currency. Thus, why some investors might have decided to

increase their ZEC and XMR holdings. POTUS: “My Administration

places the highest urgency on research and development efforts into

the potential design and deployment options of a United States

CBDC” FedCoin 🚨 Worth noting this entire executive order on digital

assets is heavy on CBDCs, doesn’t mention Bitcoin

pic.twitter.com/PuXtVI34hD — Alex Gladstein 🌋 ⚡ (@gladstein) March

9, 2022 Privacy About To Gain More Relevance? Other privacy coins

have seen a similar rally with Dash (DASH) recording a 12.8%

increase over the past day. Oasis Network (ROSE), Secret (SCRT),

Horizen (ZEN), and Keep Network (KEEP) averaging a similar profit

during the same period. In low timeframes, data from Material

Indicators suggest retail investors have been leading ZEC and XMR

rallies. Investors with bid order of around $100 injected close to

$1 billion in liquidity for the ZEC/USDT trading pair. Related

Reading | Monero (XMR) Readies For A Breakout As It Touches

Important Milestone The XMR/USDT trading pair has seen a similar

story. Retail investors are also leading the rally in lo

timeframes.

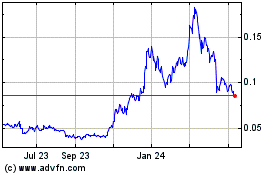

Oasis Network (COIN:ROSEUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

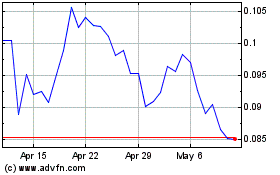

Oasis Network (COIN:ROSEUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024