Polkadot Dev’t Activity Up In Last 7 Days, Despite Steady Drop In DOT Price

27 August 2022 - 4:09PM

NEWSBTC

As the price drops to $7.55, the Polkadot (DOT) price analysis

suggests that the trend is still bearish. Polkadot price analysis

reveals a downward trend DOT/USD has looked for support at roughly

$7.49 DOT/USD is encountering resistance at $7.74 Previously

trading at about $7.74, Polkadot is now looking for support at

about $7.49. The price of DOT/USD is still facing resistance at

$7.74, but if it drops below $7.49, it might find support at $7.32.

and $7.05. If it declines below that, it might find support there.

Around these levels, Polkadot might feel some selling pressure, but

if it manages to hold above $7.49, it might start to see some

buying interest. The fact that DOT has a multitude of

parachains underpinning its decentralized web goals has helped it

to stay relevant in the cryptocurrency ecosystem. According to data

by Coingecko, DOT is trading at $6.93, down 5.5% in the last seven

days. Santiment data shows that after August 20, DOT’s development

activities spiked dramatically. Its price, however, has not held up

so well, falling by 11.31 percent over the past week. Polkadot

Announces Deployment Of New Parachains The multichain network has

shown that the Polkadot architecture is not as constricted as many

people may have thought. More so, Polkadot recently announced the

deployment of many new blockchains with ParityTech. The declaration

states that new parachains will be implemented to enable

organization. If these parachains are successfully activated, the

Polkadot community will be able to govern without having to wait

forever for approval from outside parties. Has DOT’s position

improved as a result? Related Reading: Shiba Inu Burn Events Spark

A Rally In Altcoin Over The Past Weeks Although the short-term

outlook for the DOT/USD market appears to be bearish, a breach from

the current consolidation range could see the market move in the

direction of the $8.00 level soon. The signal line is moving above

the candlesticks, which means the MACD indicator is currently in a

bearish zone. At 47.75, the RSI indicator for the DOT/USD is

approaching oversold territory, suggesting that bulls may soon

stage a recovery. The market is currently in a condition of

consolidation as the upper Bollinger Band is at $8.19 and the lower

Bollinger Band is at $7.51. DOT/USD Price Continues Its Bearish

Streak DOT/USD 4-hour price chart: Prices are anticipated to

continue declining. According to the DOT price research 4-hour

price chart, the market has been in a bearish trend over the past

four hours. A move towards $8.00 had been made by the market, but

it was swiftly rejected at approximately the $7.85 mark. Chart:

TradingView.com The market is currently consolidating, and if it

were to break out of its current range, it might soon go in one of

two directions: toward $8.00 or $7.32. The likelihood that DOT

would surpass its present levels increased as long as the buyer’s

momentum maintained its advantage over the seller scenario. The

Polkadot network’s current parachains appear to be at their best,

despite the lack of obvious rally indicators. These performances,

according to PolkadotInsider, have attracted investors’ attention.

Investors can infer from these measures that DOT may be

experiencing increased interest and momentum. Related Reading:

Bitcoin Price Watch: BTC Facing Renewed Challenge To Keep Price

Above $20,000 DOT total market cap at $7.63 billion on the weekend

chart | Source: TradingView.com Featured image from Money24H, chart

from TradingView.com

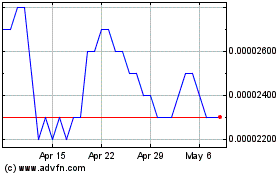

SHIBA INU (COIN:SHIBUSD)

Historical Stock Chart

From Jun 2024 to Jul 2024

SHIBA INU (COIN:SHIBUSD)

Historical Stock Chart

From Jul 2023 to Jul 2024