Ethereum Could See a 53% Price Correction If This Happens—Analyst

11 October 2024 - 9:00AM

NEWSBTC

Ethereum has been experiencing sluggishness in its price

performance recently, as the cryptocurrency continues to closely

follow Bitcoin’s movements. Currently trading at $2,392, Ethereum

is down 1.5% in the past 24 hours, adding to its gradual decline in

recent days. This drop follows a brief price surge last week, where

Ethereum saw a slight surge to above $2,600. Despite the minor

increase, Ethereum remains down by 51% from its all-time high of

$4,878, recorded in 2021. Related Reading: Ethereum Price Retests

$2,350: Is a Bounce In The Cards? Ethereum Potential To Fall 53%

The sideways movement in Ethereum’s price has left traders

cautious. Amid this, renowned crypto analyst Ali has offered his

perspective on Ethereum’s current trajectory in a recent post on X.

Ali pointed out that Ethereum’s price action tends to follow a

particular pattern based on TD Sequential indicators. He explained

that whenever Ethereum breaks above the TD setup resistance

trendline, a strong bull run often ensues. However, when Ethereum

dips below the TD setup support trendline, it typically results in

a significant price correction. According to Ali, Ethereum is

nearing a critical support level of $2,250, warning that if this

support is breached, it could trigger a major price drop. Ali

further emphasized that ETH has previously seen an average of 53%

corrections following similar breakdowns, suggesting that losing

the $2,250 level could spell trouble for the cryptocurrency. Each

time #Ethereum breaks above the TD setup resistance trendline 🔴, a

strong bull run follows. But when $ETH breaks below the TD setup

support trendline 🟢, we’ve seen an average 53% correction. The key

support now is $2,250—losing it could trigger a significant price

drop. pic.twitter.com/PljkRda78S — Ali (@ali_charts) October 10,

2024 On The Flip Side While Ali expresses concern over Ethereum’s

potential for a significant downturn, other analysts remain

optimistic about its long-term potential. A crypto analyst going by

the name EtherNasYoNAL on X recently shared a bullish outlook for

ETH, suggesting that the cryptocurrency could be on the verge of

entering a new “mega bull” cycle. According to the analyst, ETH is

currently in the final stages of what they describe as a “retest

and accumulation process.” This phase is reminiscent of Ethereum’s

price movements in 2020, where it underwent a similar process

before the 2021 mega bull run. The analyst added that Ethereum’s

price action in the months of August, September, and October 2020

followed a specific pattern, with accumulation and retests before

the asset saw a significant rise. Related Reading: Standard

Chartered Analysts Says Ethereum Price Will Reach $10,000 If This

Happens EtherNasYoNAL believes Ethereum is currently mirroring this

process and is poised to enter another mega bull cycle, expected to

occur around 2025. Despite the current decline, the analyst remains

confident that Ethereum’s long-term trajectory is still bullish,

encouraging investors to remain patient and await the expected

price surge. #Ethereum winks at the 2025 mega bull! Before the 2021

mega bull, we witnessed the retest and accumulation process in

August, September and October 2020.$ETH is in the final stage of

the retest and accumulation process in August, September and

finally October before the 2025… pic.twitter.com/VsE36le746 —

EᴛʜᴇʀNᴀꜱʏᴏɴᴀL 📈 (@EtherNasyonaL) October 9, 2024 Featured image

created with DALL-E, Chart from TradingView

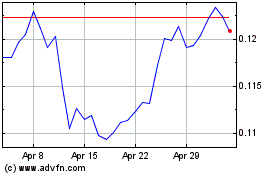

TRON (COIN:TRXUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

TRON (COIN:TRXUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024