Cardano Consolidates Within A Symmetrical Triangle – Expert Sees A 40% Move Once It Breaks

01 February 2025 - 2:30AM

NEWSBTC

Cardano (ADA) has been trading below the $1 mark for the past few

days, fueling uncertainty and speculation among investors. As the

broader market experiences shifting sentiment, ADA remains in a

tight consolidation phase, leaving traders eager for its next move.

Related Reading: Bitcoin Outflows Signal Bullish Strength As Demand

Remains High At $100K – What This Means However, market conditions

have improved, and bullish sentiment is returning as Bitcoin flirts

with a potential rally. With BTC leading the way, analysts believe

altcoins like ADA could soon follow, setting the stage for a major

breakout. Top crypto analyst Ali Martinez shared a technical

analysis on X, revealing that Cardano is consolidating within a

symmetrical triangle pattern. This formation typically signals an

upcoming breakout, though the direction remains uncertain. If ADA

breaks above key resistance, a strong rally could follow. However,

failure to hold support could result in further downside movement.

As the crypto market turns bullish, all eyes are on ADA’s price

action to determine whether it can finally reclaim the $1 level and

start a new uptrend. The coming days will be crucial in deciding

whether Cardano can break out of its consolidation phase and join

the broader market rally. Cardano Consolidates After 25% Drop

Cardano (ADA) has been under significant selling pressure since

mid-January, experiencing a steep decline of over 25%. Market

volatility has kept ADA trading below the $1 mark, a psychological

level that has become a key battleground for bulls and bears.

However, analysts are now calling for a recovery as altcoins begin

to regain strength, signaling a potential turnaround for Cardano.

Crypto analyst Ali Martinez shared a technical analysis on X,

revealing that Cardano is consolidating within a symmetrical

triangle pattern, a formation often preceding a large breakout.

According to Martinez, a decisive breakout from this pattern could

trigger a 40% price move, bringing renewed momentum to ADA. If

Cardano reclaims the $1 level and continues to push higher, buying

pressure will increase, potentially driving ADA toward multi-year

highs. A successful breakout would confirm strong demand and signal

the start of a new bullish phase for the altcoin. Related Reading:

Dogecoin Is Setting For A Massive Leg Higher – Analyst Sees Bullish

Consolidation Above Key Level With Bitcoin leading the market

upward and altcoins showing strength, ADA could be on the verge of

a significant rally. The coming days will be crucial as investors

watch whether Cardano can break out of consolidation and join the

broader market surge. ADA Struggles Below $1 Cardano (ADA) is

currently trading at $0.95 after failing to reclaim the $1 mark, a

critical resistance level. The price has not closed above $1 since

January 21, reinforcing it as a major hurdle for bulls. If ADA is

to start a rally, buyers must push the price above $1 and hold it

as support. This would confirm a trend shift and potentially

trigger a move toward the $1.15 level, which has kept ADA

suppressed for weeks. A breakout above this range could pave the

way for strong bullish momentum and a rally into multi-month highs.

However, risks remain. If ADA fails to hold above $0.90, selling

pressure could intensify, leading to a deeper correction and

prolonged consolidation before another breakout attempt. Losing

this key support level could send ADA back to lower demand zones,

delaying any significant upside moves. Related Reading: Solana

‘Still Wants Lower’ As Meme Coins Face A Major Shakeout – Analyst

For now, investors are watching closely to see if ADA can reclaim

key resistance levels or if another pullback is on the horizon. The

next few days will be critical in determining Cardano’s short-term

direction. Featured image from Dall-E, chart from TradingView

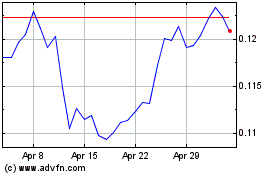

TRON (COIN:TRXUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

TRON (COIN:TRXUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025