Dogecoin Breakout Coming? Analyst Identifies Key Price Level

14 February 2025 - 11:30AM

NEWSBTC

In his latest technical breakdown posted on X, analyst Kevin

(@Kev_Capital_TA) highlighted a pivotal threshold on Dogecoin’s

daily chart. According to Kevin, reclaiming the $0.28 region on a

weekly close—and then showing clear follow-through—could set

Dogecoin on a path toward retesting its all-time highs. He notes:

“Get back above the .28 cents level on Dogecoin on a weekly close

and show follow through and my thought process is we attack the

highs not too long after that. I have been allocating into a spot

long at .25 cents on DOGE in the Patreon via the Trading Portfolio

(separate from long term bag). Ready for either outcome. Let’s send

this thing higher.” When Will The Dogecoin Correction End? The

chart highlights a well-known metric called the Bitcoin Bull Market

Support Band, applied here to Dogecoin, which consists of the

20-week Simple Moving Average (SMA) and the 21-week Exponential

Moving Average (EMA). Although this indicator was originally

developed for Bitcoin, many analysts extend it to altcoins to

determine whether the broader trend is bullish or bearish. In

Dogecoin’s current setup, this band hovers in the $0.282–$0.286

range. Price dipped below it last week and now facing a key

resistance zone between $0.27 and $0.29. Related Reading: Dogecoin

Ready For A $2.43 Rally? Elliott Wave Says Yes Beyond the price

levels, Kevin also points to two momentum studies. On the daily

Relative Strength Index (RSI), the yellow line has crossed above

its accompanying moving average, suggesting that bearish pressure

may be easing. The RSI hovers near 38, which is above a notable

support region around 27. Notably, the yellow RSI line is now back

above its pink moving average (MA) line. According to Kevin, this

may be an early sign of a shift in sentiment if follow-through

buying continues. Another important technical feature is the MACD

(Moving Average Convergence Divergence), which is nearing a bullish

crossover. The MACD line is approaching the signal line, and if

this crossover is confirmed, it could generate positive momentum

for Dogecoin. Kevin marks this as a “Pending Daily Bullish MACD

Cross,” which, if validated, would add further credence to the

bullish outlook. Related Reading: Dogecoin Holding Strong—Analyst

Says $4 Rally Could Be Next In the larger scheme, the chart

underscores that a firm weekly close above $0.28 is the key

catalyst. This level aligns with the Bull Market Support Band, and

if reclaimed decisively, could accelerate Dogecoin’s push toward

mid-$0.30s or beyond, provided broader market conditions remain

conducive. In another post, Kevin explained: “I have been saying it

for weeks now while the rest have said its altseason. We are in a

major correctional period. These periods happen in markets in case

you never noticed. Crypto is very driven off the macro, especially

altcoins. We want to hold these levels on Total Market Cap if we

want to feel good about this market otherwise the correction can go

deeper. In the mean time Chill out. Still billions in liquidity up

to $111K on BTC that will be taken eventually.” At press time, DOGE

traded at $0.25. Featured image created with DALL.E, chart from

TradingView.com

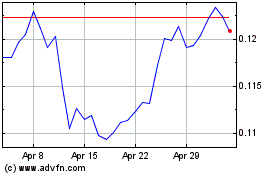

TRON (COIN:TRXUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

TRON (COIN:TRXUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025