BELGRAVIA Announces Acquisition of Securities of Blackrock Gold

01 February 2020 - 12:00AM

BELGRAVIA HARTFORD CAPITAL INC. (CSE:BLGV) (OTCQB:BLGVF)

(“Belgravia Hartford”, “Belgravia” or the “Company”) today

announced the acquisition on January 30, 2020 of 2,000,000 units

("Units") of Blackrock Gold Corp. (TSX-V:BRC) (“Blackrock

Gold”) pursuant to a private placement. Each Unit consisted of

one common share and one-half common share purchase warrant of

Blackrock Gold, each whole warrant entitling the holder to acquire

one additional common share until January 30, 2022 at an exercise

price of $0.30 per share.

The Units were purchased at a price of $0.20 per

Unit for total consideration of $400,000. The common

shares acquired by Belgravia Hartford represent approximately

3% of the issued and outstanding common shares of Blackrock

Gold.

Mehdi Azodi, Belgravia’s President and CEO,

stated “Belgravia is confident in the leadership at Blackrock Gold

and further due diligence supports the advancement of the Silver

Cloud project in Nevada.”

John Stubbs, Belgravia’s Board Chairman, stated “The recent

positive drilling results in Nevada by Blackrock Gold would

underscore the case for additional work to be undertaken, to

further develop the Silver Cloud project.”

Prior to this acquisition, Belgravia Hartford directly owned

9,780,000 common shares of Blackrock Gold and 2,640,000

warrants for a total deemed beneficial ownership of 12,420,000

common shares of Blackrock Gold, representing 18.9% of the deemed

outstanding shares. After the completion of the private

placement, Belgravia Hartford now directly

owns 11,780,000 common shares representing approximately

17.8% of the issued and outstanding common shares, together

with warrants to acquire an aggregate of 3,640,000 common

shares of Blackrock Gold. If Belgravia Hartford were to exercise

these convertible securities, the Company would own 15,420,000

common shares of Blackrock Gold, representing approximately 22.2%

of the issued and outstanding common shares deemed outstanding as

of such date. This represents a decrease of 2% since its previous

Early Warning Report filed on August 19, 2019 of a beneficial

shareholding of 24.2%.

The common shares were acquired for investment

purposes. Belgravia Hartford may, from time to time,

depending on market and other conditions, increase or decrease its

beneficial ownership, control or direction over securities of

Blackrock Gold through market transactions, private agreements

or otherwise.

This press release is being issued pursuant to National

Instrument 62-103 – The Early Warning System and Related

Take-Over Bid and Insider Reporting Issues which requires a report

to be filed under Blackrock Gold’s profile on SEDAR (www.sedar.com)

containing additional information respecting the foregoing

matters.

About Belgravia

HartfordBelgravia Hartford Capital Inc. is a publically

traded investment holding company which invests in public and

private companies in legal jurisdictions and under the rule of law.

Belgravia and its investments are high risk business ventures and

expose shareholders to financial risks. Belgravia Royalty &

Management Services has a royalty and fee income model. Further,

the cash and investment asset base provide capital to support

expansion on a selective basis.

For more information, please visit

www.belgraviahartford.com

Forward-Looking

Statements Certain information set forth in this news

release may contain forward-looking statements that involve

substantial known and unknown risks and uncertainties and other

factors which may cause the actual results, performance or

achievements of the Company to be materially different from any

future results, performance or achievements expressed or implied by

such forward-looking statements. Forward-looking statements include

statements that use forward-looking terminology such as “may”,

“will”, “expect”, “anticipate”, “believe”, “continue”, “potential”

or the negative thereof or other variations thereof or comparable

terminology. Such forward-looking statements include, without

limitation, statements regarding planned investment activities

& related returns, the timing for completion of research and

development activities, the potential value of royalties, and other

statements that are not historical facts. These forward-looking

statements are subject to numerous risks and uncertainties, certain

of which are beyond the control of the Company, including, but not

limited to, changes in market trends, the completion, results and

timing of research undertaken by the Company, risks associated with

resource assets, the impact of general economic conditions,

commodity prices, industry conditions, dependence upon regulatory,

environmental, and governmental approvals, and the uncertainty of

obtaining additional financing. Readers are cautioned that the

assumptions used in the preparation of such information, although

considered reasonable at the time of preparation, may prove to be

imprecise and, as such, undue reliance should not be placed on

forward-looking statements.

For More Information, Please

Contact:

Mehdi Azodi, President & CEOBelgravia

Hartford Capital Inc.(416) 779-3268 mazodi@blgv.ca

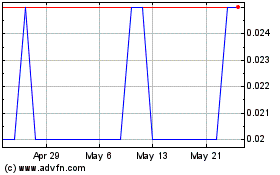

Belgravia Hartford Capital (CSE:BLGV)

Historical Stock Chart

From Nov 2024 to Dec 2024

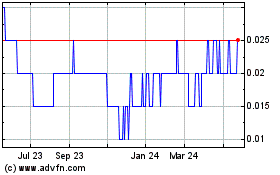

Belgravia Hartford Capital (CSE:BLGV)

Historical Stock Chart

From Dec 2023 to Dec 2024