Deer Horn Announces Amendment to Non-Brokered Private Placement and Debt Settlement Transactions

31 December 2019 - 1:24AM

Deer Horn Capital Inc. (CSE: DHC) (the “Company” or “Deer Horn”),

announces that it has amended the terms to raise up to $250,000 by

way of a non-brokered private placement of up to 5,000,000 units at

a price of $0.05/unit. Each unit consists of one common share

and one common share purchase warrant exercisable at $0.10 per

warrant share for a period of two years following the close of the

offering. The Company may pay a finder’s fee consisting of

cash, shares and/or warrants to eligible finders as permitted under

applicable securities laws and CSE policies. Proceeds from

this offering will be used for general corporate purposes.

Deer Horn also announces that it has amended the terms to effect

a debt conversion to settle an aggregate of $109,125 owing to

consultants, lenders and other creditors, including some

insiders. The debt conversion will result in the issuance of

an aggregate of 2,182,500 units of the Company at a deemed price of

$0.05/unit. Each unit consists of one common share and one common

share purchase warrant exercisable at $0.10 per warrant share for a

period of two years following the close the settlement. The settled

debt will include the issuance of 800,000 shares (approx. 3.4% of

Deer Horn’s then issued shares, assuming completion of the private

placement and the debt conversions) to a private company owned by

Tyrone Docherty, the CEO, President and a director of the Company

to settle $40,000 debt; and 50,000 shares (approx. 0.2% of Deer

Horn’s then-issued shares, assuming completion of the private

placement and all debt conversions) to Pamela Saulnier, CFO of the

Company, to settle $5,000 debt. The debt settlements to Mr.

Docherty and Ms. Saulnier will be related party transactions as

defined in Multilateral Instrument 61-101- Protection of Minority

Security Holders in Special Transactions (“MI 61-101”). The

Company is exempt from the formal valuation requirement and the

shareholder approval requirement of MI 61-101.

About Deer Horn CapitalDeer Horn

Capital is committed to exploring for, and providing, strategic and

critical metals vital to a low-carbon economy and for the

advancement of technology. The Company’s leadership has a track

record of project monetization with a board and advisory group that

includes industry leaders in finance, mineral property development,

geology, mineralogy, solar power, engineering, research and First

Nations engagement and economic development.

|

On behalf of the board of directors ofDeer Horn Capital Inc.

“Tyrone Docherty”

Tyrone DochertyPresident and CEO |

For further information please contact: Tyrone

Docherty604.789.5653tyrone@deerhorncapital.ca |

Neither the Canadian Securities Exchange

nor its regulations services accept responsibility for the adequacy

or accuracy of this release.

Forward-looking informationAll

statements included in this press release that address activities,

events or developments that the Company expects, believes or

anticipates will or may occur in the future are forward-looking

statements. These forward-looking statements involve numerous

assumptions made by the Company based on its experience, perception

of historical trends, current conditions, expected future

developments and other factors it believes are appropriate in the

circumstances. In addition, these statements involve substantial

known and unknown risks and uncertainties that contribute to the

possibility that the predictions, forecasts, projections and other

forward-looking statements will prove inaccurate, certain of which

are beyond the Company’s control. Readers should not place

undue reliance on forward-looking statements. Except as

required by law, the Company does not intend to revise or update

these forward-looking statements after the date hereof or revise

them to reflect the occurrence of future unanticipated event.

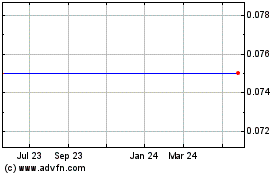

Deer Horn Capital (CSE:DHC)

Historical Stock Chart

From Dec 2024 to Jan 2025

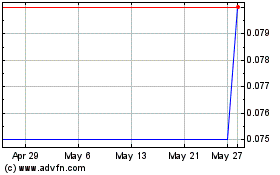

Deer Horn Capital (CSE:DHC)

Historical Stock Chart

From Jan 2024 to Jan 2025