Rising Star

Trillion Energy Ready to Supply Much Needed European

Gas

September 29, 2022 -- InvestorsHub

NewsWire -- via By Kerry Lutz - Resource World Magazine

Trillion Energy

International Inc (OTC: TRLEF – CSE: TCF – Frankfurt: Z62) is a company in the right place

at the right time as it is poised to bring on desperately needed

natural gas production within

weeks to the European market.

With energy prices

going parabolic, gas supplies cut off and the Ukraine War drags on

with no end in sight, Europe is facing a long cold winter and a

decade of sky-high energy pricing. Russia has indefinitely

shuttered the Nord Stream Pipeline, thereby cutting off much of

Europe's natural gas supply, in retaliation for Western sanctions.

The pipeline won't flow again until the sanctions are removed,

according to Russian sources.

European natural

gas and power prices are near record high levels. Electric prices

in Germany and around the continent are now exceeding $1000 per

megawatt, far exceeding the US's average of $154! Staggering

increases are negatively impacting businesses and consumers. Many

have no choice but to go without. After seeing geometric electric

price increases, many businesses, such as the UK Pub industry, may

soon be history.

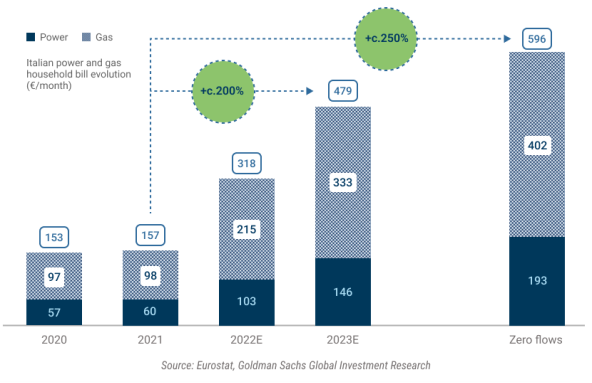

In Italy, average

household power bills have increased to €500 per month from €160 in

2021 with estimates of increases to €600, based on Russian shut

down of the Nord Stream pipeline.

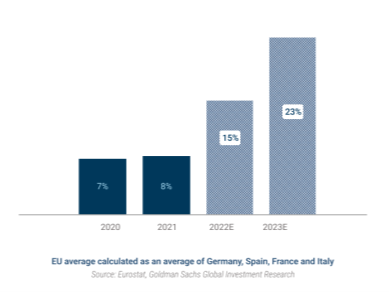

For Europe as a

whole, based on the Forward TTL power prices as represented in the

below chart, energy bills could hit 15% of GDP or €2 TRILLION. In a nightmare scenario, energy

costs could hit 20% of GDP, according to research by

Goldman Sachs, as illustrated below:

Numerous European

electric power suppliers are insolvent due to the soaring price of

natural gas. The government bailouts are just getting started;

rolling blackouts, "gas-outs," and industrial shutdowns are in the

cards. Fears of impending energy shortages have led Europeans to

start hoarding coal and firewood. Heat your home above 18 degrees

Celsius and risk going to jail for up to three years. Possible

energy rationing and exploding electric prices have ignited a

desperate search for new natural gas supplies to keep Europe from

freezing this winter. The impact of natural gas shortages has been

cataclysmic so far, and with winter looming, the worst could be yet

to come.

When will the

crisis end and gas and power prices return to normal? According to

Citigroup Inc, Europe will have to wait until later this decade

before seeing any meaningful relief.

While many bemoan

this sad, self-inflicted state of affairs, Trillion Energy (TRLEF;

TCF.CN) is doing something about it, having planned a massive

natural gas development in the Black Sea offshore Turkiye -prior to

the Ukraine War even starting, a project 10+ years in the

making.

Trillion's shares

are trading in the $0.32 range, up 233% year-to-date. A recently

released research report prepared by Research Capital Corp's

analyst Bill Newman, CFA suggests the stock is undervalued and

calls for a share price target of $1.02 (C$1.35), based on a 3.0 x

multiple of 2024F debt-adjusted cash flow. The Canadian Securities

Exchange also recently recognized Trillion's stellar performance

adding it to the CSE25 Index.

With the arrival of

the Uranus Drilling Rig from Romania this week, a massive natural

gas field in the Southwestern Black Sea of Turkiye will start gas

production imminently. Trillion Energy has been racing to commence

gas production having committed $100 million plus to a multi-year

offshore natural gas drilling program.

Marine ship pulling Uranus Rig to SASB Gas Field, September

2022

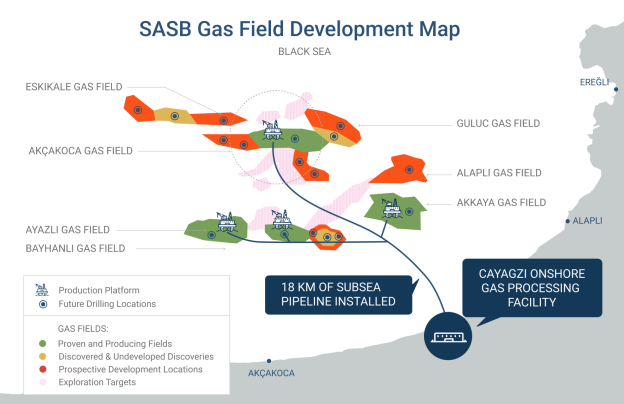

The production program utilizes a $600m+ historical investment into

the initial development and infrastructure of the field, including

12 miles of offshore pipelines tied to an onshore natural gas

processing facility, which is currently rated at 75MMcf per day but

is readily expandable to 150MMcf. Prior to the current development

phase, the SASB gas field produced 42+ billion cubic feet of gas,

which at today's $30 pricing would be worth $1.26 billion. These

figures could easily be eclipsed by the current drilling efforts

scheduled for completion in 2024.

Figure 1: Map of the SASB gas field development, Black Sea

CEO Arthur

Halleran (Ph.D.), a four-decade industry veteran, believes

that every cubic foot of natural gas counts – now more than ever –

and he has been working non-stop to bring the SASB project online

for several years. The SASB project will produce desperately needed

natural gas supplies -just in time for the cold winter.

With the Uranus

Drilling Rig, Trillion Energy plans to drill 17 new production

wells at the rate of one every 45 to 48 days. The accumulative

investment in SASB potentially makes it the largest natural gas

development in the Black Sea, where total development costs may

reach $1 billion.

While Halleran was

busy raising funds to finance the new development earlier on this

year, energy prices rose exponentially. By September of this

year, gas prices had risen exponentially to $30+ per mcf. The SASB

gas field economics were appealing at $6-7 per mcf gas when the

project was conceived, but now are truly overwhelming.

As a result of the

Company's efforts, perhaps more than any other emerging energy

producer, Trillion Energy is poised to profit from the once in a

lifetime, massive parabolic lift in European energy costs.

According to a recent statement by Trillion's CEO Art Halleran:

"We

believe the recent price increases will significantly enhance the

economic performance of … program set to commence … at the SASB gas

field. With seven wells producing, we will supply the region with

much-needed natural gas in a time of acute shortages and high

prices".

What makes the Company even more intriguing is its exploration

upside. Trillion's CEO stated that "SASB has the same Maykop source

rock as found at the recently discovered 19 Tcf Sakarya Gas Field.

This source rock is widespread and also occurs onshore Turkiye and

in South Caspian Sea area." The Sakarya Gas field is one of

the largest natural gas finds in the European region in more than

30 years and SASB is 100 miles south of Sakarya.

Trillion has 20 years of experience in this region and possesses a

wealth of historic seismic data, upon which it announced plans

earlier this year to conduct further exploration for new gas

discoveries.

Trillion's unique position as a natural gas producer in Europe at

the right time with an aggressive development plan unfolding makes

it poised to become a leader in new natural gas supply, as well as

a near-term cash cow beyond what its modest $140m market

capitalization would predict.

Small wonder that renowned oil and gas analyst Bill Newman, CFA is

calling for a significant rise in Trillion's share price to C$1.35

and the Company has been recently welcomed to the CSE25 index of

top performers.

SOURCE: Kerry Lutz - Resource World

Magazine