By Mauro Orru

This week, more European companies issued new guidance for 2020,

while others revised expectations in the wake of the coronavirus

pandemic compared with last week. However, several companies are

still skeptical when it comes to specific targets as many European

countries experience a resurgence of coronavirus outbreaks.

Below is a round-up of outlook statements from the past

week.

New guidance:

--AMRYT PHARMA PLC: The Dublin-based, London-listed

biopharmaceutical company expects to make revenue of $170

million-$175 million in 2020. This would be up from $154.1 million

in 2019.

--COMMERZBANK AG: The German bank expects to post a loss this

year "in light of the expected risk result and potential

restructuring charges." Risks provisions should be in a range of

1.3 billion and 1.5 billion euros ($1.54 billion-$1.78 billion) in

2020, while the cost base should fall slightly from last year.

--DEUTSCHE LUFTHANSA AG: The German airline expects to book an

adjusted earnings before interest and taxes loss in its second half

and therefore sees a further significant decline in adjusted EBIT

for the year.

--RHEINMETALL AG: The German defense company expects defense

sales to grow by 6% to 7% for the year compared with a previous

range of 5% and 7%, while its operating margin for the sector

should come in around 10%. Rheinmetall said it can't give a precise

forecast for the automotive sector due to persistent

uncertainties.

--SIEMENS HEALTHINEERS AG: The German medical-equipment maker

now expects revenue growth to be broadly flat on a comparable basis

during its fiscal year, while adjusted basic earnings per share

should come between EUR1.54 and EUR1.62.

Lowered Guidance:

--BAYER AG: The German pharmaceutical and chemical conglomerate

lowered its outlook for the year due to the coronavirus pandemic.

It now expects sales to be between EUR43 billion and EUR44 billion,

and earnings before interest, taxes, depreciation and amortization

before special items of around EUR12.1 billion, both on a

currency-adjusted basis.

--PIRELLI & C. SpA: The Italian tire maker slightly lowered

its 2020 outlook, projecting revenue in a range of about EUR4.15

billion and EUR4.25 billion, from previous estimates of around

EUR4.3 billion to EUR4.4 billion, citing greater exchange-rate

volatility. The company also expects a 2020 adjusted EBIT margin of

around 12%-13%, down from previous estimates of around 14%-15%.

--SOCIETE GENERALE SA: France's third-largest listed bank by

assets expects cost of risk for the year to be at the bottom of its

70 to 100 basis points guidance.

Backed guidance:

--FERRARI NV: The Italian sports-car maker backed its guidance

for 2020, narrowing it within the previous range to reflect better

visibility. It said it now expects revenue for the year to be

greater than EUR3.4 billion, adjusted Ebitda to be EUR1.075

billion-EUR1.125 billion and adjusted EBIT of between EUR650

million and EUR700 million.

--INTESA SANPAOLO SpA: The Italian bank expects net income of at

least EUR3 billion in 2020 and at least EUR3.5 billion in 2021.

--MERCK KGaA: The German pharmaceuticals and chemicals company

backed the outlook it had previously given for 2020, assuming that

its business will be affected by the pandemic "to varying degrees,"

it said. The company guided for a slight increase in net sales to a

range between EUR16.9 billion and EUR17.7 billion. It expects

Ebitda pre to be in a range between EUR4.45 billion and EUR4.85

billion, with the lower end of that range slightly above previous

expectations.

--SIEMENS AG: The German engineering conglomerate continues to

expect a moderate decline in comparable revenue for its fiscal

year.

--UNICREDIT SpA: The Italian bank confirmed its profits guidance

for next year. It also confirmed its guidance for a cost of risk of

between 100 basis points and 120 basis points for this year.

Lifted Guidance:

--HIKMA PHARMACEUTICALS PLC: The pharmaceutical company raised

its outlook for its injectables and generics divisions. It now sees

full-year revenue from its injectables business in the range of

$950 million to $980 million, with a core operating margin of

between 38% to 40%. In its generics division, the company now sees

full-year revenue in the range of $720 million to $760 million,

with a core operating margin around 21%, taking into account the

expected launch of generic Advair Diskus in the second half of the

year.

--INFINEON TECHNOLOGIES AG: The German chip maker now expects

revenue around EUR8.5 billion for the year ending Sept. 30 compared

with previous expectations of about EUR8.4 billion. Infineon

expects a segment result margin for the group of around 13%, up

from previous forecasts of about 12%.

--KONINKLIJKE AHOLD DELHAIZE NV: The Netherlands-based owner of

grocery chains such as Stop & Shop and Giant Food now expects

to report low-to-mid 20% growth in underlying EPS, compared with

previous guidance of mid-single-digit range this year.

Withheld Guidance:

--ACCOR SA: The French hospitality group said it doesn't have

enough visibility to provide a 2020 Ebitda guidance range.

--ADIDAS AG: The German sporting-goods company said it wasn't

able to provide a full-year outlook due to uncertainties around the

further development of the coronavirus pandemic.

--ALLIANZ SE: The German insurer didn't provide an updated 2020

outlook for its operating profit due to continuing uncertainties

related to the pandemic.

--HSBC HOLDINGS PLC: Europe's largest bank by assets said it

would provide an update on its medium-term financial targets and

dividend policy when announcing its year-end results for 2020.

--HUGO BOSS AG: The German premium-apparel company expects a

gradual improvement in the second half of the year but still can't

provide a reliable forecast for 2020 due to continuing

uncertainties. However, it expects a credit impairment charge for

2020 between $8 billion and $13 billion. This compared with an

earlier forecast made in April, when the bank said it would set

aside as much as $11 billion for bad loans this year.

--WOLTERS KLUWER NV: The Netherlands-based information, software

and services company said guidance for the whole of 2020 remains

suspended as of May due to uncertainty caused by the pandemic.

Write to Mauro Orru at mauro.orru@wsj.com; @MauroOrru94

(END) Dow Jones Newswires

August 07, 2020 09:31 ET (13:31 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

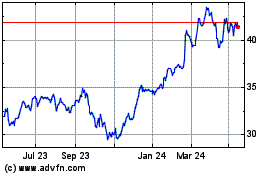

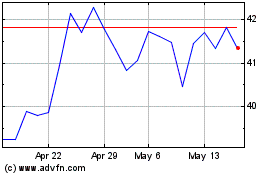

Accor (EU:AC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Accor (EU:AC)

Historical Stock Chart

From Feb 2024 to Feb 2025