- Final maturity of all bank loans extended by at least 2

years

- Equitization of the loan contracted with the EIB to reduce

its repayment in cash and optimize the Company's cash

position

Regulatory News:

CARMAT (FR0010907956, ALCAR), designer and developer of the

world’s most advanced total artificial heart, aiming to provide a

therapeutic alternative for people suffering from advanced

biventricular heart failure (the “Company” or

“CARMAT”), today announces a final agreement with all its

financial creditors on new loan repayment terms.

This agreement follows the conditional agreements1,2 in

principle announced on January 12 and February 22. It covers all of

the Company's bank loans, including the €30 million loan from the

European Investment Bank ("EIB")3 and the two State Guaranteed

Loans ("PGE"), of a principal amount of €5 million each, from BNP

Paribas ("BNPP") and Bpifrance ("BPI")4.

Given this agreement and its cash position, the Company can,

according to its current business plan, fund its activities until

mid-May 2024, and estimates its financing needs over the next 12

months at approximately €35m.

The Company carries on working very actively on other

initiatives to strengthen its equity and alleviate its cash

constraints in the short term, in order to be able to continue its

activities beyond mid-May 2024.

Stéphane Piat, CEO of CARMAT, comments: "This agreement

with the EIB, BNP Paribas and Bpifrance on new loan repayment terms

is very good news for the Company.

Its implementation enables us to extend the maturity of all our

financial debts by at least two years, and thus reduce our loan

repayments by more than €30 million over the period 2024-2025.

During this period, we will therefore be able to allocate our

financial resources primarily to support our growth, while also

significantly reducing the Company's financing requirements.

I would like to thank our banking partners for their commitment

to our project. Their support is a mark of confidence in the

robustness of our project, and enables us to focus on our primary

objective, which is to develop our sales and make Aeson® the

reference therapy for advanced biventricular heart failure."

Final Agreement with BNPP and BPI on

new repayment terms of the PGE

The banks have granted CARMAT an additional 24-month grace

period with subsequent postponement of final loan maturity:

- PGE with BNPP: maturity extended from

October 27, 2026, to October 27, 2028; - PGE with BPI: maturity

extended from November 30, 2026, to November 30, 2028.

After the grace period, the PGE contracted from BPI will be

repaid on a monthly basis, while the PGE contracted from BNPP will

give rise to one initial half-yearly payment, followed by monthly

payments5.

The amounts borrowed will continue to bear interest at fixed

rates adjusted versus those of the initial contracts, in order to

reflect the evolution of the banks' refinancing rate6. The other

terms and conditions of the loans will remain, in substance,

unchanged; the credits will particularly remain unsecured and

guaranteed at 90% by the French State.

Final Agreement with the EIB on new

loan repayment terms and on its equitization

The new repayment terms of the EIB loan, as well as those of the

planned equitization, are in all respects similar to those

described in the conditional agreement in principle reached with

the EIB in January 2024, which had been the subject of a detailed

press release by the Company on January 12, 2024. Readers are

invited to refer to said press release for more details on these

terms.

Main new repayment terms of the

loan

- Tranche 1: maturity extended from January

31, 2024, to July 31, 2026 - Tranche 2: maturity extended from May

4, 2025, to August 4, 2027 - Tranche 3: maturity extended from

October 29, 2026, to October 29, 2028

The amounts borrowed will continue to bear interest until their

new maturity dates at fixed rates specified in the initial

contract. Moreover, the initial royalty agreement associated with

this loan is modified to begin with respect to 2024 sales and for a

duration of 15 years (versus a duration of 13 years in the initial

contract).

The other terms and conditions of the loan remain, in substance,

unchanged (this is notably the case regarding the events of default

and early repayment clauses). The loan will remain unsecured.

Main terms of the equitization of the

loan

An equitization operation of the first tranche of the loan7 will

be launched to allow its gradual transformation into CARMAT shares

via a trust (fiducie-gestion) created for the requirements of this

operation and managed by a trustee independent of the Company and

EIB (the "Trust"). This equitization will successively cover the

three tranches of the loan, but the EIB could unilaterally decide,

in due time, not to proceed with the equitization of the second

and/or third tranches, of which the market would be informed.

On the day of the implementation of the equitization8, the

Company will proceed with the issuance, free of charge and with the

suppression of the preferential subscription right of the

shareholders, of a certain number of warrants in favour of the

trustee, acting on behalf of the Trust9.

Each warrant will allow the subscription of one share of the

Company. The Trustee will progressively exercise these warrants.

The shares so issued from each exercise will then be gradually sold

by the Trust on the market10, and the net proceeds from the sale

will be transferred by the Trust to the EIB until the complete

repayment of the sums due to the bank for the first tranche of the

loan.

Should the net proceeds from the sale of the shares not have

allowed the total repayment of this tranche to the EIB by July 31,

2026 (the new maturity date of the first tranche), the Company

would then repay the balance due to the EIB for this tranche, in

cash from its own cash resources, on that date11. A partial cash

repayment by the Company of the sums due to the EIB for the first

tranche is therefore possible.

A mechanism identical to that used for the first tranche would

then be put in place for equitizing the second and third tranches

of the loan, unless the EIB decided not to do so, of which the

market would be informed.

Investors are invited to consider the specific risks related to

the planned equitization, detailed in the appendix to this press

release.

About CARMAT

CARMAT is a French MedTech that designs, manufactures and

markets the Aeson® artificial heart. The Company’s ambition is to

make Aeson® the first alternative to a heart transplant, and thus

provide a therapeutic solution to people suffering from end-stage

biventricular heart failure, who are facing a well-known shortfall

in available human grafts. The world’s first physiological

artificial heart that is highly hemocompatible, pulsatile and

self-regulated, Aeson® could save, every year, the lives of

thousands of patients waiting for a heart transplant. The device

offers patients quality of life and mobility thanks to its

ergonomic and portable external power supply system that is

continuously connected to the implanted prosthesis. Aeson® is

commercially available as a bridge to transplant in the European

Union and other countries that recognize CE marking. Aeson® is also

currently being assessed within the framework of an Early

Feasibility Study (EFS) in the United States. Founded in 2008,

CARMAT is based in the Paris region, with its head offices located

in Vélizy-Villacoublay and its production site in Bois-d’Arcy. The

Company can rely on the talent and expertise of a multidisciplinary

team of circa 200 highly specialized people. CARMAT is listed on

the Euronext Growth market in Paris (Ticker: ALCAR / ISIN code:

FR0010907956).

For more information, please go to www.carmatsa.com and follow

us on LinkedIn.

Name: CARMAT ISIN code:

FR0010907956 Ticker: ALCAR

Disclaimer

This press release and the information contained herein do not

constitute an offer to sell or subscribe, nor a solicitation of an

order to buy or subscribe to CARMAT shares in any country. This

press release may contain forward-looking statements by the company

regarding its objectives and prospects. These forward-looking

statements are based on the current estimates and anticipations of

the company's management and are subject to risk factors and

uncertainties such as the company's ability to implement its

strategy, the pace of development of CARMAT's production and sales,

the pace and results of ongoing or planned clinical trials,

technological evolution and competitive environment, regulatory

changes, industrial risks, and all risks associated with the

company's growth management. The company's objectives mentioned in

this press release may not be achieved due to these elements or

other risk factors and uncertainties.

Significant and specific risks of the company are those

described in its universal registration document filed with the

French Financial Markets Authority (Autorité des marchés financiers

- the “AMF”) under number D.23-0323 and in its amendment

filed with the AMF on January 17, 2024 under number D.23-0323-A1.

Readers' attention is particularly drawn to the fact that the

company's current cash runway is limited to mid-May 2024. Readers

and investors are also advised that other risks, unknown or not

considered significant and specific, may or could exist.

Aeson® is an active implantable medical device commercially

available in the European Union and other countries recognizing CE

marking. The Aeson® total artificial heart is intended to replace

the ventricles of the native heart and is indicated as a bridge to

transplant for patients suffering from end-stage biventricular

heart failure (INTERMACS classes 1-4) who cannot benefit from

maximal medical therapy or a left ventricular assist device (LVAD)

and who are likely to undergo a heart transplant within 180 days of

implantation. The decision to implant and the surgical procedure

must be carried out by healthcare professionals trained by the

manufacturer. The documentation (clinician manual, patient manual,

and alarm booklet) should be carefully read to understand the

features of Aeson® and the information necessary for patient

selection and proper use (contraindications, precautions, side

effects). In the United States, Aeson® is currently exclusively

available as part of an Early Feasibility Study approved by the

Food & Drug Administration (FDA).

Appendix

Risk factors associated with the planned

Equitization

The public’s attention is drawn to the risk factors associated

with the Company and its activity, as described (i) in Chapter 2 of

its 2022 Universal Registration Document filed with the AMF (French

Financial Market Authority) on April 21, 2023, and (ii) in its

amendment filed with the AMF on January 17, 2024 under number

D.23-0323-A1. Both documents are available free of charge on the

Company’s website (www.carmatsa.com) and the AMF website

(www.amf-france.org).

Readers’ attention is especially drawn to the fact that the

Company’s current cash runway only extends to mid-May 2024. The

occurrence of all or some of these risks could have a negative

impact on the Company’s activity, financial situation, results,

development or outlook.

Moreover, investors are invited to take into consideration the

following specific risk factors associated with the envisaged

Equitization:

- risk of dilution for the Company’s

shareholders: shareholders will suffer dilution when the Warrants

are exercised;

- risk regarding the share price: as the

trustee acting on behalf of the Trust will not be intending to

remain a shareholder in the Company, the divestments of shares

issued upon exercise of the Warrants could result in significant

downward pressure on CARMAT’s share price, and shareholders could

thus experience a loss of their invested capital due to a

significant reduction in the value of the Company’s shares;

- risk regarding the volatility and liquidity

of the Company’s shares: the divestment on the market, of shares

issued upon exercise of the Warrants could have significant

consequences on the volatility and liquidity of its shares; and

- risk, should the EIB not be fully repaid

via the Equitization operation: the Company could have to repay

part of the various tranches of the loan in cash if, by the new due

dates of each of these tranches, the net proceeds of the share

divestments had not enabled the EIB to be fully repaid with respect

to each of these tranches.

Dilution Related to the Planned

Equitization

For illustrative purposes only, assuming (i) the warrants are

exercised at a price equal to the lowest weighted average daily

trading price of the Company's share observed over the fifteen

trading days preceding January 31, 2024 (i.e., €4.06) and (ii) the

underlying shares are sold at the closing price of the Company's

share on the eve of that same date, 4.4 million warrants would need

to be exercised to fully repay the sums due to the EIB for the

first tranche (i.e., €18 million). Under this scenario, a

shareholder holding 1% of the Company's capital before the

equitization of the first tranche would see their stake reduced to

0.87% of the capital after the equitization of this tranche.

Based on the same assumptions, 11.6 million warrants would have

to be exercised to fully repay the sums due to the EIB for the

three tranches of the loan (i.e., €47 million); under this

scenario, a shareholder holding 1% of the Company's capital before

the equitization of the three tranches would see their stake

reduced to 0.71% of the capital after the equitization of said

tranches.

This example of dilution does not prejudge the final number of

shares to be issued, nor their issuing price or sale price, which

will be determined based on the prevailing market price at the time

of the warrants' exercise and the sale of the underlying

shares.

1 Press release dated January 12, 2024, on the conditional

agreement in principle with the EIB. 2 Press release dated February

22, 2024, providing an update on the renegotiation of loan

repayment terms with financial creditors. 3 Under the terms of an

agreement entered into on December 17, 2018, the Company has

contracted a loan from the EIB for an amount of 30 million euros

paid in 3 tranches of 10 million euros each, on January 31, 2019

(the "First Tranche"), May 4, 2020 (the "Second Tranche") and

October 29, 2021 (the "Third Tranche" and, together with the other

tranches, the "Tranches"), with each tranche initially to be

repaid, in principal and interest, 5 years after its payment to the

Company. 4 Two PGEs contracted in the fourth quarter of 2020, with

BNP Paribas and Bpifrance respectively, for a principal amount of

€5 million each, repayable from the fourth quarter of 2022 to the

fourth quarter of 2026. 5 Repayments will resume in May 2025 for

the PGE with BNPP and in December 2024 for the PGE with Bpifrance.

6 As of the date of this press release, the new interest rate

applicable to the PGEs is estimated to be in the range of 4 to

4.5%. 7 The equitization will cover both the principal and the

interest of the loan, so that the Company will not have to disburse

anything for that tranche once equitization is initiated, up to its

new term (except in cases of default or early repayment, which

remain unchanged). 8 Given the time required to set up the

equitization, the Company anticipates that it should begin during

the second quarter of 2024. 9 Regarding the first tranche of the

EIB loan, this issuance would be based on the delegation granted by

the Assembly on January 5, 2024, under its eleventh resolution. It

is specified that additional warrants may later be issued by the

Company to the trustee, acting on behalf of the Trust, if the

number warrants initially issued is insufficient to fully complete

the Equitization. 10 The conditions for exercising the warrants and

selling the shares, particularly in terms of price and volumes,

will be defined in the trust agreement. 11 In view of this, the

Company will grant an autonomous first-demand guarantee to the EIB,

in case of non-repayment on the date agreed in the EIB Loan

Agreement, of the sums due for the First Tranche. Conversely, it

should be noted that the exercise of the warrants and the sale of

the underlying shares will be halted should all the sums due for

the First Tranche have been repaid to the EIB.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240322677078/en/

CARMAT Stéphane Piat Chief Executive Officer

Pascale d’Arbonneau Chief Financial Officer Tel.: +33 1 39

45 64 50 contact@carmatsas.com Alize RP Press Relations

Caroline Carmagnol Tel.: +33 6 64 18 99 59

carmat@alizerp.com NewCap Financial Communication &

Investor Relations Dusan Oresansky Jérémy Digel Tel.:

+33 1 44 71 94 92 carmat@newcap.eu

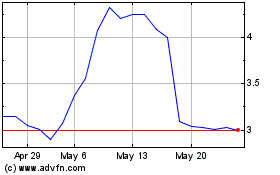

Carmat (EU:ALCAR)

Historical Stock Chart

From Dec 2024 to Jan 2025

Carmat (EU:ALCAR)

Historical Stock Chart

From Jan 2024 to Jan 2025