Bekaert: Trading update for the nine months to September 2024

22 November 2024 - 5:00PM

UK Regulatory

Bekaert: Trading update for the nine months to September 2024

Trading update for the nine months to September 2024

Taking actions to address weaker end market conditions;

share buyback restarted

Bekaert has delivered a sales performance of € 3 016 million in

the first nine months of 2024 (-10% against the same period in

2023). Sales were impacted by lower volumes (-4%) and the reversal

of raw material cost inflation and energy surcharges in previous

periods (-5%).

Bekaert remains very focused on extracting further cost

efficiencies, maintaining margins and generating cash while

managing increasingly weak end markets in the third quarter. The

period has further demonstrated the benefits from the strategic

improvements in recent years and the business resilience they have

brought to the group. Whilst there are clear headwinds, the group

continues to execute its strategy.

Financial highlights

- Consolidated sales of

€ 3 016 million in the first nine months of 2024

(-10%) driven by pricing reflecting lower raw material costs and

lower volumes

- Lower input costs, including raw

material and energy charges, lead to lower pricing reducing sales

by approximately € 150 million (-5%)

- The lower volumes (-4%) reduced sales

by approximately € 140 million

- Currency had an impact of around

€ -30 million (-1%)

- Ongoing and proactive cost management to support margins in

2024 and beyond

- Continued good cash flow generation, driven by operational

efficiencies and capex discipline, and low financial leverage

Operational and strategic highlights

- Rubber Reinforcement - weak Q3 especially in China and Europe,

with demand particularly impacted in truck tires

- Steel Wire Solutions - continuing the strong performance of H1,

despite lower volumes and some delays in the energy and utility

markets of North America

- BBRG - further impact in Q3 from the operational issues in

steel ropes in Europe and North America, however resolution of

operational issues remains on track

- Specialty Businesses:

- Sustainable Construction (Dramix®)

delivered +3% volume growth over the first nine months, despite

some project delays, with a robust project pipeline and good

progress developing sales offerings in new markets

- Hydrogen activities (Currento®)

continue to develop in line with revised expectations with good

customer traction

- Mixed performance across other

sub-segments with weak demand in combustion technologies and ultra

fine wires

- Bekaert has qualified for up to €24 million of funding from the

EU Innovation Fund to support green hydrogen manufacturing in

Europe

- Successful integration of the BEXCO acquisition into BBRG

delivering expected synergies, with trading ahead of initial

forecast

Outlook

The company’s financial performance in the first nine months of

2024, managing the challenges of weaker end markets and lower

volumes, and robust financial position gives Bekaert confidence in

its ability to further deliver on its strategic and financial

priorities.

Whilst uncertainty remains for the financial year 2024, management

is currently anticipating:

- Consolidated sales slightly below € 4 billion

reflecting the ongoing effects of lower volumes and pricing

- EBITu in the range of € 340-350 million, with EBITu margins

broadly in line with 2023

- Further good cash generation for the year

The group expects the challenging and uncertain environment to

continue in most regions into Q1 2025 and will remain focused on

successfully managing these pressures through production

efficiencies, capacity management and corporate overhead

reductions. The group will continue to deliver its strategy,

strengthening business fundamentals and resilience, and improving

opportunities for growth, margin expansion and cash flow

generation.

Share buyback

The group continues to actively evaluate acquisition

opportunities and to strategically reposition the Group in faster

growing markets. With the investments already made in the growth

platforms, the group has established a position to scale further as

these markets develop.

To date in 2024 there have been fewer acquisitions than

anticipated. Consequently, and supported by continued good cash

flow generation and low levels of indebtedness, the Board has taken

the decision to restart the share buyback immediately and will

purchase for cancellation up to €200 million of Bekaert shares over

the next 24 months.

Conference call

Yves Kerstens, CEO of Bekaert, and Seppo Parvi, CFO, will

present the 2024 third quarter trading update at 10:00 a.m. CET on

Friday 22 November. This presentation can be accessed live upon

registration (registration link) and will be available on Bekaert’s

website after the event.

- p241122E - Trading update Q3 2024

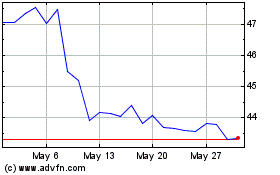

NV Bekaert (EU:BEKB)

Historical Stock Chart

From Dec 2024 to Jan 2025

NV Bekaert (EU:BEKB)

Historical Stock Chart

From Jan 2024 to Jan 2025