Half year results 2018

Results first half 2018:

Continued good results in volatile market

conditions

Regulated information - 27 September 2018

– 18:00

Headlines

During the first semester of 2018 Campine

achieved a revenue of 113.8 Mio € (2017: 116.5 Mio €). Profit after

taxes amounted to 4.67 Mio €, (2017: 4.98 Mio €). The slight

reduction in Sales (-2.3%) and profit (‑6.2%) are solely related to

the volatile and lower lead prices in 2018.

“The metal markets have been more volatile in

2018 due to threats of trade wars” explains CEO De Vos and adds

that “Despite similar average metal prices in the first half of

2017, the LME lead price in 2018 showed a downward trend. In

combination with increased used-battery purchase prices, this has a

short term negative impact on margins.” Campine confirms that since

August battery prices are lowering and availability improves. In

combination with the new lead furnace filter and related increased

output capacity, Campine is looking forward to a positive second

semester with good filled orderbooks for all businesses.

Re-aligned Business Units

Campine has aligned its business organisation

into 2 segments in conformance with its markets served. This

orientation also fits with our internal management structure says

De Vos: “The Plastics and Antimony Business Units are serving the

same customers, often even for the same applications, so it is

logical to bring them in one Segment called Specialty

Chemicals. In May 2018 the company announced its new

business plan, in which it confirmed also to increasingly recycle

other metals besides Lead. “What started as an attempt to recover

antimony from our drosses and other industrial waste streams,

resulted in the recovery, concentration or extraction of different

other metals. The metallurgical process to do this and the

suppliers and customers involved, are more linked to our lead

recycling operations, so these businesses fit very well under the

Segment header of Metals Recycling” adds De

Vos.

Specialty Chemicals hosts all

businesses which serve end-markets with chemical products and

derivates. The manufacturing of antimony trioxide used as

flame-retardant, polymerization catalyst and pigment reagent

(formerly reported under the Antimony unit) and the production of

different types of polymer and plastic masterbatches (formerly

reported under BU Plastics) are hosted in this Segment, which now

comprises the BU Antimony and BU Plastics.

Metals Recycling hosts the businesses in which

metals are being recovered from industrial and post-consumer waste

streams. The main activity is the manufacturing of lead alloys

(formerly reported in the BU Lead). To this business is now added

the growing activity of the recycling of other metals such as

antimony and tin (formerly integrated in the BU Antimony). This

Segment now comprises the BU Lead and BU Metals Recovery.

The financial reporting is adapted according to this

modification.

Performances per Segment

Specialty Chemicals

Market and Operations

- The demand for flame retardants continues to increase. Despite

regulatory pressure, antimony trioxide remains the most widely used

and most efficient product in the fire protection of plastics.

- Sales volumes increased to 8,078 mT compared to 7,855 mT over

the same period in 2017, which is an increase of 3 %. Demand

remains strong for the rest of the year.

- The operating result improved substantially to 2.70 Mio € (from

1.20 Mio € in 2017), due to increased operational

efficiencies.

- Campine keeps expanding its range of plastic masterbatches with

the addition of a 4th mixing unit.

Outlook 2018The demand for Campine’s chemical products remains

strong. The expectation is that the Specialty Chemicals Segment

will continue to perform better than in 2017 throughout the

year.

Metals Recycling

Market and Operations

- The demand for Lead products remains high and similar to last

year. Sales volumes in the first semester were however about 1,120

mT below last year’s first semester (30,469 mT versus 31,585 mT).

This was caused by capacity limitations related to the old filter,

which was replaced during the summer shutdown. The new furnace

filter (building) was taken into operation as planned on August 1st

and gives Campine about 15% additional lead recycling

capacity.

- LME lead prices were very volatile. The average LME lead prices

of the first 6 months 2018 were comparable with those of the first

semester 2017. However there are some substantial differences: In

2017 LME lead prices started relatively low around 1,900 €/mT and

increased thereafter. In 2018 LME lead prices started relatively

high (2,100 €/mT) and dropped considerably by begin of March

towards 1,900 €/mT after president Trump’s announcement of metal

import duties. Prices remained very volatile since then, even

reaching 1,700 €/mT in September.

- The operating result reduced accordingly to 6,245 Mio € (from

8,897 Mio € in 2017).

- Our process knowledge to recycle other metals such as antimony

and tin has reached a more mature stage, allowing us to run our

equipment more efficiently.

Outlook 2018The increased capacity will be

gradually filled during Q3 and we expect a strong output during Q4

to satisfy the high market demand. Campine expects the Metals

Recycling Segment to end the year 2018 with similar or even higher

volumes than in 2017. Margins are progressively restoring as

used-battery prices are adapting to the lowered lead LME rates.

The full press release and interim financial

report can be found in annex and are available on our

website

- 180927half year results

- interim financial report

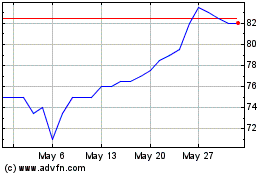

Campine NV (EU:CAMB)

Historical Stock Chart

From Jun 2024 to Jul 2024

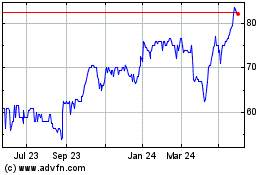

Campine NV (EU:CAMB)

Historical Stock Chart

From Jul 2023 to Jul 2024