Lagardere Welcomes Planned Stake Acquisition by Vivendi

16 September 2021 - 4:14PM

Dow Jones News

By Mauro Orru

Lagardere SA has welcomed plans from Vivendi SE to buy a stake

held by activist investor Amber Capital for about 609.86 million

euros ($720.6 million), a prelude to a full takeover of the

group.

The French media company said late Wednesday that it is

"delighted" with Vivendi's investment to buy Amber's 17.93% stake,

which will take Vivendi's total holdings in Lagardere to 45.1%.

The deal would effectively bind Vivendi, the media conglomerate

steered by the family of French billionaire Vincent Bollore, to

pursue a full takeover of Lagardere.

Requirements from France's markets regulator oblige companies

exceeding a 30% threshold in another listed company to submit a

tender offer for all remaining shares, although exemptions are

possible.

"This project demonstrates Vivendi's confidence in the relevance

of Lagardere's strategic model based on the complementarity of its

activities and its operational efficiency," Lagardere said.

The transaction, expected to be completed by Dec. 15, 2022,

would mark the exit of Amber Capital from Lagardere's capital.

Lagardere and Amber Capital have been at loggerheads since the

investor sought to oust Arnaud Lagardere as chief executive and

overhaul the company's former legal structure, which gave Mr.

Lagardere veto powers on most decisions made by shareholders,

effectively handing him control of the company well beyond the size

of his stake. Lagardere has since abandoned the "societe en

commandite par actions" structure in favor of the more common

"societe anonyme" status.

Write to Mauro Orru at mauro.orru@wsj.com; @MauroOrru94

(END) Dow Jones Newswires

September 16, 2021 01:59 ET (05:59 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

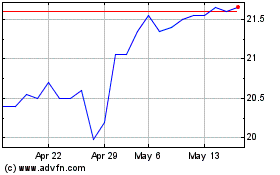

Lagardere (EU:MMB)

Historical Stock Chart

From Jan 2025 to Feb 2025

Lagardere (EU:MMB)

Historical Stock Chart

From Feb 2024 to Feb 2025

Real-Time news about Lagardere SA (Euronext): 0 recent articles

More Lagardere SA News Articles