PRESS RELEASE: NACON: FIRST HALF 2023/24 RESULTS - English version

29 November 2023 - 11:17PM

PRESS RELEASE: NACON: FIRST HALF 2023/24 RESULTS - English

version

Press

releaseLesquin, 27 November 2023 - 6 p.m. CET

FIRST HALF 2023/24

RESULTS

- PERFORMANCE AFFECTED BY A RELEASE

SCHEDULE WEIGHTED TOWARDS THE SECOND HALF

- IMPROVEMENT IN MARGIN RATES: EBITDA

OF €29.3 MILLION

STRONG, PROFITABLE GROWTH EXPECTED OVER THE FULL

YEAR

NACON (ISIN FR0013482791) is today

announcing its consolidated results for the first half of its

2023/24 financial year (six months from 1 April to 30 September

2023) as finalised by the Board of Directors in its meeting of 27

November 2023.

|

Consolidated IFRS figures (€ million) |

First half2023/24 |

First half2022/23 |

Change |

|

Sales (non-IFRS) |

70.8 |

77.5 |

-8.7% |

|

Adjustment for the partial disposal of Gollum |

(3.0) |

|

|

|

Sales (IFRS) |

67.8 |

77.5 |

|

|

Gross profit% of revenue |

43.564.2% |

47.661.4% |

-8.5% |

|

EBITDA% of revenue |

29.343.2% |

24.431.4% |

+20.1% |

|

Operating income% of revenue |

3.75.4% |

9.812.7% |

-62.7% |

|

Financial income (expense) |

(2.2) |

1.3 |

|

|

Income before tax % of

revenue |

1.52.1% |

11.114.3% |

-86.9% |

|

Income tax |

1.8 |

(2.6) |

|

|

Net income for the period% of

revenue |

3.24.8% |

8.410.9% |

-61.6% |

* This item has been classified under other operating income in

the income statement, as required by IFRSs.

In the first-half period, Catalogue sales (new

games) were adversely affected by the limited release schedule.

They amounted to €23.1 million, down 9% year-on-year. Back

Catalogue sales (games released in previous years) were resilient

at €21.2 million (down 1.8%), and returned to growth in the

second quarter. Sales in the Accessories business totalled

€24.9 million. They rose sharply at the end of the period due

to the upturn in the global market driven by the growing installed

base of new consoles.

The gross margin rate was 64.2%, an increase of

almost 3 points year-on-year.

EBITDA came in at €29.3 million, giving an

EBITDA margin rate of 43.2% as opposed to 31.4% in the year-earlier

period.Operating expenses remained under control and increased only

slightly.

After €25.6 million of depreciation and

amortisation charges relating to non-current assets

(€14.5 million in the first half of 2022/23), operating income

was €3.7 million, equal to 5.4% of sales.

The increase in net financial expense was due to

higher interest rates but above all negative exchange differences

(foreign exchange loss of €0.5 million as opposed to a gain of

€1.8 million in the year-earlier period).

Firm financial position at a time of major

development

At 30 September 2023, NACON had equity of

€248.7 million as opposed to €242.6 million at 31 March

2023. It also had €19.6 million of cash and cash equivalents

versus €47.6 million at 31 March 2023, since the Group has

chosen to fund developments while reducing the amount of new

borrowings. The value of NACON’s inventories also decreased

relative to the previous financial year.

Currently, 50 games are under development, and

the related assets have a carrying amount of

€118.1 million.

Funds from operations totalled

€22.0 million during the first half.

Full year 2023/24: Expected strong

growth in sales and earnings

The second half of the 2023/24 financial year

will see a busy release schedule, with over 10 new games expected

during the period. Games released in the third quarter include

Astérix & Obelix: Heroes TM,

Cricket 24 Official Game of The Ashes

TM, Gangs of Sherwood

TM and especially Robocop: Rogue

City TM, NACON’s most successful ever

launch. Games scheduled for release in the fourth quarter include

War Hospital and Test Drive Unlimited:

Solar Crown TM.

Sales from the back catalogue are continuing to

grow as it automatically expands with the addition of games

released in previous years.

Finally, the Accessories business will benefit

from a more favourable base for comparison, growth in the installed

base of Xbox series and PS5 consoles and the release of several

high-potential products including the REVOLUTION 5

PRO controller and RIG 600 PRO

headsets. With second-half business levels likely to be buoyant,

NACON is confirming its expectation of strong growth in sales and

operating income in its 2023/24 financial year.

Next key event:

Third-quarter 2023/24 sales: 23 January 2024 after

the market close

|

ABOUT

NACON |

|

2022/2023

SALES:€156.0 million WORKFORCEMore

than 1,000 people INTERNATIONAL

PRESENCE23 subsidiaries and a distribution network in 100

countrieshttps://corporate.nacongaming.com/ |

NACON is part of the Bigben group and was formed in 2019 to

optimise its areas of expertise and generate synergies between them

in the video game market. Combining its 16 development studios, AA

video game publishing and the design and distribution of premium

gaming peripherals, NACON has 30 years of expertise in serving

gamers. This new unified business gives NACON a stronger position

in its market and enables it to innovate by creating new and unique

competitive advantages. Listed on Euronext Paris, compartment

B – Index: CAC Mid&SmallISIN: FR0013482791; Reuters:

NACON.PA; Bloomberg: NACON:FP). CONTACT:Cap

Value – Gilles Broquelet gbroquelet@capvalue.fr - +33 1 80 81 50

01 |

- CP_Nacon_RS 2023_24 English diffusion

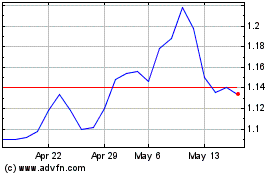

Nacon (EU:NACON)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nacon (EU:NACON)

Historical Stock Chart

From Apr 2023 to Apr 2024