THIS PRESS RELEASE IS NOT BEING MADE IN AND

COPIES OF IT MAY NOT BE DISTRIBUTED OR SENT, DIRECTLY OR

INDIRECTLY, INTO THE UNITED STATES, CANADA, SOUTH AFRICA, JAPAN OR

AUSTRALIA

Regulatory News:

GenSight Biologics (Euronext: SIGHT, ISIN: FR0013183985, PEA-PME

eligible) (the "Company"), a biopharma Company focused on

developing and commercializing innovative gene therapies for

retinal neurodegenerative diseases and central nervous system

disorders, announced today a financing through a capital increase

reserved to specialized investors by the issuance of new shares

with warrants attached, for a total gross amount of c. €1.5 million

(excluding the future net proceeds related to the exercise of the

warrants) (the "Reserved Offering"). The subscription price

for one ABSA is €0.2816 (the "Offering Price").

"This €1.5 million financing reaffirms the strong commitment of

Heights Capital and Sofinnova Partners to our company's success,"

said Jan Eryk Umiastowski, Chief Financial Officer of

GenSight Biologics. "Their continued support provides us with the

necessary operational runway until February 2025, bridging us to

the anticipated first indemnities from the AAC program. This

strategic funding demonstrates our investors' confidence in

GenSight's potential and our ability to execute on our

objectives."

"We continue to interact constructively with the ANSM," said

Laurence Rodriguez, Chief Executive Officer of GenSight

Biologics. "Our entire team remains fully mobilized, including

through the holiday period, to address regulatory requirements with

the highest level of diligence and quality. We are encouraged by

the progress of our discussions and remain confident in our ability

to bring this important therapy to patients who are waiting for

treatment."

Use of Proceeds

The Company intends to use the net proceeds from the Reserved

Offering to finance only its general corporate needs in connection

with the slight delay the Company has experienced in the resumption

of the early access program expected in February 2025.

Working Capital Statement

To date, without taking into account the net proceeds of the

Reserved Offering, the Company does not have sufficient net working

capital to meet its obligations over the next twelve months but

only until early January 2025.

As of December 24, 2024, the Company’s available cash and cash

equivalents amounted to €1.5 million.

Before completion of the Reserved Offering and without taking

into account the potential indemnities generated by the resumption

of AAC, the Company estimates that (i) its net cash requirement for

the next twelve months is approximately €29 million and (ii) it

will need to raise approximately €1.4 million to supplement its

working capital requirements and fund its operating expenses until

the first payments in connection with the potential resumption of

the early access in France (AAC) that is expected in February

2025.

Taking into account the expected net proceeds of the Reserved

Offering for €1.46 million, the Company does not have sufficient

net working capital to meet its obligations over the next 12 months

but only until late February 2025 when the first payments in

connection with the potential resumption of the AAC program are

expected. With the potential indemnities generated by the

resumption of AAC and the net proceeds of the Reserved Offering,

the Company anticipates that it would have sufficient net working

capital to meet its obligations over the next 12 months. In

November 2026, the Company will have to pay the annual rebates on

the 2025 AAC program which will amount to around 50% of the AAC

indemnities generated over the year. Consequently, the Company may

need to seek other sources of debt or equity financing or achieve

partnering or M&A opportunities, in order to supplement its

working capital requirements and fund its operating expenses before

the second half of 2026.

Even though the Company believes in its ability to achieve its

manufacturing objectives, to raise additional funds or achieve

partnership or M&A opportunities, no assurance can be given at

this time as to whether the Company will be able to achieve these

objectives or to obtain funds at attractive terms and

conditions.

Terms of the Reserved Offering

The Reserved Offering, for a total of €1,500,000.40 (share issue

premium included), was carried out through the issuance of

5,326,706 ABSA (as defined below) via a capital increase without

shareholders’ preferential subscription rights reserved to a

category of persons satisfying determined characteristics, pursuant

to Article L. 225-138 of the French Commercial Code and in

accordance with the 23rd resolution of the Company’s combined

general shareholders’ meeting held on May 29, 2024 (the "General

meeting")1, through the issuance of new shares of a per value

of €0.025 (the "New Shares"), to which are attached 1

warrant for 1 new shares (the "Warrants", together with the

New Shares, the "ABSA") and the new shares of the Company

resulting from the exercise of the Warrants (the "Warrants

Shares").

Among Eligible Investors, the Reserved Offering was exclusively

opened (i) in the European Union (including France) to “qualified

investors” within the meaning of Article 2(e) of Regulation (EU)

2017/1129 of the European Parliament and of the Council of June 14,

2017, as amended (the "Prospectus Regulation") and (ii)

outside the European Union to certain institutional and qualified

investors on a private placement basis.

The ABSA will be issued and the price per ABSA determined by the

decision of the Chief Executive Officer of the Company dated

December 24, 2024, pursuant to and within the limits of the

sub-delegation of authority granted by the Company’s Board of

Directors held on December 23, 2024 and in accordance with the 23rd

and 29th resolutions of the General Meeting, it being specified

that in accordance with Article L. 225-38 of the French Commercial

Code and in application of the provisions of the Board of

Directors’ internal rules relating to conflicts of interest,

Sofinnova Partners took no part in the deliberations nor in the

vote relating to this decision.

The Offering Price is €0.2816, equal the volume-weighted average

price of the Company’s shares on Euronext Paris during the last

five trading sessions preceding its setting (i.e. December 17, 18,

19, 20 and 23, 2024) (the "Reference Price") plus a premium

of 3.7%. Taking into account the estimated theoretical value of

100% of a Warrant (i.e., €0.0516, this value was obtained using the

Black & Scholes method with a volatility of 35%), this would

represent a discount of 15.32% compared with the Reference Price,

in accordance with the 23rd resolution of the General Meeting.

Upon settlement of the Reserved Offering, the Warrants will be

exercisable from April 1st, 2025 until November 6, 2029. In no

event, the Warrants will be exercisable before April 1st, 2025.

The exercise of a Warrant will give the right to subscribe to

one (1) Warrant Share (the "Exercise Ratio"), it being

specified that this Exercise Ratio may be adjusted following any

transactions carried out by the Company on its share capital or

reserves, as from the issuance date of the Warrants, in order to

maintain the rights of the Warrants’ holders.

The exercise price of the Warrants will be equal to €0.3465,

i.e. a premium of 27.6% to the Reference Price, payable at the time

of exercise of the Warrants.

Admission to trading of the New Shares

Settlement-delivery of the Reserved Offering and the admission

of the New Shares for trading on the regulated market of Euronext

Paris are expected on December 31, 2024. The New Shares will be

immediately fungible with the existing shares of the Company and

will be traded on the same listing line under the ISIN Code

FR0013183985. Application will be made for the Warrants to be

admitted to Euroclear France.

The Warrants will be detached from New Shares and no application

will be made for their admission on Euronext Paris.

The Warrants Shares will be subject to periodic application for

admission to trading until three business day following the

Exercise Period, i.e., November 9, 2029 at the latest.

Impact of the Reserved Offering on the share capital

Following the settlement and delivery of the Reserved Offering,

expected to occur on December 31, 2024, the Company’s total share

capital will be equal to €3,071,106.25 divided into 122,844,250

shares.

For illustration purposes, the impact of the issuance of the New

Shares and the Warrant Shares on the ownership of a shareholder

holding 1% of the Company’s share capital prior to the Reserved

Offering and not subscribing to it, is as follows:

Ownership interest (in

%)

On a non-diluted basis

On a diluted basis(1)

Prior to the issue of 5,326,706 New

Shares

1.00%

0.64%

Following the issue of 5,326,706 New

Shares

0.96%

0.61%

Following the issue of 5,326,706 New

Shares and 5,326,706 Warrants Shares from the exercise of all the

Warrants

0.92%

0.61%

(1) The calculations are based on the assumption of the exercise

of all the share warrants, founders share warrants, free shares and

stock options outstanding at the date hereof, giving access to a

maximum of 71,303,793 shares

Impact of the Reserved Offering on shareholders'

equity

For illustration purposes, the impact of the issuance of the New

Shares and the Warrant Shares on the Company's equity per share

(calculation made on the basis of the Company's shareholders'

equity at November 30, 2024 increased by the capital increase of

December 2024 for the quarterly amortization payments of the

convertible bonds issued in 2022) is as follows:

Share of equity per share (in

euros)

On a non-diluted basis

On a diluted basis(1)

Prior to the issue of 5,326,706 New

Shares

-0.17

0.06

Following the issue of 5,326,706 New

Shares

-0.15

0.07

Following the issue of 5,326,706 New

Shares and 5,326,706 Warrants Shares from the exercise of all the

Warrants

-0.13

0.07

(1) The calculations are based on the assumption of the exercise

of all the share warrants, founders share warrants, free shares and

stock options outstanding at the date hereof, giving access to a

maximum of 71,303,793 shares

Evolution of the shareholding structure following the

Reserved Offering

To the Company’s knowledge, the breakdown in share ownership

before and after the Reserved Offering is as follows:

The shareholding structure of the Company before the Reserved

Offering:

Shareholders

Shareholders

(non-diluted)

Shareholders (diluted)

Number of

shares and voting

rights

% of share capital and voting

rights

Number of shares and voting

rights

% of share capital and voting

rights

5% Shareholders

Sofinnova

26,360,241

22,43%

34,235,755

18,66%

Invus

17,109,832

14,56%

21,730,085

11.84%

UPMC

10,158,364

8.64%

12,487,477

6.81%

ARMISTICE

2,647,122

2.25%

8,976,235

4.89%

Heights

7,807,707

6.65%

41,850,520

22.81%

Goldman Sachs Group, Inc

6,360,453

5.41%

6,360,453

3.47%

Directors and Officers

167,002

0.14%

2,392,002

1.30%

Employees

80,000

0.07%

548,000

0.30%

Other shareholders (total)

46,826,823

39.85%

54,914,104

29.92%

Total

117,517,544

100.00%

184,494,631

100.00%

The shareholding structure of the Company following the

settlement of the Reserved Offering:

Shareholders

Shareholders

(non-diluted)

Shareholders (diluted)

Number of shares and voting

rights

% of share capital and voting

rights

Number of shares and voting

rights

% of share capital and voting

rights

5% Shareholders

Sofinnova

29,023,594

23.63%

39,562,461

20.38%

Invus

17,109,832

13.93%

21,730,085

11.19%

UPMC

10,158,364

8.27%

12,487,477

6.43%

ARMISTICE

2,647,122

2.15%

8,976,235

4.62%

Heights

10,471,060

8.52%

47,177,226

24.30%

Goldman Sachs Group, Inc

6,360,453

5.18%

6,360,453

3.28%

Directors and Officers

167,002

0.14%

2,392,002

1.23%

Employees

80,000

0.06%

548,000

0.28%

Other shareholders (total)

46,826,823

38.12%

54,914,104

28.28%

Total

122,844,250

100.00%

194,148,043

100.00%

The shareholding structure of the Company following the

settlement of the Reserved Offering and the exercise of all the

Warrants:

Shareholders

Shareholders

(non-diluted)

Shareholders (diluted)

Number of shares and voting

rights

% of share capital and voting

rights

Number of shares and voting

rights

% of share capital and voting

rights

5% Shareholders

Sofinnova

31,686,947

24.72%

39,562,461

20.38%

Invus

17,109,832

13.35%

21,730,085

11.19%

UPMC

10,158,364

7.93%

12,487,477

6.43%

ARMISTICE

2,647,122

2.07%

8,976,235

4.62%

Heights

13,134,413

10.25%

47,177,226

24.30%

Goldman Sachs Group, Inc

6,360,453

4.96%

6,360,453

3.28%

Directors and Officers

167,002

0.13%

2,392,002

1.23%

Employees

80,000

0.06%

548,000

0.28%

Other shareholders (total)

46,826,823

36.53%

54,914,104

28.28%

Total

128,170,956

100.00%

194,148,043

100.00%

Sofinnova Partners, represented on the Company’s Board of

Directors and holding 22.43% of the share capital of the Company

before the Reserved Offering, subscribes for 2,663,353 ABSA of the

Company and will hold, after the completion of the Reserved

Offering (excluding the exercise of the Warrants), 23.63% of the

Company's share capital. After the exercise of all its Warrants,

Sofinnova Partners will hold 24.72% of the Company's share capital.

The representative of Sofinnova Partner on the Company’s Board of

Directors abstained from voting on the Board decisions concerning

the Reserved Offering.

Heights Capital holding 6.64% of the share capital of the

Company before the Reserved Offering, subscribes for 2,663,353 ABSA

of the Company and will hold, after the completion of the Reserved

Offering (excluding the exercise of the Warrants), 8.52% of the

Company's share capital. After the exercise of all its Warrants,

Heights Capital will hold 10.25% of the Company's share

capital.

No Prospectus

The Reserved Offering is not subject to a prospectus requiring

an approval from the French Financial Markets Authority (Autorité

des Marchés Financiers) (the "AMF") in accordance with

Articles 1(4)(a) and 1(5)(a) and (b) of the Prospectus

Regulation.

Information available to the public and risk factors

Detailed information regarding the Company, including its

business, financial information, results, perspectives and related

risk factors are contained in the Company’s 2023 Universal

Registration Document filed with the AMF on April 17, 2024 under

number D. 24-299 (the "2023 Universal Registration

Document"), as amended by an amendment to the 2023 Universal

Registration Document to be filed with the AMF on May 7, 2024 (the

"Amendment to the 2023 Universal Registration Document").

These documents, as well as other regulated information (including

the half-year financial report of the Company for the six-month

period ended June 30, 2024) and all of the Company's press

releases, are available free of charge on the website of the

Company (www.gensight-biologics.com). Your attention is drawn to

the risk factors related to the Company and its activities

presented in chapter 3 of its 2023 Universal Registration Document

and in chapter 2 of the Amendment to the 2023 Universal

Registration Document.

About GenSight Biologics

GenSight Biologics S.A. is a clinical-stage biopharma company

focused on developing and commercializing innovative gene therapies

for retinal neurodegenerative diseases and central nervous system

disorders. GenSight Biologics’ pipeline leverages two core

technology platforms, the Mitochondrial Targeting Sequence (MTS)

and optogenetics, to help preserve or restore vision in patients

suffering from blinding retinal diseases. GenSight Biologics’ lead

product candidate, LUMEVOQ® (GS010; lenadogene nolparvovec), is an

investigational compound and has not been registered in any country

at this stage, developed for the treatment of Leber Hereditary

Optic Neuropathy (LHON), a rare mitochondrial disease affecting

primarily teens and young adults that leads to irreversible

blindness. Using its gene therapy-based approach, GenSight

Biologics’ product candidates are designed to be administered in a

single treatment to each eye by intravitreal injection to offer

patients a sustainable functional visual recovery.

Disclaimer

The distribution of this press release may be restricted by

certain local laws. Recipients of this press release are required

to inform themselves of any such restrictions and, if applicable,

to observe them. This press release does not constitute an offer or

a solicitation of an offer to purchase or subscribe for securities

in France.

This announcement is an advertisement and not a prospectus

within the meaning of the Prospectus Regulation. Any decision to

purchase securities must be made solely on the basis of publicly

available information on the Company.

In France, the Reserved Offering described above will be carried

out exclusively within the framework of offering reserved in favor

of a categories of beneficiaries as referred to in the 23rd

resolution of the General Meeting.

In respect of Member States of the European Economic Area (the

"Member States"), no action has been or will be taken to

permit a public offering of the securities requiring the

publication of a prospectus in any of these Member States.

Consequently, the securities can and will only be offered in any of

the Member State (including France), to qualified investors as

defined in Article 2(e) of the Prospectus Regulation.

This document and the information contained herein do not

constitute either an offer to sell or purchase, or the solicitation

of an offer to sell or purchase, securities of the Company in any

jurisdiction.

No communication and no information in respect of the offering

by the Company of its securities may be distributed to the public

in any jurisdiction where registration or approval is required. No

steps have been taken or will be taken in any jurisdiction where

such steps would be required. The offering or subscription of

securities may be subject to specific legal or regulatory

restrictions in certain jurisdictions.

This announcement does not, and shall not, in any circumstances,

constitute a public offering nor an invitation to the public in

connection with any offer. The distribution of this document may be

restricted by law in certain jurisdictions. Persons into whose

possession this document comes are required to inform themselves

about and to observe any such restrictions.

Not for release, directly or indirectly, in or into the United

States, Canada, South Africa, Japan or Australia. This document

(and the information contained herein) does not contain or

constitute an offer of securities for sale, or solicitation of an

offer to purchase securities, in the United States, Canada, South

Africa, Japan or Australia or any other jurisdiction where such an

offer or solicitation would be unlawful. The securities referred to

herein have not been and will not be registered under the

Securities Act, or under the securities laws of any state or other

jurisdiction of the United States, and may not be offered or sold

in the United States except pursuant to an exemption from, or in a

transaction not subject to, the registration requirements of the

Securities Act and in compliance with the securities laws of any

state or any other jurisdiction of the United States. No public

offering of the securities will be made in the United States.

1 (i) natural or legal persons (including companies), investment

companies, trusts, investment funds or other investment vehicles in

whatever form, whether under French or foreign law, investing on a

regular basis in the pharmaceutical, biotechnological,

ophthalmological, neurodegenerative diseases or medical

technologies sectors; and/or (ii) French or foreign companies,

institutions or entities, whatever their form, exercising a

significant part of their activity in these fields (such investors,

being "Eligible Investors").

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241224221191/en/

GenSight Biologics Chief Financial Officer Jan Eryk

Umiastowski jeumiastowski@GENSIGHT-BIOLOGICS.COM LifeSci

Advisors Investor Relations Guillaume van Renterghem +41 (0)76

735 01 31

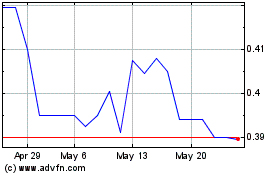

GenSight Biologics (EU:SIGHT)

Historical Stock Chart

From Dec 2024 to Jan 2025

GenSight Biologics (EU:SIGHT)

Historical Stock Chart

From Jan 2024 to Jan 2025