SMCP - 2023 FY Results

Full-year 2023 Results Press

release - Paris, February 28th, 2024

Good sales resilience; profitability

impacted by inflationary environmentAcceleration

in 2024 of action plan to boost growth and

profitability

- FY 2023 Sales

at €1,231m, a progression of +4% at constant exchange rates (+3% on

an organic1 basis) vs. 2022, which was a high basis of

comparison

- Growth driven

by APAC despite a lower-than-expected sales trend in China. Good

resilience in the Americas, with a sequential improvement of the

second half. Europe, and France in particular, impacted by the

slowdown in demand, which progressively intensified throughout the

year

- Q4 sales at

€326m, in line with 2022 at constant exchange rates (-1% on an

organic1 basis)

- Store network

expansion with 47 net openings in 2023 to reach 1,730 POS

- Adjusted EBIT

improvement in H2 to reach €79.5m (6.5% of sales) in full-year

- Net profit of

€11m, €37m excluding non-recurring impacts (non-cash)

- Improvement of

cash generation in H2 (€23m); net debt reduction vs 2022

- Major

achievements in ESG ratings: Sustainalytics score improvement, CDP

A- (from B in 2022) and validation of carbon footprint strategy by

SBTi

- Acceleration

in 2024 of mid-term action plan through 4 key priorities:

- Reignite growth and gain market

shares

- Mitigate risk across

geographies

- Improve efficiency

- Protect profit, cash and

liquidity

Commenting on those results, Isabelle

Guichot, CEO of SMCP, stated: “In a deteriorating

macroeconomic environment marked by a slowdown in consumption and

high inflation, SMCP achieved double-digit growth in Asia and

resilient sales in Europe and the United States. Although the

Group's profitability has been impacted and despite an improvement

in the second half of the year, we have been able to preserve the

company's financial strength. A similar trend is expected for 2024,

at least in the first half of the year. We have therefore decided

to accelerate our action plan to revive our profitable growth

momentum. We will particularly intensify our efforts to enhance the

desirability of our brands and in digital, optimize our store

network across various regions and deeper delve into cost

management, while maintaining our focus on profitability and cash

generation. We expect to see the first benefits of this plan by

2024, with further acceleration from 2025 onwards.”

| €m

except % |

Q4 2022 |

Q4 2023 |

Organic change |

Reported change |

|

FY 2022 |

FY 2023 |

Organic change |

Reported change |

|

Sales by region |

|

|

|

|

|

| France |

119.8 |

111.7 |

-6.7% |

-6.7% |

|

413.6 |

413.2 |

-0.1% |

-0.1% |

| EMEA ex.

France |

105.0 |

103.2 |

-2.0% |

-1.7% |

|

377.0 |

388.8 |

+3.2% |

+3.1% |

| America |

52.2 |

50.4 |

+1.3% |

-3.5% |

|

184.3 |

173.4 |

-3.0% |

-6.0% |

|

Asia Pacific |

55.0 |

60.5 |

+11.3% |

+10.0% |

|

230.9 |

255.2 |

+12.5% |

+10.6% |

|

|

|

|

|

|

|

| Sandro |

165.0 |

162.6 |

-0.4% |

-1.5% |

|

582.0 |

601.4 |

+4.2% |

+3.3% |

| Maje |

123.6 |

121.6 |

-0.6% |

-1.6% |

|

467.4 |

462.5 |

+0.0% |

-1.1% |

| Other

brands1F1F2 |

43.4 |

41.6 |

-4.4% |

-4.2% |

|

156.4 |

166.6 |

+6.5% |

+6.5% |

|

TOTAL |

332.0 |

325.8 |

-1.0% |

-1.9% |

|

1,205.8 |

1,230.5 |

+2.9% |

+2.1% |

SALES BREAKDOWN

BY REGION

In France, sales reached €413m,

stable in organic vs 2022 which was a high basis of comparison. The

second semester was impacted by traffic slowdown, especially in

December, due to the persistent inflation which affected consumer

purchasing power. Sandro and the “Other brands” showed a positive

annual performance. Digital sales also performed well.The network

is growing with 12 net POS openings in 2023.

In EMEA, sales reached €389m,

an organic increase of +3% compared to 2022, driven by

like-for-like network, despite a high basis of comparison. After a

good performance in the first semester (+9%), the second semester

was impacted by inflation and demand slowdown. However, several

European countries performed well (Germany, Spain and Middle East),

while the year was tougher in the UK and in Switzerland due to low

tourism flow.The network remains nearly stable with one net POS

opening in 2023. The openings offset the definitive closure of the

POS of the former partner in Russia.

In America, after two years in

a row of outstanding performance, sales reached €173m, and recorded

a slight organic decrease of 3% compared to 2022. The trend

sequentially improved during the second semester with a positive

organic growth in Q4. US sales remained resilient, and Canada

returned to growth in Q4.The network increased by 17 net POS

openings in 2023.

In APAC, sales reached €255m,

+13% organic vs 2022. Except for Korea and Taiwan, all the markets

are progressing. Greater China sales signed a double-digit growth

vs 2022. The rest of the region benefited from a good performance

in Hong-Kong, Macau, Singapore, and Malaysia, and from the

internalization of Australia & New-Zealand network.The network

increased by 17 net POS openings in 2023.

Unless stated

otherwise, all figures used to analyze the performance are

disclosed by taking into account the impact of the application of

IFRS 16.

|

KEY FIGURES (€m) |

2022 |

2023 |

Change as reported |

|

Sales |

1,205.8 |

1,230.5 |

+2.1% |

| Adjusted

EBITDA |

266.6 |

236.4 |

-11.3% |

| Adjusted

EBIT |

110.5 |

79.5 |

-28.0% |

| Net Income

Group Share |

51.3 |

11.2 |

-78.2% |

| EPS2F2F3

(€) |

0.68 |

0.15 |

-78.2% |

| Diluted

EPS3F3F4 (€) |

0.65 |

0.14 |

-77.9% |

| FCF |

34.3 |

14.4 |

-57.9% |

2023

CONSOLIDATED RESULTS

Adjusted EBITDA reached €236m

in 2023 (adjusted EBITDA margin of 19% of sales), compared with

€267m in 2022.

Management gross margin (73.8%, -0.7pp vs 2022)

remained at a high level with an improvement in H2 (74.4% in H2 vs

73.1% in H1) due to a very strict full-price strategy. The average

in-season discount rate remains nearly stable vs 2022, despite a

challenging and very promotional environment in several

markets.Total Opex (store costs4F4F5 and general

and administrative expenses) have been impacted by inflation

specially on rents and staff costs in stores and HQ. This increase

has been controlled in particular in the second semester (vs 2022:

+10% in H1 vs +3% in H2) resulting from savings plan

implemented.

Depreciation, amortization, and

provisions remained nearly stable at -€157m in 2023, vs

-€156m in 2022. Excluding IFRS 16, depreciation and amortization

represented 3.8% of sales in 2023, nearly stable vs 2022 (4.1% in

2022).

As a result, adjusted EBIT

reached €79.5m in 2023 compared with €111m in 2022. The adjusted

EBIT margin is 6.5% in 2023 (9.2% in 2022).

Other non-current expenses

reached -€26m, increasing vs 2022 (-€12m), including impairment of

stores and goodwill (with no impact on cash).

Financial expenses are

increasing at -€28m in 2023 (vs -€24m in 2022) due to the increase

in interest rates.

With an income tax expense at

-€11m in 2023 (vs -€17m in 2022), Net income - Group

share remains positive at €11m (€51m in 2022). Excluding

the non-cash impairment effect, the net income stands at €37m.

2023 BALANCE

SHEET AND NET FINANCIAL DEBT

The Group maintained a strict control over its

inventories and investments during the year. Inventories went down

from €292m year-end 2022 to €282m as of December 31st, 2023.

Capex increased as a percentage of sales,

representing 4.5% of sales in 2023, compared with 3.7% in FY

2022.

Net financial debt stands at

€286m as of December 31st, 2023, vs €293M on December 31st, 2022,

and €306m on June 30th, 2023. The net debt/EBITDA ratio is at

2.55x. The slight gap with the contract level of 2.50x has been

waived by the pool of banks.As a reminder, the maturity of the main

lines of financing (including the revolving credit facility) has

been renegotiated and extended to 2026 and 2027 depending on the

lines, confirming SMCP's financial flexibility.

CONCLUSION AND

OUTLOOK

After 2023 was impacted by a challenging

macroeconomic environment, 2024 should see a similar trend,

especially in the first half of the year. Given the lack of

visibility on the timing of the turnaround in consumer demand, the

Group will not provide financial guidance for 2024. The management

team is fully committed to accelerating its action plan to foster

growth through new development opportunities and to protect

profitability through significant savings. The action plan is

articulated around four key priorities:

1. Reignite growth and

gain market share by working on brand desirability,

maintaining brand relevance, and positioning, and maximizing the

product offer. To this end, the Group will seize new digital

opportunities and enhance its business model with new opportunities

of development

2. Mitigate risk across

geographies

- Review

systematically the existing network by closing the less

contributive points of sales (in particular 15% of China network)

to improve retail productivity

- Accelerate

opportunities with partners, such as Middle East and Latin

America

- Challenge

operations in low contributive countries (mutualization,

externalization and/or closing)

3. Improve

efficiency with more agility in the way we execute

projects, as well as through a strict inventory management

4. Continue to protect

profits, cash and liquidity by

- Shifting

savings from a one-off to a recurrent approach

- prioritizing

the most productive investments

- and adjusting

the organization to optimize smaller brands

The initial benefits are expected in 2024 with

full effect from 2025 onwards. Management will provide an update on

mid-term plan during next publication (end of April).

OTHER

INFORMATION

The Board of Directors held a meeting today and

approved the consolidated accounts for the year of 2023. The review

procedures have been carried out by the statutory auditors and the

related report is being issued.

FINANCIAL

CALENDAR

April 25, 2024 – 2024 Q1 Sales publication

A conference call with

investors and analysts will be held today by CEO Isabelle Guichot

and CFO Patricia Huyghues Despointes, from 6:00 p.m. (Paris time).

Related slides will also be available on the website

(www.smcp.com), in the Finance section.

FINANCIAL INDICATORS NOT DEFINED IN

IFRS

The Group uses certain key financial and

non-financial measures to analyze the performance of its business.

The principal performance indicators used include the number of its

points of sale, like-for-like sales growth, Adjusted EBITDA and

Adjusted EBITDA margin, Adjusted EBIT and Adjusted EBIT margin.

Number of points of sale

The number of the Group’s points of sale

comprises total retail points of sale open at the relevant date,

which includes (i) directly-operated stores, including

free-standing stores, concessions in department stores,

affiliate-operated stores, factory outlets and online stores, and

(ii) partnered retail points of sale.

Organic sales growth

Organic sales growth refers to the performance

of the Group at constant currency and scope, i.e. excluding the

acquisition of Fursac.

Like-for-like sales growth

Like-for-like sales growth corresponds to retail

sales from directly operated points of sale on a like-for-like

basis in a given period compared with the same period in the

previous year, expressed as a percentage change between the two

periods. Like-for-like points of sale for a given period include

all of the Group’s points of sale that were open at the beginning

of the previous period and exclude points of sale closed during the

period, including points of sale closed for renovation for more

than one month, as well as points of sale that changed their

activity (for example, Sandro points of sale changing from Sandro

Femme to Sandro Homme or to a mixed Sandro Femme and Sandro Homme

store). Like-for-like sales growth percentage is presented at

constant exchange rates (sales for year N and year N-1 in foreign

currencies are converted at the average N-1 rate, as presented in

the annexes to the Group's consolidated financial statements as of

December 31 for the year N in question).

Adjusted EBITDA and adjusted EBITDA

margin

Adjusted EBITDA is defined by the Group as

operating income before depreciation, amortization, provisions, and

charges related to share-based long-term incentive plans (LTIP).

Consequently, Adjusted EBITDA corresponds to EBITDA before charges

related to LTIP.Adjusted EBITDA is not a standardized accounting

measure that meets a single generally accepted definition. It must

not be considered as a substitute for operating income, net income,

cash flow from operating activities, or as a measure of liquidity.

Adjusted EBITDA margin corresponds to adjusted EBITDA divided by

net sales.

Adjusted EBIT and adjusted EBIT

margin

Adjusted EBIT is defined by the Group as earning

before interests, taxes, and charges related to share-based

long-term incentive plans (LTIP). Consequently, Adjusted EBIT

corresponds to EBIT before charges related to LTIP. Adjusted EBIT

margin corresponds to Adjusted EBIT divided by net sales.

Management Gross margin

Management gross margin corresponds to the sales

after deducting rebates and cost of sales only. The accounting

gross margin (as appearing in the accounts) corresponds to the

sales after deducting the rebates, the cost of sales and the

commissions paid to the department stores and affiliates.

Retail Margin

Retail margin corresponds to the management

gross margin after taking into account the points of sale’s direct

expenses such as rent, personnel costs, commissions paid to the

department stores and other operating costs. The table below

summarizes the reconciliation of the management gross margin and

the retail margin with the accounting gross margin as included in

the Group’s financial statements for the following periods:

|

(€m) – excluding IFRS 16 |

2022 |

2023 |

|

Gross margin (as appearing in the accounts) |

769.2 |

775.2 |

| Readjustment

of the commissions and other adjustments |

128.3 |

135.2 |

|

Management Gross margin |

897.5 |

910.4 |

| Direct costs

of point of sales |

-514.5 |

-554.5 |

| Retail

margin |

383.0 |

355.9 |

Net financial debt

Net financial debt represents the net financial

debt portion bearing interest. It corresponds to current and

non-current financial debt, net of cash and cash equivalents and

net of current bank overdrafts.

***

METHODOLOGY NOTE

Unless otherwise indicated, amounts are

expressed in millions of euros and rounded to the first digit after

the decimal point. In general, figures presented in this press

release are rounded to the nearest full unit. As a result, the sum

of rounded amounts may show non-material differences with the total

as reported. Note that ratios and differences are calculated based

on underlying amounts and not based on rounded amounts.

***

DISCLAIMER: FORWARD-LOOKING STATEMENTS

Certain information contained in this document

includes projections and forecasts. These projections and forecasts

are based on SMCP management's current views and assumptions. Such

forward-looking statements are not guarantees of future performance

of the Group. Actual results or performances may differ materially

from those in such projections and forecasts as a result of

numerous factors, risks and uncertainties, including the impact of

the current COVID-19 outbreak. These risks and uncertainties

include those discussed or identified under Chapter 3 “Risk factors

and internal control” of the Company’s Universal Registration

Document filed with the French Financial Markets Authority

(Autorité des Marchés Financiers - AMF) on 11 April 2023 and

available on SMCP's website (www.smcp.com).This document has not

been independently verified. SMCP makes no representation or

undertaking as to the accuracy or completeness of such information.

None of the SMCP or any of its affiliate’s representatives shall

bear any liability (in negligence or otherwise) for any loss

arising from any use of this document or its contents or otherwise

arising in connection with this document.

APPENDICES

Breakdown of DOS

|

Number of DOS |

2022 |

Q1-23 |

Q2-23 |

Q3-23 |

2023 |

|

Q4-23 variation |

annual variation |

| |

|

|

|

|

|

|

|

|

| By

region |

|

|

|

|

|

|

|

|

| France |

460 |

456 |

463 |

463 |

472 |

|

+9 |

+12 |

| EMEA |

395 |

391 |

399 |

401 |

409 |

|

+8 |

+14 |

| America |

166 |

164 |

167 |

171 |

176 |

|

+5 |

+10 |

| APAC |

259 |

305 |

301 |

314 |

316 |

|

+2 |

+57* |

| |

|

|

|

|

|

|

|

|

| By

brand |

|

|

|

|

|

|

|

|

| Sandro |

551 |

569 |

575 |

583 |

591 |

|

+8 |

+40 |

| Maje |

457 |

476 |

477 |

485 |

490 |

|

+5 |

+33 |

| Claudie

Pierlot |

201 |

203 |

206 |

206 |

210 |

|

+4 |

+9 |

| Suite 341 |

2 |

- |

- |

- |

- |

|

- |

-2 |

| Fursac |

69 |

68 |

72 |

75 |

82 |

|

+7 |

+13 |

|

Total DOS |

1,280 |

1,316 |

1,330 |

1,349 |

1,373 |

|

+24 |

+93* |

Breakdown of POS

|

Number of POS |

2022 |

Q1-23 |

Q2-23 |

Q3-23 |

2023 |

|

Q4-23 variation |

annual variation |

| |

|

|

|

|

|

|

|

|

| By

region |

|

|

|

|

|

|

|

|

| France |

461 |

457 |

464 |

464 |

473 |

|

+9 |

+12 |

| EMEA |

552 |

505 |

520 |

540 |

553 |

|

+13 |

+1 |

| America |

198 |

196 |

200 |

209 |

215 |

|

+6 |

+17 |

| APAC |

472 |

477 |

474 |

491 |

489 |

|

-2 |

+17 |

| |

|

|

|

|

|

|

|

|

| By

brand |

|

|

|

|

|

|

|

|

| Sandro |

752 |

733 |

744 |

765 |

775 |

|

+10 |

+23 |

| Maje |

627 |

611 |

615 |

633 |

640 |

|

+7 |

+13 |

| Claudie

Pierlot |

233 |

223 |

227 |

231 |

233 |

|

+2 |

- |

| Suite 341 |

2 |

- |

- |

- |

- |

|

- |

-2 |

| Fursac |

69 |

68 |

72 |

75 |

82 |

|

+7 |

+13 |

|

Total POS |

1,683 |

1,635 |

1,658 |

1,704 |

1,730 |

|

+26 |

+47 |

|

o/w Partners POS |

403 |

319 |

328 |

355 |

357 |

|

+2 |

-46* |

* Including the stores operated in Retail in Australia and New

Zealand from January 2023.

CONSOLIDATED FINANCIAL STATEMENTS

|

INCOME STATEMENT (€m) |

2022 |

2023 |

|

Sales |

1 205.8 |

1 230.5 |

| Adjusted

EBITDA |

266.6 |

236.4 |

| D&A |

-156.1 |

-156.9 |

|

Adjusted EBIT |

110.5 |

79.5 |

| Allocation of

LTIP |

-5.6 |

-3.0 |

|

EBIT |

104.9 |

76.5 |

| Other

non-recurring income and expenses |

-12.4 |

-25.9 |

|

Operating profit |

92.5 |

50.5 |

| Financial

result |

-23.8 |

-27.9 |

| Profit

before tax |

68.7 |

22.6 |

| Income tax |

-17.4 |

-11.4 |

| Net

income - Group share |

51.3 |

11.2 |

|

BALANCE SHEET - ASSETS (€m) |

2022 |

2023 |

|

Goodwill |

626.3 |

626.7 |

|

Trademarks, other intangible & right-of-use assets |

1 128.5 |

1 120.4 |

|

Property, plant and equipment |

82.5 |

83.1 |

|

Non-current financial assets |

18.7 |

18.5 |

|

Deferred tax assets |

35.7 |

32.0 |

|

Non-current assets |

1 891.7 |

1 880.7 |

|

Inventories and work in progress |

291.6 |

281.8 |

|

Accounts receivables |

62.9 |

68.2 |

|

Other receivables |

61.4 |

69.2 |

|

Cash and cash equivalents |

73.3 |

50.9 |

|

Current assets |

489.2 |

470.1 |

|

|

|

|

|

Total assets |

2 380.9 |

2 350.8 |

|

|

|

|

|

|

BALANCE SHEET - EQUITY & LIABILITIES (€m) |

2022 |

2023 |

|

Total Equity |

1 172.1 |

1 180.1 |

|

Non-current lease liabilities |

302.9 |

305.7 |

|

Non-current financial debt |

261.9 |

223.5 |

|

Other financial liabilities |

0.1 |

0.1 |

|

Provisions and other non-current liabilities |

0.7 |

0.7 |

|

Net employee defined benefit liabilities |

4.2 |

4.9 |

|

Deferred tax liabilities |

169.2 |

166.9 |

|

Non-current liabilities |

739.0 |

701.8 |

|

Trade and other payables |

171.8 |

161.9 |

|

Current lease liabilities |

100.0 |

106.6 |

|

Bank overdrafts and short-term financial borrowings and debt |

104.2 |

113.6 |

|

Short-term provisions |

1.6 |

1.3 |

|

Other current liabilities |

92.2 |

85.5 |

|

Current liabilities |

469.8 |

468.9 |

|

|

|

|

|

Total Equity & Liabilities |

2 380.9 |

2 350.8 |

|

NET FINANCIAL DEBT (€m) |

2022 |

2023 |

| Non-current

financial debt & other financial liabilities |

-262.0 |

-223.6 |

| Bank

overdrafts and short-term financial liability |

-104.2 |

-113.6 |

| Cash and cash

equivalents |

73.3 |

50.9 |

|

Net financial debt |

-292.9 |

-286.3 |

| adjusted

EBITDA (excl. IFRS) – 12 months |

151.3 |

112.4 |

|

Net financial debt / adjusted EBITDA |

1,9x |

2.5X |

|

CASH FLOW STATEMENT (€m) |

2022 |

2023 |

| Adjusted

EBIT |

110.5 |

79.5 |

| D&A |

156.1 |

156.9 |

| Changes in

working capital |

-45.4 |

-3.7 |

| Income tax

expense |

-12.2 |

-16.9 |

|

Net cash flow from operating activities |

208.9 |

215.8 |

| Capital

expenditure |

-44.5 |

-55.6 |

| Others |

- |

-6.1 |

|

Net cash flow from investing activities |

-44.5 |

-61.7 |

| Treasury

shares purchase program |

-7.4 |

-2.4 |

| Change in

short-term borrowings and debt |

-85.0 |

-43.6 |

| Net interests

paid |

-9.9 |

-16.3 |

| Other

financial income and expenses |

0.5 |

-0.8 |

| Reimbursement

of rent lease |

-120.9 |

-128.2 |

|

Net cash flow from financing activities |

-222.7 |

-191.3 |

| Net foreign

exchange difference |

0.2 |

-0.5 |

|

Change in net cash |

-58.1 |

-37.7 |

|

FCF (€m) |

2022 |

2023 |

| Adjusted

EBIT |

110.5 |

79.5 |

| D&A |

156.1 |

156.9 |

| Change in

working capital |

-45.4 |

-3.7 |

| Income

tax |

-12.2 |

-16.9 |

|

Net cash flow from operating activities |

208.9 |

215.8 |

| Capital

expenditure (operating and financial) |

-44.5 |

-55.6 |

| Reimbursement

of rent lease |

-120.9 |

-128.2 |

| Interest &

Other financial |

-9.4 |

-17.1 |

| Other &

FX |

0.2 |

-0.5 |

|

Free cash-flow |

34.3 |

14.4 |

ABOUT SMCP

SMCP is a global leader in the accessible luxury

market with four unique Parisian brands: Sandro, Maje, Claudie

Pierlot and Fursac. Present in 47 countries, the Group comprises a

network of over 1,600 stores globally and a strong digital presence

in all its key markets. Evelyne Chetrite and Judith Milgrom founded

Sandro and Maje in Paris, in 1984 and 1998 respectively, and

continue to provide creative direction for the brands. Claudie

Pierlot and Fursac were respectively acquired by SMCP in 2009 and

2019. SMCP is listed on the Euronext Paris regulated market

(compartment A, ISIN Code FR0013214145, ticker: SMCP).

CONTACTS

|

INVESTORS/PRESS

|

|

| |

|

|

SMCP

|

BRUNSWICK |

|

Amélie

Dernis |

Hugues Boëton |

|

|

Tristan Roquet Montegon |

|

+33 (0) 1 55 80 51

00 |

+33 (0) 1 53 96 83 83 |

|

amelie.dernis@smcp.com |

smcp@brunswickgroup.com |

| |

|

| |

|

| |

|

| |

|

| |

|

1 Organic growth | All references in this document to the

“organic sales performance” refer to the performance of the Group

at constant currency and scope

2 Claudie Pierlot and Fursac brands3 Net Income

Group Share divided by the average number of ordinary shares as of

December 31st, 2023, minus existing treasury shares held by the

Group.4 Net Income Group Share divided by the average number of

common shares as of December 31 st, 2023, minus the treasury shares

held by the company, plus the common shares that may be issued in

the future. This includes the conversion of the Class G preferred

shares and the performance bonus shares – LTIP which are prorated

according to the performance criteria reached as of December 31st,

2023.5 Excluding IFRS 16

- SMCP - Press Release - 2023 FY Results

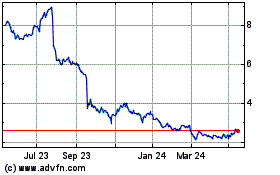

SMCP (EU:SMCP)

Historical Stock Chart

From Jan 2025 to Feb 2025

SMCP (EU:SMCP)

Historical Stock Chart

From Feb 2024 to Feb 2025