Van Lanschot Kempen: first-quarter 2023 trading update

04 May 2023 - 3:30PM

Van Lanschot Kempen: first-quarter 2023 trading update

Amsterdam/’s-Hertogenbosch, the Netherlands, 4 May 2023

- Solid quarterly

result; slight

decrease compared with Q1

2022, reflecting

strong results at Private

Clients, reduced profits

at Investment Banking

Clients and a lower

result from financial

transactions

- Strong net AuM

inflows of

€2.2

billion, with

€1.3

billion at Private

Clients and

€1.0 billion

at Wholesale & Institutional

Clients, both within fiduciary management and

investment strategies

- Client assets up to

€128.3

billion

(2022:

€124.2

billion) and

AuM to

€112.8

billion

(2022:

€107.8

billion)

- Robust capital ratio at

20.4%

(2022:

20.6%)

Jeroen Kroes, Van

Lanschot Kempen’s Chief Financial

Officer, said: “Encouraged by favourable

market conditions, our clients increased their investments. This

resulted in net inflows of €1.3 billion at Private Clients, and an

increase in assets under management (AuM). In addition to this

organic growth, we completed the acquisition of the remaining stake

in Belgian wealth manager Mercier Vanderlinden in the quarter. We

also took a major step with Evi van Lanschot with our intended

acquisition of Robeco’s online investment platform (AuM: €4.7

billion). This acquisition is expected to complete this summer.

Van Lanschot Kempen shares have been included in both the

Euronext AMX Index and the AEX ESG Index since March 2023,

underlining our growth both as an organisation and in terms of

sustainability in the past few years. For us this is a great

motivation to continue on our track and help our clients navigate

through the key transitions of our time.”

In the first quarter client assets increased to €128.3 billion

(2022: €124.2 billion) and AuM to €112.8 billion (2022: €107.8

billion). Savings came down in the quarter to €11.6 billion (2022:

€12.7 billion), mostly as clients converted savings into

investments. The loan portfolio remained stable at

€9.4 billion and the addition to loan loss provisions was

minor.

Thanks in part to increased interest income, first-quarter

results at Private Clients were strong, whereas less favourable

conditions for mergers and acquisitions caused a decrease at

Investment Banking Clients. The result from financial transactions

also was lower than in the first quarter of 2022. Wholesale &

Institutional Clients continues to focus on achieving profitable

growth for investment strategies in Western Europe and for

fiduciary management in the Netherlands and the United Kingdom.

Our CET 1 ratio remains strong at 20.4% (2022: 20.6%) and Van

Lanschot Kempen plans to return €2.00 per share to its

shareholders in the second half of 2023 (about €85 million in

total), subject to regulatory approval.

In April 2023 Van Lanschot Kempen completed its accelerated

acquisition of the remaining 30% stake in Mercier Vanderlinden, for

which it paid 53% in cash and 47% in shares, with a lock-up period

until 2030. As a result, Mercier Vanderlinden’s managing partners

obtained a 3.9% stake in Van Lanschot Kempen. Together with the Van

Lanschot Belgium team they are currently preparing for the start of

Mercier Van Lanschot to realise our growth ambitions within private

banking in Belgium.

At the end of March, four of the 10-strong small-cap team at Van

Lanschot Kempen Investment Management announced their intention to

leave. The quality of the team’s investment process is safeguarded

by the Head of the Small-Cap Strategy and the team consisting of

five small-cap managers, complemented by experienced sector

specialists from Van Lanschot Kempen Investment Management’s other

investment teams. Two new people have since been hired to help

return the team back to full strength.

Private Banking boosted its presence in the Groningen region

with the addition of four new Private Banking colleagues, enabling

Van Lanschot Kempen to respond even better to growth opportunities

in this area.

FINANCIAL CALENDAR25 May

2023 Annual

General Meeting29 May 2023

Ex-dividend date6 June

2023 2022

dividend payment date24 August 2023

Publication of 2023 half-year results2 November

2023 Publication of

2023 third-quarter trading update

Media Relations: +

31 20 354 45 85;

mediarelations@vanlanschotkempen.comInvestor

Relations: +31

20 354 45 90;

investorrelations@vanlanschotkempen.com

About Van Lanschot Kempen Van Lanschot Kempen

is an independent, specialist wealth manager active in private

banking, investment management and investment banking, with the aim

of preserving and creating wealth, in a sustainable way, for both

its clients and the society of which it is part. Through our

long-term focus, we create positive financial and non-financial

value. Listed at Euronext Amsterdam, Van Lanschot Kempen is the

Netherlands’ oldest independent financial services company, with a

history dating back to 1737.

For more information, please visit vanlanschotkempen.com

Disclaimer and cautionary note on forward-looking

statements This press release may contain forward-looking

statements on future events and developments. These forward-looking

statements are based on the current insights, information and

assumptions of Van Lanschot Kempen’s management about known and

unknown risks, developments and uncertainties. Forward-looking

statements do not relate strictly to historical or current facts

and are subject to such risks, developments and uncertainties which

by their very nature fall outside the control of Van Lanschot

Kempen and its management. Actual results, performances and

circumstances may differ significantly from these forward-looking

statements.

Van Lanschot Kempen cautions that forward-looking statements and

targets in this press release are only valid on the specific dates

on which they are expressed, and accepts no responsibility or

obligation to revise or update any information, whether as a result

of new information or for any other reason.

The figures in this press release have not been audited.

Percentages are calculated based on unrounded figures.

This press release does not constitute an offer or solicitation

for the sale, purchase or acquisition in any other way or

subscription to any financial instrument and is not a

recommendation to perform or refrain from performing any

action.

Elements of this press release contain information about Van

Lanschot Kempen NV within the meaning of Article 7(1) to (4) of EU

Regulation No. 596/2014.

This press release is a translation of the Dutch language

original and is provided as a courtesy only. In the event of any

disparities, the Dutch language version will prevail. No rights can

be derived from any translation thereof.

- Van Lanschot Kempen press release Q1 2023

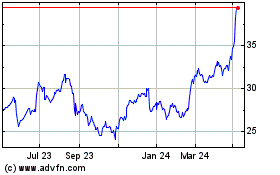

Van Lanschot Kempen NV (EU:VLK)

Historical Stock Chart

From Oct 2024 to Nov 2024

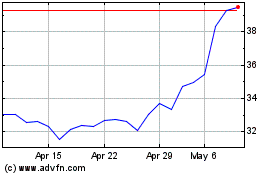

Van Lanschot Kempen NV (EU:VLK)

Historical Stock Chart

From Nov 2023 to Nov 2024