Australian Dollar Rises On RBA's Rate Hike Speculation

06 February 2024 - 1:26PM

RTTF2

The Australian dollar strengthened against other major

currencies in the Asian session on Tuesday, after the Reserve Bank

of Australia kept interest rates steady, as widely expected.

Meanwhile, the central bank signals more rate hikes if inflation

remain in the target range.

The policy board of the RBA, governed by Michele Bullock,

decided to maintain the cash rate target at 4.35 percent. The RBA

board also maintained the interest rate paid on exchange settlement

balances at 4.25 percent.

The RBA has increased its cash rate target by 425 basis points

since May last year. The current 4.35 percent is the highest since

late 2011.

Although recent data suggests that inflation is easing, it

remains high, the bank said. "The Board expects that it will be

some time yet before inflation is sustainably in the target

range."

"The path of interest rates that will best ensure that inflation

returns to target in a reasonable timeframe will depend upon the

data and the evolving assessment of risks, and a further increase

in interest rates cannot be ruled out," the bank added.

Crude oil prices settled higher as concerns about trade and

supply disruptions outweighed a firm dollar. West Texas

Intermediate Crude oil futures for March settled lower by $0.50 or

0.7 percent a barrel at $72.78 a barrel.

In the Asian trading today, the Australian dollar rose to 4-day

highs of 1.6494 against the euro and 0.8808 against the Canadian

dollar from yesterday's closing quotes of 1.6565 and 0.8775,

respectively. The aussie may test resistance near 1.62 against the

euro and 0.89 against the loonie.

Against the yen, the aussie advanced to 96.81 from Monday's

closing value of 96.37. On the upside, 98.00 is seen as the next

resistance level for the aussie.

Against the U.S. and the New Zealand dollars, the aussie edged

up to 0.6518 and 1.0732 from yesterday's closing quotes of 0.6482

and 1.0702, respectively. If the aussie extends its uptrend, it may

find resistance around 0.67 against the greenback and 1.08 against

the kiwi.

At the same time, the other anipodean currencue, or the NZ

dollar also strengthened against its most major rivals after the

RBA monetary policy decision.

The NZ dollar rose to a 4-day high of 1.7692 against the euro

from yesterday's closing value of 1.7733. The kiwi may test

resistance around the 1.74 region.

Against the U.S. dollar and the yen, the kiwi edged up to 0.6078

and 90.24 from Monday's closing quotes of 0.6053 and 89.99,

respectively. If the kiwi extends its uptrend, it could find

resistance around 0.62 against the greenback and 91.00 against the

yen.

Looking ahead, Construction PMI reports from various European

economies and U.K., for January and Eurozone retail sales data for

December are slated for release in the European session.

In the New York session, Canada building permits for December,

U.S. Redbook report and Canada Ivey PMI for January are set to be

published.

At 12:00 pm ET, Federal Reserve Bank of Cleveland President

Loretta Mester will give a keynote before the Ohio Bankers League

Economic Summit, in Ohio, Columbus.

At 1:00 pm ET, Bank of Canada Governor Tiff Macklem will give a

speech in Montreal, Canada.

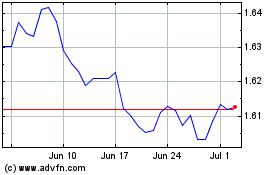

Euro vs AUD (FX:EURAUD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs AUD (FX:EURAUD)

Forex Chart

From Apr 2023 to Apr 2024