Pound Climbs On Fed Optimism

06 November 2023 - 6:30PM

RTTF2

The pound advanced against its major counterparts in the

European session on Monday, on optimism the Federal Reserve has

finished raising interest rates.

Weak U.S. jobs and service sector activity data released on

Friday reinforced expectations that the Fed may not hike interest

rates any further. Futures markets currently imply an 86 percent

chance the first policy easing would come as soon as June.

Markets also expect the European Central Bank to cut rates by

April, and the Bank of England in August.

Oil prices rose as top exporters Saudi Arabia and Russia said

they would continue with oil supply curbs of more than 1 million

barrels a day through year-end.

The U.S. economic calendar is relatively quiet this week, with

reports on initial jobless claims, the U.S. trade deficit and

consumer sentiment along with remarks by Fed Chair Jerome Powell

awaited.

The pound appreciated to near a 2-month high of 1.2426 against

the greenback and more than a 4-week high of 1.1144 against the

franc, off its early lows of 1.2362 and 1.1096, respectively. The

pound is seen facing resistance around 1.27 against the greenback

and 1.13 against the franc.

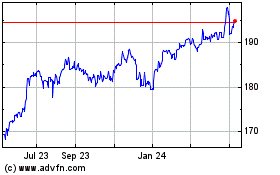

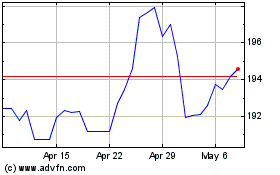

The pound moved up to more than a 2-month high of 185.91 against

the yen and near a 3-week high of 0.8650 against the euro, from its

previous lows of 184.67 and 0.8676, respectively. The pound is

likely to face resistance around 188.00 against the yen and 0.84

against the euro.

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Jun 2024 to Jul 2024

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Jul 2023 to Jul 2024