Pound Falls Amid Risk Aversion

14 June 2024 - 9:08PM

RTTF2

The pound lost ground against its major counterparts on Friday,

as European shares fell amid persistent concerns about the upcoming

parliamentary elections in France.

Political uncertainty in France weighed after the country's

finance chief warned that a new left-wing coalition coming to power

in France would lead to the country's exit from the European

Union.

Elsewhere, Nigel Farage's Reform UK has surpassed Prime Minister

Rishi Sunak's Conservatives in a YouGov poll.

The poll for the Times newspaper puts Reform UK at 19 percent,

up from 17 percent previously, and the Conservative Party unchanged

at 18 percent in voting intention.

In economic releases, France's consumer price inflation

accelerated in May on higher energy and food prices, final data

from the statistical office INSEE showed.

The consumer price index climbed 2.3 percent on a yearly basis

in May, faster than the 2.2 percent increase seen in April. The

rate for May was revised up from 2.2 percent.

The pound declined to a 4-week low of 1.2656 against the

greenback and near a 2-month low of 1.1286 against the franc, off

its early highs of 1.2763 and 1.1418, respectively. The pound is

seen finding support around 1.23 against the greenback and 1.11

against the franc.

The pound edged down to 0.8431 against the euro, from an early

nearly 2-year high of 0.8397. On the downside, 0.88 is likely seen

as its next support level.

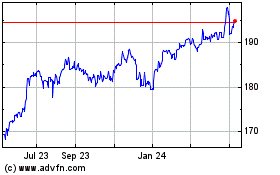

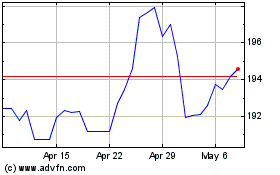

The pound touched a 1-week low of 198.92 against the yen, down

from an early nearly 16-year high of 201.61. If the currency falls

further, it is likely to test support around the 189.00 region.

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Dec 2024 to Jan 2025

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Jan 2024 to Jan 2025