Singapore Dollar Shows Mixed Trading Against Majors

22 September 2009 - 9:34AM

RTTF2

Tuesday in Asia, the Singapore dollar showed mixed trading

against its major counterparts. While the Singapore dollar advanced

against the currencies of U.S. and Hong Kong, it plunged against

the euro and the pound.

With no prominent triggers to guide them, participants in most

of the Asian stock markets are treading a cautious path and are

seen indulging in stock-specific action today. The flat close on

Wall Street, where some upbeat economic data pulled the market out

of the red overnight, and caution ahead of the outcome of the

crucial U.S. Federal Reserve meet are rendering price movements a

bit sluggish in most of the markets in the region.

Singapore's Strait Times Index is currently up 18.05 points or

0.68% at 2,665.90.

The Singapore dollar that closed yesterday's trading at 1.4186

against the US currency climbed to 1.4145 during Asian deals on

Tuesday. The near term resistance for the Singapore dollar is seen

at 1.411.

In Asian trading on Tuesday, the Singapore dollar rose to 5.4787

against the Hong Kong dollar. This may be compared to Monday's

closing value of 5.4637. On the upside, 5.484 is seen as the next

target level for the Singapore dollar.

Today, Hong Kong is scheduled to announce consumer price index

data for August. Forecasts call for a decline of 0.9 percent on

year after the 1.5 percent annual contraction in July.

The Singapore dollar fell to 2.3019 against the pound in Asian

deals on Tuesday. The next downside target level for the Singapore

dollar is seen at 2.342. At yesterday's close, the pair was quoted

at 2.3003.

During Asian deals on Tuesday, the Singapore dollar dropped to

2.0842 against the euro. If the Singapore dollar slides further, it

may target the 2.087 level. The pair was worth 2.0824 at

yesterday's close.

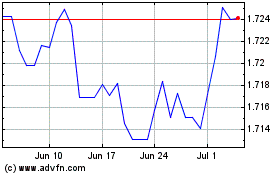

Sterling vs SGD (FX:GBPSGD)

Forex Chart

From Oct 2024 to Nov 2024

Sterling vs SGD (FX:GBPSGD)

Forex Chart

From Nov 2023 to Nov 2024

Real-Time news about Pound Sterling vs Singapore Dollar (Forex): 0 recent articles

More Europe News Articles