U.S. Dollar Drops As Powell Signals Progress On Softening Of Price Pressures

02 July 2024 - 10:52PM

RTTF2

The U.S. dollar weakened against its major counterparts in the

New York session on Tuesday, as Federal Reserve Chair Jerome Powell

signalled progress on cooling in inflation.

Speaking at the ECB Forum in Portugal, Powell said that policy

makers want to understand whether recent weaker inflation readings

indicate a true picture of underlying price pressures.

The Fed chief acknowledged that the latest inflation readings

suggest that Fed officials are getting back on the disinflationary

path.

"We want to be more confident that inflation is moving

sustainably down toward 2% before we start the process of reducing

or loosening policy," Powell noted.

Powell's remarks reinforced hopes that the Fed will start

reducing interest rates this year.

The dollar gained traction in the previous session as the

Supreme Court ruled that presidents have absolute immunity from

prosecution for core official acts.

The greenback eased to 161.26 against the yen and 0.9031 against

the franc, from an early 38-year high of 161.74 and nearly a 5-week

high of 0.9049, respectively. The greenback is poised to challenge

support around 147.00 against the yen and 0.88 against the

franc.

The greenback fell to 1.0746 against the euro and 1.2685 against

the pound, from an early 4-day high of 1.0709 and a 5-day high of

1.2615, respectively. The greenback is likely to face support

around 1.10 against the euro and 1.31 against the pound.

The greenback retreated to 1.3687 against the loonie, 0.6670

against the aussie and 0.6079 against the kiwi, from an early

2-week high of 1.3755, 4-day high of 0.6634 and a 1-1/2-month high

of 0.6047, respectively. The currency is seen finding support

around 1.34 against the loonie, 0.68 against the aussie and 0.63

against the kiwi.

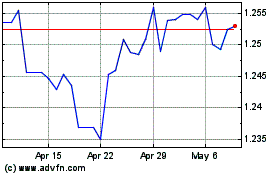

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Jun 2024 to Jul 2024

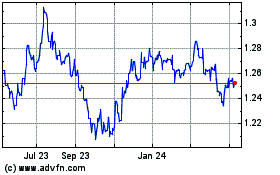

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Jul 2023 to Jul 2024