NZ Dollar Rebounds After Strong China PMI Data

03 April 2024 - 3:17PM

RTTF2

The New Zealand dollar rebounded from recent lows against other

major currencies in the Asian session on Wednesday, after data

showed that China's service sector continued to expand in

March.

Data from S&P Global showed that the Caixin service sector

Purchasing Managers' Index rose to 52.7 in March, in line with

expectations, from 52.5 in February.

The survey showed that overall private sector activity growth

was the strongest since May 2023. The composite output index

advanced to 52.7 in March from 52.5 a month ago.

In economic news, the Global Dairy Trade index has rebounded in

the Tuesday's auction, following two straight trading price drops

in the previous trading events.

Cheddar cheese made the biggest gain, up 4.1% to $4,340 per

metric ton or $1.96 per pound.

There were 108 winning bidders out of 168 participants in the

auction. A total of 18,737 metric tons of dairy products were sold

in 21 rounds of bidding.

In the Asian trading today, the NZ dollar rose to 2-day highs of

0.5978 against the U.S. dollar and 90.59 against the yen, from

early lows of 0.5953 and 90.23, respectively. If the kiwi extends

its uptrend, it is likely to find resistance around 0.60 against

the greenback and 93.00 against the yen,

Against the Australian dollar and the euro, the kiwi edged up to

1.0907 and 1.8030 from recent 2-day lows of 1.0931 and 1.8089,

respectively. The kiwi may test resistance near 1.07 against the

aussie and 1.78 against the euro.

Looking ahead, Eurostat is scheduled to issue euro area flash

inflation for March and unemployment figures for February, at 5:00

am ET in the European session.

At 5:15 am ET, OPEC+ meeting is due to be held, at which the

group is expected to affirm current supply cuts.

In the New York session, U.S. MBA mortgage approvals data, U.S.

and Canada PMI reports for March, U.S. EIA crude oil data and U.S.

ADP employment data for March are slated for release.

At 9:45 am ET, Federal Reserve Board Governor Michelle Bowman

will speak on "Bank Liquidity, Regulation, and the Fed's Role as

Lender of Last Resort" before the Committee on Capital Markets

Regulation Roundtable on Lender of Last Resort, in Washington D.C.,

U.S.

At 12:00 pm ET, Federal Reserve Bank of Chicago President Austan

Goolsbee will give opening remarks before virtual Federal Reserve

Bank of Chicago event, "Preventing Elder Financial Exploitation:

Research, Policies, and Strategies,", in Chicago, U.S.

At 12:10 pm ET, Federal Reserve Chair Jerome Powell is scheduled

to speak on the economic outlook before the Stanford Business,

Government and Society Forum at the Stanford Graduate School of

Business, in Stanford, U.S.

One hour later, Federal Reserve Vice Chair for Supervision

Michael Barr participates in "Community Reinvestment Act"

discussion before the National Community Reinvestment Coalition

"Just Economy Conference 2024.", in Washington D.C., U.S.

At 4:30 pm ET, Federal Reserve Board Governor Adriana Kugler

will speak on "The Outlook of the U.S. Economy and Monetary Policy"

before a conversation hosted by the Washington University in St.

Louis, U.S.

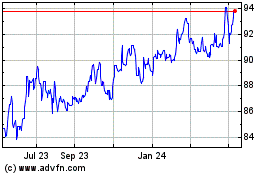

NZD vs Yen (FX:NZDJPY)

Forex Chart

From Apr 2024 to May 2024

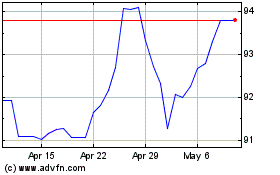

NZD vs Yen (FX:NZDJPY)

Forex Chart

From May 2023 to May 2024