false

0000351569

0000351569

2023-11-15

2023-11-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

| Date of report (Date of earliest event reported): |

November 15, 2023 |

| Ameris Bancorp |

|

(Exact Name of Registrant as Specified in

Charter)

|

| Georgia |

001-13901 |

58-1456434 |

(State or Other Jurisdiction of

Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| |

3490 Piedmont Road N.E., Suite

1550, Atlanta, Georgia |

30305 |

| |

(Address of Principal Executive Offices) |

(Zip Code) |

| Registrant’s telephone number, including area code: |

(404) 639-6500 |

| |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $1.00 per share |

ABCB |

Nasdaq Global Select Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 | Regulation FD Disclosure. |

In

connection with various upcoming investor meetings, Ameris Bancorp (the “Company”) will be using certain presentation material,

a copy of which is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated in Item 7.01 of this Current Report

by this reference. The investor presentation material is also available on the “Investor Relations” page of the Company’s

website (http://www.amerisbank.com).

The information contained

in this Item 7.01 and in Exhibit 99.1 attached to this Report is being furnished and shall not be deemed filed for purposes of Section

18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of such section. Furthermore, such information

shall not be deemed to be incorporated by reference into any registration statement or other document filed pursuant to the Securities

Act of 1933, as amended.

| Item 9.01 | Financial Statements and Exhibits. |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned,

hereunto duly authorized.

| |

AMERIS BANCORP |

| |

|

| |

By: |

/s/ Nicole S. Stokes |

| |

|

Nicole S. Stokes |

| |

|

Chief Financial Officer |

| |

| |

| Date: November 15, 2023 |

Exhibit 99.1

November 2023 Investor Presentation

Cautionary Statements 1 This presentation contains forward - looking statements, as defined by federal securities laws, including, among other forward - looking statements, certain plans, expectations and goals . Words such as “may,” “believe,” “expect,” “anticipate,” “intend,” “will,” “should,” “plan,” “estimate,” “predict,” “continue” and “potential” or the negative of these terms or other comparable terminology, as well as similar expressions, are meant to identify forward - looking statements . The forward - looking statements in this presentation are based on current expectations and are provided to assist in the understanding of potential future performance . Such forward - looking statements involve numerous assumptions, risks and uncertainties that may cause actual results to differ materially from those expressed or implied in any such statements, including, without limitation, the following : general competitive, economic, unemployment, political and market conditions and fluctuations, including real estate market conditions, and the effects of such conditions and fluctuations on the creditworthiness of borrowers, collateral values, asset recovery values and the value of investment securities ; movements in interest rates and their impacts on net interest margin, investment security valuations and other performance measures ; expectations on credit quality and performance ; legislative and regulatory changes ; changes in U . S . government monetary and fiscal policy ; competitive pressures on product pricing and services ; the cost savings and any revenue synergies expected to result from acquisition transactions, which may not be fully realized within the expected timeframes if at all ; the success and timing of other business strategies ; our outlook and long - term goals for future growth ; and natural disasters, geopolitical events, acts of war or terrorism or other hostilities, public health crises and other catastrophic events beyond our control . For a discussion of some of the other risks and other factors that may cause such forward - looking statements to differ materially from actual results, please refer to the Company’s filings with the Securities and Exchange Commission, including the Company’s Annual Report on Form 10 - K for the year ended December 31 , 2022 and the Company’s subsequently filed periodic reports and other filings . Forward - looking statements speak only as of the date they are made, and the Company undertakes no obligation to update or revise forward - looking statements .

Ameris Profile Investment Rationale • Top of peer financial results with culture of discipline – credit, liquidity, expense control, capital • Proven liquidity management supported by strong, stable deposit base • Proven stewards of shareholder value – TBV has grown 13 % annualized over past five years • Experienced executive team with skills and leadership to continue to grow organically • Diversified loan portfolio among geographies and product lines • Diversified revenue streams with strong core bank and lines of business Strong Southeastern Markets • Atlanta’s premier independent banking franchise • Scarcity value in many of the fastest growing regions in nation • Stable core deposit base • Over 65% of our franchise are in MSAs which grew at least 2x the national average over the last 15 years 2 Charlotte MSA Tampa MSA Orlando MSA

Ameris Profile 3 Focus on Shareholder Value 1 – Considered Non - GAAP measures – See reconciliation of GAAP to Non - GAAP measures in Appendix $28.62 $29.92 $30.79 $31.42 $32.38 $26.00 $27.00 $28.00 $29.00 $30.00 $31.00 $32.00 $33.00 3Q22 4Q22 1Q23 2Q23 3Q23 Consistent Tangible Book Value (1) Growth $1.34 $1.18 $0.87 $0.91 $1.16 $0.00 $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 $1.40 $1.60 3Q22 4Q22 1Q23 2Q23 3Q23 Diluted EPS $23.8 $25.1 $26.1 $25.8 $25.7 $22.5 $23.0 $23.5 $24.0 $24.5 $25.0 $25.5 $26.0 $26.5 3Q22 4Q22 1Q23 2Q23 3Q23 Total Assets (in billions) 138,727 137,424 128,281 128,486 129,486 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 120,000 125,000 130,000 135,000 140,000 145,000 3Q22 4Q22 1Q23 2Q23 3Q23 Stable pre - tax pre - provision net revenue ROA (in 000's) PPNR PPNR ROA

3 rd Quarter 2023 Financial Results

3Q 2023 Operating Highlights 5 • Net income of $80.1 million, or $1.16 per diluted share • PPNR ROA (1) of 2.01% for 3Q23 • Adjusted efficiency ratio (1) of 52.02% • TCE ratio (1) of 9.11% • Nonperforming assets, excluding government - guaranteed loans, as a percentage of total assets improved three basis points to 0.27% • Increase in allowance for credit losses to 1.44% of total loans due to economic model, particularly forecasted future declines in commercial real estate pricing • Net interest margin of 3.54% reflecting favorable deposit mix with noninterest bearing deposits representing 32.0% of total deposits at September 30, 2023 • Interest bearing deposit costs increased 33 basis points in 3Q23, compared with an 82 basis point increase in 2Q23 • Total deposit growth of $147.2 million, or 2.9% annualized • Reduction in FHLB advances of $325.0 million, or 26.6%, during the quarter 1 – Considered Non - GAAP measures – See reconciliation of GAAP to Non - GAAP measures in Appendix

2023 YTD Operating Highlights 6 • Net income of $203.2 million, or $2.94 per diluted share • PPNR ROA (1) of 2.03% • Growth in tangible book value (1) of $2.46 per share, or 11.0% annualized, to $32.38 • Adjusted efficiency ratio (1) of 52.49% • Net interest margin of 3.63% • Organic loan growth of $345.8 million, or 2.3% annualized • Total deposit growth of $1.13 billion, or 7.7% annualized • Reduction in FHLB Advances of $600.1 million • Increase in allowance for credit losses to 1.44% of total loans at September 30, 2023, compared with 1.04% at December 31, 2022, due to economic forecast, particularly commercial real estate price levels • Redemption of $75 million in floating rate (was 8.39%) subordinated notes due 2027 and repurchase (at a discount) and redemption of $11.0 million aggregate principal of 4.25% fixed - to - floating subordinated notes due 2029 YTD 1 – Considered Non - GAAP measures – See reconciliation of GAAP to Non - GAAP measures in Appendix

Financial Highlights 7 1 – Considered Non - GAAP measures – See reconciliation of GAAP to Non - GAAP measures in Appendix 2 – Growth rates are annualized for the applicable periods 3 – Excludes serviced GNMA - guaranteed mortgage loans (dollars in thousands, except per share data) Quarter to Date Results Year to Date Results 3Q23 2Q23 Change 3Q22 Change 2023 2022 Change Net Interest Income $ 207,751 $ 209,540 - 1% $ 212,981 - 2% $ 628,943 $ 576,889 9% Noninterest Income $ 63,181 $ 67,349 - 6% $ 65,324 - 3% $ 186,580 $ 236,076 - 21% Provision for Credit Losses $ 24,459 $ 45,516 - 46% $ 17,652 39% $ 119,704 $ 38,807 208% Noninterest Expense $ 141,446 $ 148,403 - 5% $ 139,578 1% $ 429,270 $ 425,594 1% Net Income $ 80,115 $ 62,635 28% $ 92,555 - 13% $ 203,171 $ 264,319 - 23% Net Income Per Diluted Share $ 1.16 $ 0.91 27% $ 1.34 - 13% $ 2.94 $ 3.81 - 23% Return on Average Assets 1.25% 0.98% 27% 1.56% - 20% 1.07% 1.51% - 29% Return on Average Equity 9.56% 7.63% 25% 11.76% - 19% 8.26% 11.57% - 29% Efficiency Ratio 52.21% 53.60% - 3% 50.15% 4% 52.64% 52.35% 1% Net Interest Margin 3.54% 3.60% - 2% 3.97% - 11% 3.63% 3.67% - 1% Adjusted Net Income (1) $ 80,115 $ 62,635 28% $ 91,817 - 13% $ 202,685 $ 248,329 - 18% Adjusted Net Income Per Diluted Share (1) $ 1.16 $ 0.91 27% $ 1.32 - 12% $ 2.93 $ 3.58 - 18% Adjusted Return on Assets (1) 1.25% 0.98% 27% 1.54% - 19% 1.07% 1.42% - 25% Adjusted Return on TCE (1) 14.35% 11.53% 24% 18.33% - 22% 12.46% 17.33% - 28% Adjusted Efficiency Ratio (1) 52.02% 53.41% - 3% 50.12% 4% 52.49% 53.46% - 2% Organic Loan Growth $ (270,680) $ 473,888 - 157% $ 1,245,834 - 122% $ 345,826 $ 2,932,598 - 88% Organic Loan Growth Rate (2) - 5.29% 9.48% - 156% 28.38% - 119% 2.32% 24.63% - 91% Portfolio NPAs/Assets (3) 0.27% 0.30% - 9% 0.32% - 17% 0.27% 0.32% - 17% Total NPAs/Assets 0.58% 0.57% 3% 0.55% 5% 0.58% 0.55% 5%

Strong Net Interest Margin 8 Banking Division Loan Production Details Period Fixed Rate Variable Rate Total 3Q23 $ 247.0 10.69% $ 374.0 8.69% $621.0 9.49% 2Q23 $ 341.7 9.87% $ 202.5 8.47% $554.3 9.35% 1Q23 $ 339.8 9.40% $ 223.2 7.68% $563.0 8.72% • Above peer group margin at 3.54% • Net interest income (TE) of $208.7 million in 3Q23, compared with $210.5 million in 2Q23: – Interest income (TE) increased $8.6 million – Interest expense increased $10.4 million • Average earning assets decreased $91.6 million • Total deposit costs up 24bp in 3Q23, compared with a 63bp increase in 2Q23 • Noninterest bearing deposits remain above historic levels and were 32.0% of total deposits at quarter end • Average FHLB advances down $465.0 million during the quarter Spread Income and Margin $213.9 $225.1 $212.6 $210.5 $208.7 3.97% 4.03% 3.76% 3.60% 3.54% 3.25% 3.50% 3.75% 4.00% 4.25% 4.50% 4.75% 5.00% 5.25% $200.0 $205.0 $210.0 $215.0 $220.0 $225.0 $230.0 3Q22 4Q22 1Q23 2Q23 3Q23 Net Interest Income (TE) (in millions) NIM

Diversified Revenue Stream 9 • Strong revenue base of net interest income from core banking division • Additional revenue provided by our diversified lines of business Mortgage Banking Activity • Retail mortgage activity has continued to stabilize back to pre - pandemic levels • Mortgage banking activity was 13% of total revenue in 3Q23 • Purchase business remained at 85% in 3Q23 due to strong core relationships with builders and realtors • Approximately 86% of the net interest income included in mortgage revenue is related to portfolio loans generated from the mortgage division • Gain on sale margin continues to improve from historic low in 4Q22 Other Noninterest Income • Other Noninterest Income has been stable contributor to total revenue • Other Noninterest Income includes: • Fee income from equipment finance group • BOLI Income • Gains on sale of SBA Loans 2.10% 1.26% 1.96% 2.18% 2.15% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3Q22 4Q22 1Q23 2Q23 3Q23 Mortgage Gain on Sale Margin 77% 82% 79% 76% 77% 14% 9% 12% 15% 13% 9% 9% 9% 9% 10% $279.2 $273.4 $268.6 $277.8 $271.9 0% 20% 40% 60% 80% 100% 120% 3Q22 4Q22 1Q23 2Q23 3Q23 FTE Revenue Sources (in millions) FTE Net Interest Income Mortgage Banking Activity Other Noninterest Income

Disciplined Expense Control Adjusted Operating Expenses (1) and Efficiency Ratio (1) OPEX Highlights 10 • Management continues to deliver high performing operating efficiency • Adjusted efficiency ratio of 52.02% in 3Q23, compared with 53.41% in 2Q23 • Total adjusted operating expenses decreased $7.0 million in 3Q23 compared with 2Q23: ‒ Decrease of $6.2 million in 3Q23 banking division operating expenses primarily due to: ‒ $2.1 million decrease in credit resolution - related expenses ‒ $1.6 million decrease in legal and professional fees ‒ $1.0 million decrease in FDIC insurance ‒ $1.5 million net decrease in fraud/forgery and litigation resolution expenses – Net decrease of $768,000 in 3Q23 lines of business operating expenses due to variable compensation related to production increases • Disciplined expense control throughout the Company with identified cost savings utilized to fund future technology and innovation costs 1 – Considered Non - GAAP measures – See reconciliation of GAAP to Non - GAAP measures in Appendix $93.6 $96.4 $98.9 $105.9 $99.7 $45.9 $38.4 $40.6 $42.5 $41.7 20.0 40.0 60.0 80.0 100.0 120.0 140.0 160.0 180.0 3Q22 4Q22 1Q23 2Q23 3Q23 Adjusted Operating Expenses (in millions) Banking LOBs 50.12% 49.61% 51.99% 53.41% 52.02% 40.00% 45.00% 50.00% 55.00% 60.00% 65.00% 3Q22 4Q22 1Q23 2Q23 3Q23 Adjusted Efficiency Ratio

Balance Sheet Trends 11 • Asset sensitivity is moderating as the FOMC nears the end of its tightening cycle: – - 0.3% asset sensitivity in - 100bps – - 0.1% asset sensitivity in - 50bps – 0.1% asset sensitivity in +50bps – 0.2% asset sensitivity in +100bps • Approximately $7.2 billion, or 35%, of loans are variable rate • Approximately $9.7 billion of total loans reprice within one year through either maturities or floating rate indices • Cumulative weighted - average beta for all non - maturity deposits through this cycle has been 29% Interest Rate Sensitivity Earning Assets Highlights • Available - for - sale (AFS) securities represent less than 6% of total assets, limiting potential tangible book value dilution from rising interest rates • Unrealized loss of AFS portfolio was $78 million at September 30, 2023, representing approximately 5% of book value • No transfers to held - to - maturity (HTM) portfolio – all securities classified as HTM were previously purchased for CRA purposes Capital Highlights • Ameris is well capitalized with minimal unrealized losses in the investment portfolio • TCE Ratio of 9.11% at September 30, 2023 • Earnings expected to add between 25 - 35 basis points to capital each quarter assuming flat balance sheet • Repurchase plan announced in October 2023 of $100 million - 5,000 10,000 15,000 20,000 25,000 30,000 3Q22 4Q22 1Q23 2Q23 3Q23 Earning Assets (in millions) Loans Loans HFS Other Earning Assets Total Assets

Proven Liquidity Plan 12 At September 30, 2023 $ in millions Total Available Amount Used Net Availability Internal Sources Cash $ 1,546 $ - $ 1,546 Unpledged Securities 677 - 677 External Sources FHLB 5,421 1,798 3,623 FRB Discount Window 2,635 - 2,635 Brokered Deposits 2,853 1,567 1,286 Other 127 - 127 Total Liquidity $ 13,259 $ 3,365 $ 9,894 • Diverse sources of liquidity available to the Company • Minimal unrealized losses on unpledged securities due to disciplined investment strategy • Majority of funding used is short - term to manage interest rate profile and provide flexibility as liquidity needs fluctuate • Have not accessed Bank Term Funding Program • Available liquidity sources provide approximately 117% coverage for uninsured deposits and approximately 161% coverage for non - collateralized uninsured deposits • No single depositor represents more than 1% of total deposits • Uninsured and uncollateralized deposits represent 29.7% of total deposits Sources of Liquidity Solid Liquidity Plan

Strong Core Deposit Base 13 Deposit Highlights • Noninterest bearing deposits remained strong at 32% of total deposits • Total deposits increased $147.2 million in 3Q23 compared with 2Q23 • Noninterest - bearing deposits decreased $117.3 million, or 1.7% • MMDA and savings increased $359.6 million, or 5.7% • CDs increased $157.8 million, or 4.4% • Brokered CDs were minimally changed during the quarter Deposit Type Balance (in 000s) Count Average per account (in 000’s) NIB 6,589,610 297,584 22.1 NOW 3,607,856 44,984 80.2 MMDA 5,818,896 31,177 186.6 Savings 830,402 65,249 12.7 CD 3,743,581 41,018 91.3 Total 20,590,345 480,012 42.9 Deposits by Product Type NIB 32% NOW 18% MMDA 28% Savings 4% CD 18% Deposits by Type 3Q23 Consumer 37% Commercial 43% Public 12% Brokered 8% Deposits by Customer 3Q23

Capital Strength 14 Capital Highlights • Ameris is well capitalized with minimal unrealized losses in the investment portfolio • CET1 ratio is strong at 10.82% • CET1, net of unrealized losses on bond portfolio, remains strong at 10.45% • Net unrealized losses in AFS portfolio were $78 million at September 30, 2023, and represents approximately 5% of book value • No transfers to held - to - maturity (HTM) portfolio – all securities classified as HTM were previously purchased for CRA purposes • Earnings expected to add between 25 - 35 basis points to capital each quarter assuming flat balance sheet • Repurchase plan announced in October 2023 of $100 million 9.32% 9.36% 9.26% 9.27% 9.62% 10.06% 9.86% 10.10% 10.25% 10.82% 13.15% 12.90% 13.16% 13.40% 14.01% 3Q22 4Q22 1Q23 2Q23 3Q23 Strong Capital Base Leverage Ratio CET1/Tier 1 Capital Ratio Total Capital Ratio

17.78 18.83 19.73 20.81 20.29 20.81 20.44 20.90 22.46 23.69 25.27 26.45 27.46 26.26 26.84 27.89 28.62 29.92 30.79 31.42 32.38 $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 $35.00 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 Tangible Book Value Capital and TBV Proven Stewards of Shareholder Value 15 • Management focused on long term growth in TBV (1) , such that over the past five years TBV has grown by 13% annualized • TBV increased $0.96 per share in 3Q23: – $1.01 from retained earnings – ($0.15) from impact of OCI – $0.10 from all other items including stock compensation and share repurchases 1 – Considered Non - GAAP measures – See reconciliation of GAAP to Non - GAAP measures in Appendix Equipment Finance Acquisition LION Acquisition CECL Adoption

Loan Diversification and Credit Quality

Diversified Loan Portfolio 3Q23 Loan Portfolio 17 • Loan portfolio is well diversified across loan types and geographies • CRE and C&D concentrations were 283% and 79%, respectively, at 3Q23 • Non - owner occupied office loans totaled $1.45 billion at 3Q23, or 7.2% of total loans • Continued strong asset quality metrics during 3Q23 as evidenced by a lower volume of Non - Performing loans, net of GNMA - backed mortgage loans • Reserve increased to 1.44% of total loans during 3Q23 to account for forecasted economic conditions • Limited exposure in SNCs and syndications • Continued diligence by credit staff on portfolio reviews given the current economic environment, focused on maturing and floating - rate loans, particularly in C&D and investor CRE loans Portfolio Highlights Agriculture 1% C&I 22% Municipal 2% Consumer 2% Investor CRE 24% OO CRE 10% Construction 11% Multi - Family 4% SFR Mortgage & HELOC 24% Total Loans $20.2 Billion

Loan Production vs Growth 18 • 3Q23 loan production was spread across many product lines, continuing to contribute to portfolio diversification • Overall, 3Q23 production exhibited a 19% decrease from 2Q23. Loan balance decline in 3Q23 was primarily driven by lower seasonal volume of Mortgage Warehouse loans *Loan production reflects committed balance total, excluding Mortgage Warehouse production; loan portfolio growth reflects qu art er - over - quarter loan ending balances. 4Q22 loan growth includes acquired loans of $472.3 million. (in millions ) $3,627 $3,192 $2,168 $1,509 $1,760 $1,424 $1,417 $1,246 $1,055 $143 $474 $(271) $(500) $- $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 Loan Production Loan Growth *

Loan Balance Changes 3Q23 Loan Balance Changes 19 • Loan balances were $270.7 million lower in 3Q23, primarily the result of a $294.6 million decrease in Mortgage Warehouse loans • YTD, total loan growth was $345.8 million, or 2.3% annualized through 3Q23 • C&D growth was primarily driven by advances on existing commercial construction loans (in millions) $100 $50 $19 $19 $(13) $(16) $(48) $(86) $(295) $(350) $(300) $(250) $(200) $(150) $(100) $(50) $- $50 $100 $150 SFR Mtgs CRE C&D Premium Finance Municipal Indirect Consumer C&I Mtg WHSE

Allowance for Credit Losses 20 • Increase in reserve during 3Q23 due to forecasted economic conditions • The ACL on loans totaled $290.1 million at 3Q23, a net increase of $ 18.0 mil lion, or 6.6% from 2Q23 • The reserve for unfunded commitments totaled $49.0 million, a decrease of $5.6 million, or 10.3%, primarily due to lower unfunded balances • During 3Q23, recorded a provision expense of $24.5 million • The ACL on loans equated to 1.44% of total loans at 3Q23, compared with 1.33% at 2 Q23 • The total ACL on loans + unfunded commitments was $339.1 million, or 1.33% 3 Q23 CECL Reserve Reserve Summary (in millions) 3Q23 Allowance Coverage Balance (MM's) ALLL (MM's) % ALLL Gross Loans 20,201.1$ 290.1$ 1.44% Unfunded Commitments 5,303.7$ 49.0$ 0.92% ACL / Total Loans + Unfunded 25,504.8$ 339.1$ 1.33%

Allowance for Credit Losses 21 • Results were primarily driven by negative forecasts for CRE and home prices over the next four quarters • The ALLL for the two CRE categories (RE – C&D, RE – CRE) exhibited the highest increase from 2 Q23 of $14.5 million • The blended ALLL % fo r those two categories was 1.64% at 3Q23 • The negative forecast for home prices resulted in a $2.0 million increase in the ALLL for residential mortgage loans (RE – RES) 3Q23 CECL Reserve by Loan Type Reserve Summary Reserve Methodology • Moody’s September 2023 forecast model provided material inputs into ACL • Primary model drivers included: • US and Regional Unemployment rates • US GDP • US and Regional Home Price Indices • US and State - Level CRE Price Index for our five - state footprint • Estimate derived using Baseline scenario Loan Type Net Outstanding (MM's) ALLL (MM's) % ALLL 6/30/23 ALLL (MM's) Change from 2Q23 CFIA 2,632.8$ 53.7$ 2.04% 50.8$ 2.9$ Consumer 259.8$ 4.1$ 1.58% 4.5$ (0.4)$ Indirect 47.1$ 0.1$ 0.21% 0.1$ (0.0)$ Municipal 497.1$ 0.3$ 0.06% 0.4$ (0.1)$ Premium Finance 1,007.3$ 0.6$ 0.06% 0.8$ (0.2)$ RE - C&D 2,236.7$ 63.2$ 2.83% 54.6$ 8.6$ RE - CRE 7,865.4$ 102.0$ 1.30% 96.1$ 5.9$ RE - RES 4,802.0$ 64.4$ 1.34% 62.4$ 2.0$ Warehouse Lending 852.8$ 1.7$ 0.20% 2.3$ (0.6)$ Grand Total 20,201.1$ 290.1$ 1.44% 272.1$ 18.0$

NPA / Charge - Off Trend 22 • Net of GNMA - guaranteed mortgage loans, NPAs declined as a percentage of total assets to 0.27% at 3Q23 vs 0.30% at 2Q23 • Total NPAs in creased $3.6 million, to $149.9 million, primarily as a result of: • $11.1 million increase in 90+ past due GNMA - guaranteed mortgage loans • Charge - off of $3.2 million in remaining pre - acquisition nonaccrual loans in the Equipment Finance division • $2.8 million net decrease in OREO due to the sale of our largest OREO property • Net charge - offs totaled $12.1 million, which equated to an annualized NCO ratio of 0.23% • Included in 3Q23 charge - offs were $3.2 million of pre - acquisition, nonaccrual loans in the Equipment Finance division that were 100% reserved at the acquisition date • Excluding those acquired loans, net charge - offs totaled $8.9 million, or 0.17% annualized Non - Performing Assets (NPAs) Net Charge - Offs ($ in millions) 0.55% 0.61% 0.61% 0.57% 0.58% 0.32% 0.34% 0.33% 0.30% 0.27% 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% 0.60% 0.70% 3Q22 4Q22 1Q23 2Q23 3Q23 Non - Performing Assets NPA / Total Assets NPA x GNMA / Total Assets 0.11% 0.08% 0.22% 0.28% 0.23% -0.03% 0.02% 0.07% 0.12% 0.17% 0.22% 0.27% 0.32% $- $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 3Q22 4Q22 1Q23 2Q23 3Q23 Net Charge - Offs Net Charge-offs NCO Ratio (Annualized)

Problem Loan Trends 23 • Total classified loans, excluding GNMA - guaranteed mortgage loans, increased $3.8 million • Total criticized loans (including special mention ), excluding GNMA - guaranteed mortgage loans, increased $20.2 million • Nonperforming l oans, excluding GNMA - guaranteed mortgage loans, de creased $4.7 million, primarily the result of collection efforts and upgrades • The watch list totaling $388.2 million is primarily comprised of the following loan types: Highlights (in millions) Note: Criticized, Classified and Nonperforming loan totals exclude GNMA - guaranteed loans 33% Owner - Occupied RRE 17% Assisted Living 13% Multi - Family 9% Mortgage WHSE 6% Retail Hotels 6% Total Loans Criticized Loans Classified Loans Nonperforming Loans GNMA-guaranteed Loans $54.6 $69.6 $75.0 $69.7 $80.8 $269.2 $76.5 $271.9 $83.1 $19,997.9 $268.6 $158.8 $167.3 $152.3 $83.8 3Q22 4Q22 1Q23 2Q23 $20,201.1$20,471.8$18,806.9 $19,855.3 $70.4 3Q23 $307.4 $65.7 $116.2 $120.0 $287.2 1.43% 1.37% 1.34% 1.40% 1.52% 0.84% 0.84% 0.76% 0.57% 0.59% 0.41% 0.42% 0.42% 0.34% 0.33% $0 $50 $100 $150 $200 $250 $300 $350 $400 3Q22 4Q22 1Q23 2Q23 3Q23 Criticized Loans Classified Loans Nonperforming Loans Expressed as a percent of Total Loans

Investor CRE Loans 24 Investor CRE 24% C&D 11% Multi - Family 4% Stratification of Investor CRE Portfolio • Non - Owner Occupied CRE Portfolio is well diversified • Over 80% of CRE loans are located in MSAs in the Bank’s five - state footprint, which exhibit population growth forecasts exceeding the national average • Overall past dues for investor CRE loans were 0.15% and NPAs 0.07% CRE Positioned in Growing Markets Outstanding Loans (MMs) 5-Yr Proj Population Growth Rate Atlanta-Sandy Springs-Alpharetta GA 2,278.7$ 4.7% Jacksonville FL 777.0$ 6.9% Orlando-Kissimmee-Sanford FL 624.5$ 6.4% Greenville-Anderson SC 294.4$ 4.7% Tampa-St Petersburg-Clearwater FL 277.3$ 6.3% Columbia, SC 272.3$ 3.6% Charlotte-Concord-Gatonia NC 266.7$ 5.2% Charleston-North Charleston SC 265.8$ 5.8% Miami-Ft Lauderdale-Pompano Beach FL 206.4$ 2.0% Tallahassee FL 139.1$ 2.8% U.S. National Average 2.1% Loan Type Outstanding (MM's) % NPL % PD Avg Size Commitment (000's) Construction Loans: RRE - Presold 313.9$ 0.09% 2.72% 460.2$ RRE - Spec & Models 281.2$ 0.00% 0.00% 472.1$ RRE - Lots & Land 65.0$ 0.00% 0.58% 238.5$ RRE - Subdivisions 21.7$ 0.00% 0.00% 353.1$ Sub-Total RRE Construction 681.8$ 0.04% 1.32% 454.3$ CML - Improved 1,468.6$ 0.00% 0.00% 13,052.5$ CML - Raw Land & Other 86.3$ 0.00% 0.32% 479.4$ Sub-Total CRE Construction 1,554.9$ 0.00% 0.02% 7,235.1$ Total Construction Loans 2,236.7$ 0.01% 0.41% 1,471.3$ Term Loans: Office 1,223.2$ 0.30% 0.00% 2,829.9$ Strip Center, Anchored 1,011.0$ 0.00% 0.00% 8,415.7$ Multi-Family 900.7$ 0.00% 0.00% 5,423.3$ General Retail 655.3$ 0.00% 0.00% 1,388.6$ Warehouse / Industrial 629.7$ 0.00% 0.00% 2,874.3$ Strip Center, Non-Anchored 466.2$ 0.00% 0.00% 2,551.0$ Hotels / Motels 406.4$ 0.44% 0.69% 4,098.1$ Mini-Storage Warehouse 279.8$ 0.00% 0.00% 3,198.4$ Assisted Living Facilities 132.9$ 0.00% 0.00% 5,824.6$ Misc CRE (Church, etc) 71.0$ 0.00% 0.00% 819.6$ Sub-Total CRE Term Loans 5,776.2$ 0.09% 0.05% 3,051.6$ Grand Total Investor CRE Loans 8,012.9$ 0.07% 0.15% 1,618.4$

Office Portfolio • 86% of non - owner occupied office loans are located in MSAs in the Bank’s primary footprint; overall, the average vacancy was ~10% • Central Business District (CBD) locations represent 7 % of non - owner occupied properties ; Charleston, SC and Tampa, FL represent the two largest CBD MSAs ( 66 % of total CBD properties) • The portion of the ACL apportioned to non - owner occupied office loans was 1 . 52 % * Results based on loans > $ 1 million, or 95 % of total loans • Non - owner occupied office loans totaled $1.45 billion of outstanding balances and $1.68 billion of total committed exposure at 3Q23 • As a percentage of total loans outstanding and committed exposure, non - owner occupied office loans were 7.2% and 6.6%, respectively • 66% are comprised of Class A, Essential - Use Facility or Medical Office Building (MOB) Highlights 25 Construction , $388.5 Investor CRE , $1,293.3 Owner - Occupied , $569.3 Total Office Portfolio by Loan Type (Total Committed Exposure) Class A 35% Class B 29% Essential Use 21% MOB 10% Class C 5% Investor Office Portfolio by Property Class * CBD 7% Suburban 52% Urban 41% Investor Office Loans by Location * 16.2% 12.0% 6.8% 2.0% 5.3% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% Class A Class B Class C Essential Use MOB Average Vacancy by Investor Office Property Class *

Commercial Real Estate Production 3 Q23 Commercial Real Estate Production Summary: 26 3 Q23 Residential Construction Production Summary: • 3 Q23 production of C&D and CRE loans - $381.8 million in total committed exposure • Residential real estate construction: • Spec/model to pre - sold ratio of 0.5:1 • Investor CRE 3Q23 production: • Production totaled $58.1 million • Weighted average 1.55:1 debt service coverage • Weighted average 52.4% loan/value • Summary of CRE production by collateral state: Highlights Loan Type Outstanding (MM's) Committed Exposure (MM's) Avg Size Commitment (000's) RRE Construction - Pre-Sold 60.7$ 192.1$ 393.6$ RRE Construction - Spec 37.7$ 104.5$ 340.4$ A&D, RRE Lots, Other Land Loans 21.0$ 25.1$ 964.8$ RRE Construction - Model 1.3$ 2.0$ 288.4$ Total Construction Loans 120.7$ 323.7$ 391.0$ Loan Type Outstanding (MM's) Committed Exposure (MM's) Debt Service Coverage (DSC)* Loan / Value* Multi-Family -$ 27.5$ 1.31 43.7% Retail (inc Single-Tenant) 2.3$ 10.5$ 1.69 69.0% Hotels 10.0$ 10.0$ 1.84 55.0% Office 0.7$ 3.8$ 1.20 61.0% Other CRE Types 2.9$ 2.9$ 2.92 46.8% Strip Center, Non-Anchored 0.1$ 2.3$ 1.32 56.6% Misc CRE (Church, etc.) 0.6$ 1.1$ 1.52 62.7% Warehouse / Industrial -$ -$ 0.00 0.0% Strip Center, Anchored -$ -$ 0.00 0.0% Mini-Storage Warehouses -$ -$ 0.00 0.0% Total CRE Loans 16.6$ 58.1$ 1.55 52.4% FL 7% GA 70% SC 5% Others 18%

Equipment Finance Portfolio 27 • Total loans were $1.2 billion, or 6.0% of Ameris’s total portfolio • The overall average loan size was $48.3 thousand • Loan production totaled $156.7 million in 3Q23. The average FICO score for new production in 3Q23 was 738 • 30 - 89 day accruing past due loans were 0.85% of total loans; non - performing loans continue to decline and totaled 0.39% of total loans • The remaining pre - acquisition, fully reserved non - performing loans, totaling $3.2 million, were charged - off during 3Q23 • The portion of the ACL attributed to the Equipment Finance division totaled $40.1 million, or 3.30% of loans Highlights (in millions) $913 $1,021 $1,115 $1,175 $1,210 $174 $189 $197 $168 $157 $- $200 $400 $600 $800 $1,000 $1,200 3Q22 4Q22 1Q23 2Q23 3Q23 Total Loans (MM's) Quarterly Originations (MM's) 0.70% 0.85% 0.95% 1.03% 0.85% 0.94% 0.92% 0.87% 0.65% 0.39% 0.25% 0.35% 0.45% 0.55% 0.65% 0.75% 0.85% 0.95% 1.05% 1.15% 3Q22 4Q22 1Q23 2Q23 3Q23 30+ Accruing Past Dues Non-Performing Loans

Appendix

29 Reconciliation of GAAP to Non - GAAP Measures (dollars in thousands) 3Q23 2Q23 3Q22 2023 2022 Net Income $ 80,115 $ 62,635 $ 92,555 $ 203,171 $ 264,319 Adjustment items Merger and conversion charges - - - - 977 Gain on sale of mortgage servicing rights - - 316 - 316 Servicing right impairment (recovery) - - (1,332) - (21,824) Gain on BOLI proceeds - - (55) (486) (55) Natural disaster expenses - - 151 - 151 (Gain) loss on sale of premises - - - - (45) Tax effect of adjustment items - - 182 - 4,490 After tax adjustment items - - (738) (486) (15,990) Adjusted Net Income $ 80,115 $ 62,635 $ 91,817 $ 202,685 $ 248,329 Weighted average number of shares - diluted 68,994,247 69,034,763 69,327,414 69,129,921 69,427,522 Net income per diluted share $ 1.16 $ 0.91 $ 1.34 $ 2.94 $ 3.81 Adjusted net income per diluted share $ 1.16 $ 0.91 $ 1.32 $ 2.93 $ 3.58 Average assets 25,525,913 25,631,846 23,598,465 25,426,064 23,405,411 Return on average assets 1.25% 0.98% 1.56% 1.07% 1.51% Adjusted return on average assets 1.25% 0.98% 1.54% 1.07% 1.42% Average common equity 3,324,960 3,293,049 3,123,718 3,289,706 3,054,356 Average tangible common equity 2,214,775 2,178,323 1,987,385 2,174,958 1,916,262 Return on average common equity 9.56% 7.63% 11.76% 8.26% 11.57% Adjusted return on average tangible common equity 14.35% 11.53% 18.33% 12.46% 17.33% For the quarter For the year to date period

30 Reconciliation of GAAP to Non - GAAP Measures (dollars in thousands) 3Q23 2Q23 1Q23 4Q22 3Q22 2023 2022 Adjusted Noninterest Expense Total noninterest expense 141,446$ 148,403$ 139,421$ 135,061$ 139,578$ 429,270$ 425,594$ Adjustment items: Merger and conversion charges - - - (235) - - (977) Natural disaster expenses - - - - (151) - (151) Gain (loss) on sale of premises - - - - - - 45 Adjusted noninterest expense 141,446$ 148,403$ 139,421$ 134,826$ 139,427$ 429,270$ 424,511$ Total Revenue Net interest income 207,751$ 209,540$ 211,652$ 224,137$ 212,981$ 628,943$ 576,889$ Noninterest income 63,181 67,349 56,050 48,348 65,324 186,580 236,076 Total revenue 270,932$ 276,889$ 267,702$ 272,485$ 278,305$ 815,523$ 812,965$ Adjusted Total Revenue Net interest income (TE) 208,701$ 210,488$ 212,587$ 225,092$ 213,912$ 631,776$ 579,803$ Noninterest income 63,181 67,349 56,050 48,348 65,324 186,580 236,076 Total revenue (TE) 271,882$ 277,837$ 268,637$ 273,440$ 279,236$ 818,356$ 815,879$ Adjustment items: (Gain) loss on securities 16 6 (6) (3) 21 16 (200) Gain on BOLI proceeds - - (486) - (55) (486) (55) (Gain) loss on sale of mortgage servicing rights - - - (1,672) 316 - 316 Servicing right impairment (recovery) - - - - (1,332) - (21,824) Adjusted total revenue (TE) 271,898$ 277,843$ 268,145$ 271,765$ 278,186$ 817,886$ 794,116$ Efficiency ratio 52.21% 53.60% 52.08% 49.57% 50.15% 52.64% 52.35% Adjusted efficiency ratio (TE) 52.02% 53.41% 51.99% 49.61% 50.12% 52.49% 53.46% Year to DateQuarter to Date

31 Reconciliation of GAAP to Non - GAAP Measures (dollars in thousands) 3Q23 2Q23 1Q23 4Q22 3Q22 3Q23 3Q22 Net income 80,115$ 62,635$ 60,421$ 82,221$ 92,555$ 203,171$ 264,319$ Plus: Income taxes 24,912 20,335 18,131 22,313 28,520 63,378 84,245 Provision for credit losses 24,459 45,516 49,729 32,890 17,652 119,704 38,807 Pre-tax pre-provision net revenue (PPNR) 129,486$ 128,486$ 128,281$ 137,424$ 138,727$ 386,253$ 387,371$ Average Assets $ 25,525,913 $ 25,631,846 $ 25,115,927 $ 24,354,979 $ 23,598,465 $25,426,064 $23,405,411 Return on Average Assets (ROA) 1.25% 0.98% 0.98% 1.34% 1.56% 1.07% 1.51% PPNR ROA 2.01% 2.01% 2.07% 2.24% 2.33% 2.03% 2.21% Quarter to Date Year to Date

32 Reconciliation of GAAP to Non - GAAP Measures (dollars in thousands) 3Q23 2Q23 1Q23 4Q22 3Q22 2Q22 1Q22 4Q21 3Q21 2Q21 1Q21 Total shareholders' equity 3,347,069$ 3,284,630$ 3,253,195$ 3,197,400$ 3,119,070$ 3,073,376$ 3,007,159$ 2,966,451$ 2,900,770$ 2,837,004$ 2,757,596$ Less: Goodwill 1,015,646 1,015,646 1,015,646 1,015,646 1,023,071 1,023,056 1,022,345 1,012,620 928,005 928,005 928,005 Other intangibles, net 92,375 96,800 101,488 106,194 110,903 115,613 120,757 125,938 60,396 63,783 67,848 Total tangible shareholders' equity 2,239,048$ 2,172,184$ 2,136,061$ 2,075,560$ 1,985,096$ 1,934,707$ 1,864,057$ 1,827,893$ 1,912,369$ 1,845,216$ 1,761,743$ Period end number of shares 69,138,461 69,139,783 69,373,863 69,369,050 69,352,709 69,360,461 69,439,084 69,609,228 69,635,435 69,767,209 69,713,426 Book value per share (period end) 48.41$ 47.51$ 46.89$ 46.09$ 44.97$ 44.31$ 43.31$ 42.62$ 41.66$ 40.66$ 39.56$ Tangible book value per share (period end) 32.38$ 31.42$ 30.79$ 29.92$ 28.62$ 27.89$ 26.84$ 26.26$ 27.46$ 26.45$ 25.27$ 4Q20 3Q20 2Q20 1Q20 4Q19 3Q19 2Q19 1Q19 4Q18 3Q18 Total shareholders' equity 2,647,088$ 2,564,683$ 2,460,130$ 2,437,150$ 2,469,582$ 2,420,723$ 1,537,121$ 1,495,584$ 1,456,347$ 1,404,977$ Less: Goodwill 928,005 928,005 928,005 931,947 931,637 911,488 501,140 501,308 503,434 505,604 Other intangibles, net 71,974 76,164 80,354 85,955 91,586 97,328 52,437 55,557 58,689 54,729 Total tangible shareholders' equity 1,647,109$ 1,560,514$ 1,451,771$ 1,419,248$ 1,446,359$ 1,411,907$ 983,544$ 938,719$ 894,224$ 844,644$ Period end number of shares 69,541,481 69,490,546 69,461,968 69,441,274 69,503,833 69,593,833 47,261,584 47,585,309 47,499,941 47,496,966 Book value per share (period end) 38.06$ 36.91$ 35.42$ 35.10$ 35.53$ 34.78$ 32.52$ 31.43$ 30.66$ 29.58$ Tangible book value per share (period end) 23.69$ 22.46$ 20.90$ 20.44$ 20.81$ 20.29$ 20.81$ 19.73$ 18.83$ 17.78$ As of As of

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

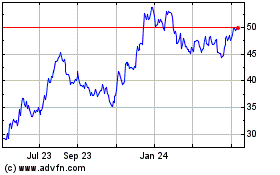

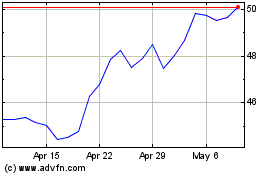

Ameris Bancorp (NASDAQ:ABCB)

Historical Stock Chart

From Apr 2024 to May 2024

Ameris Bancorp (NASDAQ:ABCB)

Historical Stock Chart

From May 2023 to May 2024