false

0001824884

00-0000000

0001824884

2024-03-05

2024-03-05

0001824884

ADOC:ClassOrdinaryShares.0001ParValuePerShareMember

2024-03-05

2024-03-05

0001824884

ADOC:RightsExchangeableIntoOnetenthOfOneClassOrdinaryShareMember

2024-03-05

2024-03-05

0001824884

ADOC:WarrantsEachExercisableForOnehalfOfOneClassOrdinaryShareEachWholeWarrantExercisableFor11.50PerShareMember

2024-03-05

2024-03-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

March 5, 2024

EDOC Acquisition Corp.

(Exact name of registrant as specified in its charter)

| Cayman Islands |

|

001-39689 |

|

N/A |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

7612 Main Street Fishers

Suite 200

Victor, NY 14564

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: (585) 678-1198

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Securities registered pursuant

to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class A Ordinary Shares, $.0001 par value per share |

|

ADOC |

|

The Nasdaq Stock Market LLC |

| Rights, exchangeable into one-tenth of one Class A Ordinary Share |

|

ADOCR |

|

The Nasdaq Stock Market LLC |

| Warrants, each exercisable for one-half of one Class A Ordinary Share, each whole Warrant exercisable for $11.50 per share |

|

ADOCW |

|

The Nasdaq Stock Market LLC |

Item 5.07 Submission of Matters to a Vote of Security Holders.

On March 5, 2024, Edoc Acquisition

Corp. (“Edoc” or the “Company”) held an extraordinary general meeting of its shareholders (the “Special

Meeting”) in connection with its previously announced proposed business combination (the “Business Combination”) with,

among others, Australian Oilseeds Investments Pty Ltd., an Australian proprietary company (the “AOI”), Australian Oilseeds

Holdings Limited, a Cayman Islands exempted company (“Pubco”), AOI Merger Sub, Cayman Islands exempted company and a wholly-owned

subsidiary of Pubco (“Merger Sub”), American Physicians LLC, a Delaware limited liability company (“Purchaser Representative”),

in the capacity as the Purchaser Representative thereunder, and Gary Seaton, in his capacity as the representative for the Sellers (as

defined in the Business Combination Agreement), pursuant to that certain Business Combination Agreement (as amended on March 31, 2023

and December 7, 2023 and as may be further amended or supplemented from time to time, the “Business Combination Agreement,”

and the transactions contemplated thereby, the “Transaction”).

The

number of shares outstanding on the record date and entitled to vote at this Special Meeting was 3,620,207 ordinary shares of Edoc, and

there were present, either in person or by proxy, holders of at least 1,810,104 Edoc ordinary shares entitled to vote at the Special Meeting,

which represented a quorum of the shares entitled to vote.

At the Special Meeting, Edoc’s

shareholders voted on the proposals set forth below, each of which is described in greater detail in the definitive proxy statement/prospectus,

filed with the Securities and Exchange Commission (the “SEC”) on February 8, 2024, as supplemented (the “Proxy Statement”).

At the Special Meeting, each of the proposals in the Proxy Statement voted upon at the Special Meeting was approved by the stockholders.

Defined terms used and not otherwise defined herein shall have the meanings ascribed in the Proxy Statement.

The final voting results for

each proposal submitted to a vote of the shareholders of Edoc at the Special Meeting are as follows:

| ● | Proposal No. 1 - The NTA

Proposal - to consider and vote upon a proposal, as a Special Resolution, to approve amendments (the “NTA Amendments”)

to the Existing Organizational Documents, which amendments shall be effective, if adopted and implemented by Edoc, immediately prior

to the consummation of the proposed Business Combination, to remove the requirements contained in the Existing Organizational Documents

limiting Edoc’s ability to consummate an initial business combination if Edoc would have less than $5,000,001 in net tangible assets

prior to or upon consummation of such initial business combination. |

| FOR |

|

AGAINST |

|

ABSTENTIONS |

| 2,601,684 |

|

0 |

|

92 |

| ● | Proposal No. 2 - The Business

Combination Proposal - to approve and adopt the Business Combination Agreement. At the closing of the transactions contemplated by

the Business Combination Agreement (the “Closing”), (a) Edoc will merge with and into Merger Sub, with Edoc continuing as

the surviving entity (the “Merger”), as a result of which, (i) Edoc shall become a wholly-owned subsidiary of Pubco, and

(ii) each issued and outstanding security of Edoc immediately prior to the Effective Time shall no longer be outstanding and shall automatically

be cancelled, in exchange for the right of the holder thereof to receive substantially identical securities of Pubco, and (b) Pubco will

acquire all of the issued and outstanding ordinary shares of AOI (the “Purchased Shares”) from the Sellers in exchange for

ordinary shares of Pubco, par value $0.0001 per share (“Pubco Ordinary Shares”), all upon the terms and subject to the conditions

set forth in the Business Combination Agreement and in accordance with the applicable provisions of the Companies Act and the Australian

Act, such proposal to include authorization of the Plan of Merger by Special Resolution. |

| FOR |

|

AGAINST |

|

ABSTENTIONS |

| 2,599,677 |

|

2,007 |

|

92 |

| ● | Proposal No. 3 - Memorandum

and Articles Proposal - to consider and vote upon a proposal, as a Special Resolution, immediately prior to the consummation of the

Business Combination, assuming the Business Combination Proposal is approved, to replace Pubco’s current memorandum and articles

of association with the amended and restated memorandum and articles of association of Pubco (the “Proposed Memorandum and Articles”). |

| FOR |

|

AGAINST |

|

ABSTENTIONS |

| 15,680,104 |

|

591,564 |

|

0 |

| ● | Proposal No. 4 - Advisory

Charter Proposals - to consider and vote upon, as an Ordinary Resolution, on an advisory and non-binding basis, five separate proposals

with respect to certain governance provisions in the Proposed Memorandum and Articles: |

| o | Proposal 4(a) - a. To approve and adopt, on a non-binding

advisory basis, provisions in the Proposed Memorandum and Articles, providing that Pubco’s post-Closing board will consist of

five individuals across three classes (i.e., Class I, II and III) with staggered expiries of terms whereby three (3) persons are to

be designated by AOI prior to the Closing, at least one (1) of whom shall qualify as an independent director under Nasdaq rules, one

person is to be designed by Edoc who shall qualify as an independent director under Nasdaq rules and one (1) person that is mutually

agreed upon and designated by Edoc and AOI prior to the Closing who shall qualify as an independent director under Nasdaq rules,

which post-Closing board of Pubco will also comprise the board of AOI. |

| FOR |

|

AGAINST |

|

ABSTENTIONS |

| 2,599,677 |

|

2,007 |

|

92 |

| o | Proposal 4(b) - b. To

approve and adopt, on a non-binding advisory basis, provisions to be included in the Proposed Memorandum and Articles providing that

Pubco’s directors may be removed from office with or without cause by (A) an Ordinary Resolution passed at a meeting of Members

called for the purposes of removing the director or for purposes including the removal of the director; or (B) by the affirmative vote

of a majority of the directors present and voting at a meeting. |

| FOR |

|

AGAINST |

|

ABSTENTIONS |

| 2,599,677 |

|

2,007 |

|

92 |

| o | Proposal 4(c) - c. To

approve and adopt, on a non-binding advisory basis, provisions to be included in the Proposed Memorandum and Articles providing that

Pubco’s directors may call a general meeting of the shareholders. The CEO or chairman may call an extraordinary general meeting.

No shareholder may call a general meeting or an extraordinary general meeting. |

| FOR |

|

AGAINST |

|

ABSTENTIONS |

| 2,599,677 |

|

2,007 |

|

92 |

| o | Proposal 4(d) - d. To

approve and adopt, on a non-binding advisory basis, provisions to be included in the Proposed Memorandum and Articles providing that

Pubco’s directors may nominate candidates at any time and its Members may nominate candidates for election as Directors at the

annual general meeting by delivering notice to the principal executive offices of Pubco not later than the close of business on the 90th

day nor earlier than the close of business on the 120th day prior to the scheduled date of the annual general meeting. |

| FOR |

|

AGAINST |

|

ABSTENTIONS |

| 2,592,997 |

|

2,007 |

|

6,772 |

| o | Proposal 4(e) - e. To

approve and adopt, on a non-binding advisory basis, provisions to be included in the Proposed Memorandum and Articles providing that

subject to the Companies Act and as provided in the Proposed Memorandum and Articles, Pubco may, by Special Resolution, amend the Proposed

Memorandum and Articles in whole or in part, which requires the affirmative vote of at least a two-thirds majority of the votes cast

by the holders of the issued and outstanding Pubco Ordinary Shares represented in person or by proxy and entitled to vote thereon and

who vote at the meeting. |

| FOR |

|

AGAINST |

|

ABSTENTIONS |

| 2,599,677 |

|

2,007 |

|

92 |

| ● | Proposal No. 5 - Equity

Incentive Plan Proposal - to approve the adoption, as an Ordinary Resolution, of the Pubco 2024 Equity Incentive Plan (the “Incentive

Plan”), which is described in more detail in the accompanying proxy statement/prospectus under the heading “The Equity Incentive

Plan Proposal.” |

| FOR |

|

AGAINST |

|

ABSTENTIONS |

| 2,599,677 |

|

2,007 |

|

92 |

| |

● |

Proposal No. 6 - Director Election Proposal

- to consider and vote upon a proposal, as an Ordinary Resolution to consider and vote on a proposal to elect, effective at Closing,

the five (5) persons listed below be appointed as directors of Pubco, effective upon the Closing of the Business Combination, to serve

on the Pubco Board for one, two or three years depending on their Class. If elected, the Class I directors will serve until the first

annual meeting of shareholders of Pubco to be held following the date of Closing; the Class II directors will serve until the second annual

meeting of shareholders of Pubco following the date of Closing; and the Class III directors will serve until the third annual meeting

of shareholders of Pubco to be held following the date of Closing or until their earlier death, resignation, retirement or removal for

cause.

Menaka Athukorala (Class I) |

| FOR |

|

AGAINST |

|

BROKER NONVOTE |

| 2,499,768 |

|

102,008 |

|

0 |

Kevin Chen (Class I)

| FOR |

|

AGAINST |

|

BROKER NONVOTE |

| 2,499,769 |

|

102,007 |

|

0 |

Kapil Singh (Class II)

| FOR |

|

AGAINST |

|

BROKER NONVOTE |

| 2,499,768 |

|

102,008 |

|

0 |

Gowri Shankar (Class II)

| FOR |

|

AGAINST |

|

BROKER NONVOTE |

| 2,499,768 |

|

102,008 |

|

0 |

Gary Seaton (Class III)

| FOR |

|

AGAINST |

|

BROKER NONVOTE |

| 2,499,769 |

|

102,007 |

|

0 |

| ● | Proposal No. 7 - Nasdaq

Proposal - to consider and vote upon a proposal, as an Ordinary Resolution, for the purposes of complying with the applicable listing

rules of Nasdaq, to approve the potential issuance of Pubco Ordinary Shares pursuant to (a) the Business Combination, (b) a proposed

$50,000,000 Equity Line of Credit arrangement that Pubco intends to enter into on the closing of the Business Combination, and (c) the

Debentures and the Arena Warrants. |

| FOR |

|

AGAINST |

|

ABSTENTIONS |

| 2,599,677 |

|

2,007 |

|

92 |

As there were sufficient votes

to approve the above proposals, the “Adjournment Proposal” described in the Proxy Statement was not presented to Edoc’s

shareholders.

Shareholders holding an aggregate

of 650,039 ordinary shares have exercised their right to have such shares redeemed for a pro rata portion of the trust account holding

the proceeds from Edoc’s initial public offering, calculated on the date of the Special Meeting, which was $11.76 per share, or

$7,644,458.64 in the aggregate that was redeemed. Such payment to the redeemed shareholders of Edoc will only be made if and when the

Business Combination is consummated. The remaining amount in the trust account will be used to fund certain expenses incurred by Edoc

and AOI in connection with the Business Combination, and the balance will be used for general corporate purposes of AOI and its subsidiaries

following the Business Combination.

In light of receipt of the

requisite approvals by Edoc’s shareholders described above, pending fulfilment of the other closing requirements (including Nasdaq

approval), Edoc expects the Business Combination to close before the end of March 2024.

No Offer or Solicitation

This

Current Report on Form 8-K does not constitute (i) a solicitation of a proxy, consent or authorization with respect to any securities

or in respect of the proposed Transaction or (ii) an offer to sell, a solicitation of an offer to buy, or a recommendation to buy any

security of AOI, Edoc, or any of their respective affiliates. There shall not be any sale of any securities in any state or jurisdiction

in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the laws of such other jurisdiction.

No offering of securities shall be made except by means of prospectus meeting the requirements of Section 10 of the Securities Act of

1933, as amended, or an exemption therefrom.

Forward-Looking Statements

The

information in this report includes “forward-looking statements” within the meaning of the “safe harbor” provisions

of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words

such as “estimate,” “plan,” “project,” “forecast,” “intend,” “may,”

“will,” “expect,” “continue,” “should,” “would,” “anticipate,”

“believe,” “seek,” “target,” “predict,” “potential,” “seem,” “future,”

“outlook” or other similar expressions that predict or indicate future events or trends or that are not statements of historical

matters, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements include,

but are not limited to, (1) statements regarding estimates and forecasts of financial and performance metrics and projections of market

opportunity and market share; (2) references with respect to the anticipated benefits of the proposed Transaction and the projected future

financial performance of Edoc and AOI’s operating companies following the proposed Transaction; (3) changes in the market for AOI’s

products and services and expansion plans and opportunities; (4) AOI’s unit economics; (5) the sources and uses of cash of the proposed

Transaction; (6) the anticipated capitalization and enterprise value of the combined company following the consummation of the proposed

Transaction; (7) the projected technological developments of AOI and its competitors; (8) anticipated short- and long-term customer benefits;

(9) current and future potential commercial and customer relationships; (10) the ability to manufacture efficiently at scale; (11) anticipated

investments in research and development and the effect of these investments and timing related to commercial product launches; (12) expectations

related to the terms and timing of the proposed Transaction; and (13) potential issuance of 10,000,000 Pubco Ordinary Shares underlying

the 10,000,000 Penny Warrants could decrease shareholders’ proportionate ownership interest in Pubco, diminish the relative voting

strength of each previously outstanding Pubco Ordinary Share and cause a decrease to the market price of Pubco Ordinary Shares. These

statements are based on various assumptions, whether or not identified in this report, and on the current expectations of AOI’s

and Edoc’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative

purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction

or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ

from assumptions. Many actual events and circumstances are beyond the control of AOI and Edoc. These forward-looking statements are subject

to a number of risks and uncertainties, including the occurrence of any event, change or other circumstances that could give rise to the

termination of the Business Combination Agreement; the risk that the proposed Transaction disrupts current plans and operations as a result

of the announcement and consummation of the transactions described herein; the inability to recognize the anticipated benefits of the

proposed Transaction; the ability to obtain or maintain the listing of the Pubco’s securities on The Nasdaq Stock Market, following

the Transaction, including having the requisite number of shareholders; costs related to the proposed Transaction; changes in domestic

and foreign business, market, financial, political and legal conditions; risks relating to the uncertainty of the projected financial

information with respect to AOI; AOI’s ability to successfully and timely develop, manufacture, sell and expand its technology and

products, including implement its growth strategy; AOI’s ability to adequately manage any supply chain risks, including the purchase

of a sufficient supply of critical components incorporated into its product offerings; risks relating to AOI’s operations and business,

including information technology and cybersecurity risks, failure to adequately forecast supply and demand, loss of key customers and

deterioration in relationships between AOI and its employees; AOI’s ability to successfully collaborate with business partners;

demand for AOI’s current and future offerings; risks that orders that have been placed for AOI’s products are cancelled or

modified; risks related to increased competition; risks relating to potential disruption in the transportation and shipping infrastructure,

including trade policies and export controls; risks that AOI is unable to secure or protect its intellectual property; risks of product

liability or regulatory lawsuits relating to AOI’s products and services; risks that the post-combination company experiences difficulties

managing its growth and expanding operations; the uncertain effects of certain geopolitical developments; the inability of the parties

to successfully or timely consummate the proposed Transaction, including the risk that any required shareholder or regulatory approvals

are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected

benefits of the proposed Transaction; the outcome of any legal proceedings that may be instituted against AOI, Edoc or Pubco or other

following announcement of the proposed Transaction; the ability of AOI to execute its business model, including market acceptance of its

planned products and services and achieving sufficient production volumes at acceptable quality levels and prices; technological improvements

by AOI’s peers and competitors; and those risk factors discussed in documents of Pubco and Edoc filed, or to be filed, with the

SEC. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied

by these forward-looking statements. There may be additional risks that neither Edoc nor AOI presently know or that Edoc and AOI currently

believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition,

forward-looking statements reflect Edoc’s and AOI’s expectations, plans or forecasts of future events and views as of the

date of this report. Edoc and AOI anticipate that subsequent events and developments will cause Edoc’s and AOI’s assessments

to change. However, while Edoc and AOI may elect to update these forward-looking statements at some point in the future, Edoc and AOI

specifically disclaim any obligation to do so. Readers are referred to the most recent reports filed with the SEC by Edoc. Readers are

cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made, and we undertake no obligation

to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Dated: March 11, 2024 |

EDOC Acquisition Corp. |

| |

|

|

| |

By: |

/s/ Kevin Chen |

| |

|

Name: |

Kevin Chen |

| |

|

Title: |

Chief Executive Officer |

5

v3.24.0.1

Cover

|

Mar. 05, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 05, 2024

|

| Entity File Number |

001-39689

|

| Entity Registrant Name |

EDOC Acquisition Corp.

|

| Entity Central Index Key |

0001824884

|

| Entity Tax Identification Number |

00-0000000

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Address, Address Line One |

7612 Main Street Fishers

|

| Entity Address, Address Line Two |

Suite 200

|

| Entity Address, City or Town |

Victor

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

14564

|

| City Area Code |

585)

|

| Local Phone Number |

678-1198

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Class A Ordinary Shares, $.0001 par value per share |

|

| Title of 12(b) Security |

Class A Ordinary Shares, $.0001 par value per share

|

| Trading Symbol |

ADOC

|

| Security Exchange Name |

NASDAQ

|

| Rights, exchangeable into one-tenth of one Class A Ordinary Share |

|

| Title of 12(b) Security |

Rights, exchangeable into one-tenth of one Class A Ordinary Share

|

| Trading Symbol |

ADOCR

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each exercisable for one-half of one Class A Ordinary Share, each whole Warrant exercisable for $11.50 per share |

|

| Title of 12(b) Security |

Warrants, each exercisable for one-half of one Class A Ordinary Share, each whole Warrant exercisable for $11.50 per share

|

| Trading Symbol |

ADOCW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ADOC_ClassOrdinaryShares.0001ParValuePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ADOC_RightsExchangeableIntoOnetenthOfOneClassOrdinaryShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ADOC_WarrantsEachExercisableForOnehalfOfOneClassOrdinaryShareEachWholeWarrantExercisableFor11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

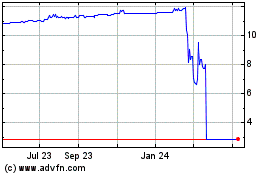

Edoc Acquisition (NASDAQ:ADOC)

Historical Stock Chart

From Mar 2024 to Apr 2024

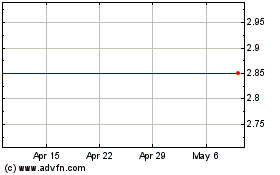

Edoc Acquisition (NASDAQ:ADOC)

Historical Stock Chart

From Apr 2023 to Apr 2024